Bloomberg News/Landov

Bloomberg News/Landov The numbers: The wholesale cost of U.S. goods and services posted the biggest decline in February in five years, reflecting a large drop in oil prices likely tied to disruptions in global travel due to the coronavirus.

The producer price index sank 0.6% last month, the government said Thursday. Economists polled by MarketWatch had predicted a smaller 0.1% decline.

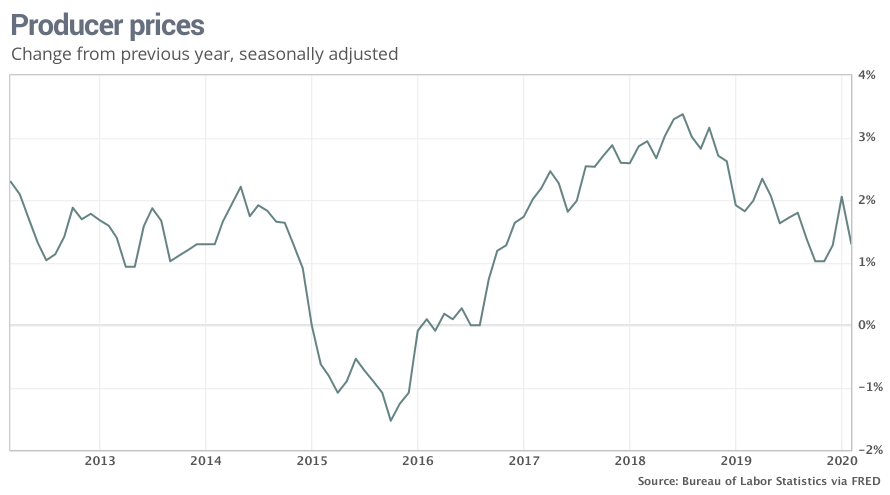

Wholesale inflation has risen just 1.3% in the past 12 months and inflation is likely to taper off even more if the coronavirus brings the U.S. economy to a standstill.

Read: Inflation creeps higher, but it’s ‘all water under a bridge’ as coronavirus spreads

What happened: The cost of goods dropped almost 1% last month, with three-fifths of the decline traced to lower energy prices. The cost of gasoline fell 6.5% and jet fuel 16.5%, among other things.

The COVID-19 outbreak in China in January caused a big decline in travel to and from the world’s second largest economy. The resulting drop in demand for oil has since spawned a price war between Russia and Saudi Arabia as they try to make up for lost revenue by increasing supply.

Oil prices are likely to decline even further in the months ahead, tugging inflation even lower.

Wholesale food prices also fell sharply last month, down 1.6%. That’s the biggest drop since 2015.

Another measure of wholesale costs that strips out food, energy and trade margins, known as core PPI, slid 0.1% last month. The 12-month core rate edged down to 1.4% from 1.5%.

The cost of raw materials and partly finished goods both declined last month, adding to the evidence that inflation was largely contained before the coronavirus outbreak.

Read: Coronavirus and the economy: Businesses face shortages, confidence plunges

Big picture: Inflation is low by almost any measure and widely expected to soften even more in the months ahead with oil prices tumbling. The coronavirus epidemic is also reducing demand for many goods and services, forcing airlines and other companies to cut prices in an effort to drum up sales.

Market reaction: The Dow Jones Industrial Average DJIA, -5.86% and S&P 500 SPX, -4.89% were set to tumble again in Thursday trades. The Dow has lost more than 6,000 points in the past few weeks as nations around the world grapple with the coronavirus.

The 10-year Treasury yield TMUBMUSD10Y, -16.62% slipped to 0.69%. Yields are sitting at record lows as investors seek the perceived safety of government bonds.

Add Comment