We just finished a paper on how older workers use “nontraditional” jobs — that is, jobs without health and retirement benefits. In the process of answering that question, we found that only 26 percent of older workers were employed steadily in traditional jobs with benefits. This finding has really changed how I think about people’s work lives.

Let me back up. Despite the increased focus on “nontraditional” jobs, it is unclear how older workers use these jobs and how they might affect retirement security. If some older workers end up in nontraditional work for much of their later careers, then they likely will end up worse off financially. If, instead, older workers use nontraditional jobs only temporarily before returning to traditional work or as a bridge to retirement, then they may stay working longer than expected and improve their financial situation.

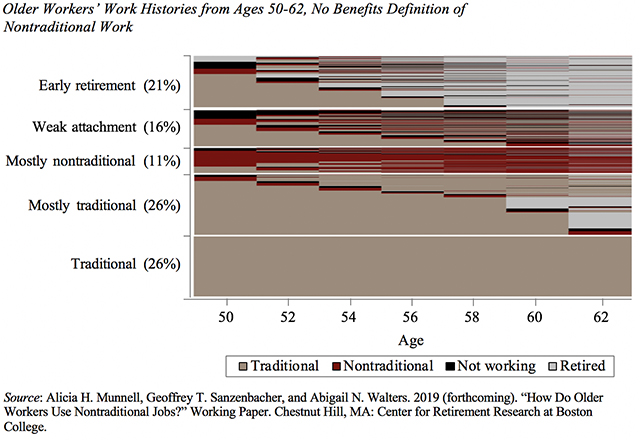

To gain a better understanding of how older workers use nontraditional jobs, we followed workers in the Health and Retirement Study (HRS) from ages 50 to 62 to determine at each age whether they are in a traditional job, a nontraditional job, not working, or retired. Then we used sequence analysis to group older workers who have similar employment patterns.

That process allocated people to five groups (see the figure below). The first two involved individuals who do not work consistently throughout their 50s and 60s. These individuals are either in an “Early Retirement” sequence with retirement in their 50s (21% of sample members) or are in a “Weak Attachment” sequence, with frequent spells of not working despite not retiring (16%). The next three sequences consist of people who work most of the time, and include sequences of work that are: “Mostly Nontraditional” (11%); “Mostly Traditional” (26%); and “Traditional” (26%).

From my perspective, the two most interesting results are the following:

First, with respect to how nontraditional jobs are used, the vast majority of nontraditional work is done by those who do it often, and it is used less often as a bridge to retirement or a stopgap to unemployment.

Second, and even more interesting — although peripheral to the study — is that only 26% of the sample held a traditional job with benefits steadily from ages 50 to 62.

Before the results of this study, as well as recent work on 401(k) balances, I had thought that the norm was traditional employment, with most people holding a steady job with health and retirement benefits from ages of 50 to 62. Deviations were the exception. The goal, to my mind, was to get people to stay in that steady job until their late 60s. It turns out, though, that people’s labor market experiences are significantly less secure than I had ever thought.