The numbers: The wholesale cost of U.S. goods and services sank 1.3% in April — the largest decline on record — as the coronavirus bore down on the economy and cratered demand.

The decline last month was the third in a row and the largest since the government reconfigured its wholesale report in 2009 to include services such as finance and health care. Economists polled by MarketWatch had predicted a 0.5% drop.

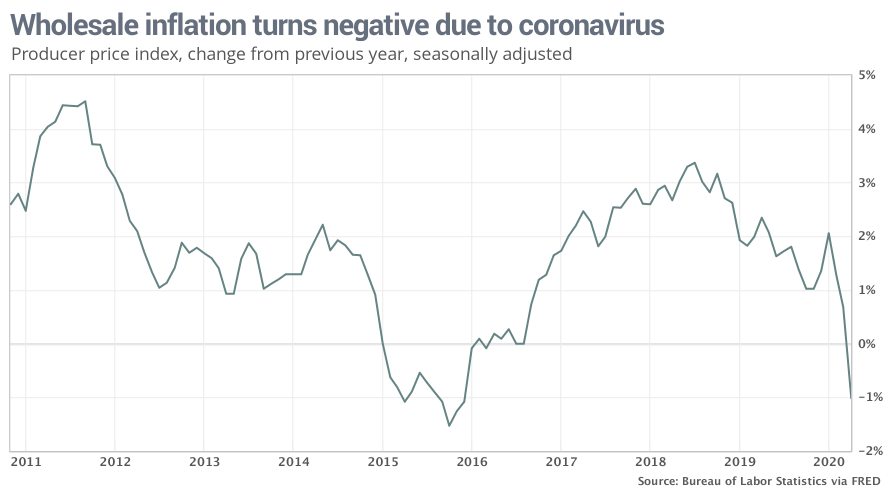

The rate of wholesale inflation in the past year also turned negative for the first time since 2015, tumbling to 1.2% in April from a small increase in March, the government said Wednesday.

Read:Consumer prices post one of the biggest declines ever

What happened: Plunging oil prices drove much of the decline in wholesale costs in April. Gasoline prices sank almost 57%, the largest decline since the government began keeping track in 1947.

A gallon of regular gasoline costs less than $2 in many parts of the country, reflecting collapsing demand amid widespread stay-at-home orders and a price war between Saudi Arabia and Russia.

Other products to post notable price declines included organic chemicals and corn.

The cost of everything isn’t falling, however. Prices for beef and liquor rose last month, for example.

Meat-packing plants have been hit hard by COVID-19 outbreaks, forcing some plants to close and limiting supplies. And demand for liquor has surged with most Americans staying at home.

The cost of services, meanwhile, fell a smaller 0.2%

Stripping out food and energy, another measure of wholesale costs known as core PPI slid 0.9% last month. The 12-month rate turned negative for the first time since the PPI data was overhauled in 2009, falling to 0.3% from a 1% increase in March.

One year ago, core wholesale prices were rising at a 2.4% clip.

See: MarketWatch Economic Calendar

Big picture: The coronavirus pandemic has suppressed inflation by driving the economy into recession and slashing demand, but the cost of some goods in short supply or high demand have spiked. They include beef, chicken, toilet paper and sanitary products.

Still, the U.S. is likely facing a prolonged battle with deflation instead of inflation. The lack of demand will maintain downward pressure on the wholesale or retail cost of goods and services until growth in the economy starts to recover.

What they are saying? “The core PPI will not continue falling at this pace, but the virus will remain a sustained disinflationary shock long after the initial hit from the lockdown has largely reversed,” said chief economist Ian Shepherdson of Pantheon Macroeconomics.

Read: Why the economy’s recovery from the coronavirus is likely to be long and painful

Market reaction: The Dow Jones Industrial Average DJIA, -0.96% and S&P 500 SPX, -0.71% were set to rise again in Wednesday trades. Stocks have been rising in fits and starts over the past few weeks as the economy slowly begins to reopen.