Hi! In this week’s ETF Wrap, I spoke with Todd Sohn of Strategas about this year’s lagging inflows into energy, the sole sector of the S&P 500 that’s seen gains in 2022. Also, Ivana Delevska, founder and chief investment officer of SPEAR Invest, explains why her SPEAR Alpha ETF has added to growth positions this year.

Please send tips and feedback to [email protected]. You can follow me on Twitter at @cidzelis and find me on LinkedIn.

Energy has trounced other sectors this year with outsize gains, but exchange-traded funds focused on the area are lagging when it comes to inflows in 2022, according to Strategas.

“It’s amazing to me that there’s this animosity towards the sector because its performance over the last year and a half or so has been outstanding,” said Todd Sohn, an ETF strategist at macro research firm Strategas, in a phone interview. “It’s the only sector that’s up so far this year.”

The Energy Select Sector SPDR Fund XLE, +1.32% has surged around 32% this year through Wednesday as oil prices climbed, while the S&P 500 index’s 10 other sectors have suffered losses this year, according to FactSet data. Consumer discretionary is the worst-performing sector over the same period, with the Consumer Discretionary Select Sector SPDR Fund XLY, +3.81% plummeting about 32%.

Stocks have sold off in 2022 amid investor worries over the rising odds of a recession as the Federal Reserve fights inflation with higher interest rates.

ETFs focused on health care, staples, technology, and utilities have this year attracted larger inflows than energy, which has seen about $3.1 billion, according to a Strategas note dated June 21. Sohn said the flow data is for U.S.-listed ETFs through June 17.

“I get that utilities and staples have taken in flows in assets because of the defensive equity environment,” said Sohn, but questioned why energy wasn’t seeing more.

In his view, energy’s poor performance over the past decade may have created “reluctance” on the part of investors. Mandates tied to environment, social and governance criteria may also partially explain why energy is relatively unloved when considering ETF flows into the sector versus performance, he said.

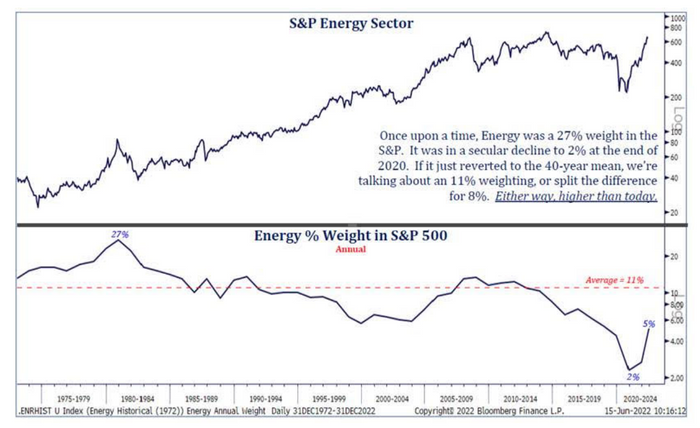

Energy has a small weight in the S&P 500 index SPX, +3.06%, after shrinking dramatically since the 1970s, according to Sohn. The sector’s weight was a hefty 27% around the late 1970s and early 1980s, “when we last had an inflation problem,” and fell to 2% in 2020, he said.

Energy now represents around 5% of the S&P 500, below its 11% average, according to Sohn.

Energy’s gains in the large-cap-focused S&P 500 are strong so far in 2022, even after dropping around 15% in June, according to FactSet data through Wednesday.

“On the value side, energy is starting to correct,” said Sohn, referring to value versus growth bets in the stock market. That comes as “the recession chorus is growing louder” in the slowing U.S. economy, he said.

Meanwhile, energy’s weight is poised to shift in Russell U.S. equity indexes as a result of their annual rebalancing.

Read: Why stock-market volatility may rise Friday due to Russell rebalancing

The rebalancing of Russell U.S. indexes, set to take place after the close of the stock market on Friday, is expected to decrease the weight of energy in the Russell 2000 Value Index, according to a Jefferies note dated June 5. At the same time, the sector’s presence in the Russell 2000 Growth Index is poised to rise, the note shows.

“The sector is seeing selling pressure come from the ETFs, and maybe even value managers, as the group’s weight falls significantly in their indexes due to FTSE Russell rebalancing,” said Jefferies equity strategist Steven DeSanctis said in a research note dated June 20. “With the selloff in energy, the cyclicals have taken their lumps in June.”

Sentiment for cyclicals, which includes areas such as energy, industrials and materials, has been broadly “weak,” according to Jefferies.

“Secular growth is holding up best, which is unusual,” DeSanctis wrote. “The relative outperformance by the cyclicals vs. secular growth had been really strong up until recently and was not sustainable, hence some of the give back.”

Growth versus value

In the slumping stock market, the iShares S&P 500 Value ETF IVE, +2.75% has lost about 9.6% this month through Wednesday, while the iShares S&P 500 Growth ETF IVW, +3.47% has held up slightly better in June, with a 8.8% decline, according to FactSet data.

Still, the S&P 500 Growth is heading for its worst first half of a year on record, while the S&P 500 Value is on track for its largest, first-half outperformance ever based on data going back to 1994, according to Dow Jones Market Data.

So far in 2022, the S&P 500 Value has dropped 13.3%, versus a 28.2% plunge for the S&P 500 Growth as of Wednesday’s close. That translates into 14.9 percentage points of outperformance by the S&P 500 Value.

“Over the past 6 months, we’ve significantly added to growth,” said Ivana Delevska, founder and chief investment officer of SPEAR Invest, in a phone interview, referring to growth bets in her actively managed SPEAR Alpha ETF SPRX, +4.33%.

“We think that from this point on, especially if recession fears continue, growth will perform better than the overall market,” she said. The fund’s portfolio is now around 75% growth and 25% value, after heading into 2022 with about an equal split between the two investment styles, according to Delevska.

The SPEAR Alpha ETF, which invests in companies that may benefit from innovations in industrial technology, has been “under pressure with the market,” she said. The fund, which began trading in August, is down around 35% this year through Wednesday, FactSet data show.

Cybersecurity is probably the “biggest theme in our portfolio,” said Delevska, explaining that company earnings in that area should hold up relatively well in an economic slowdown. “If a recession comes,” she said, “you don’t want to be in economically sensitive things.”

As usual, here’s your look at the top and bottom performing ETFs over the past week through Wednesday, according to FactSet data.

The good…

| Best performers | %Performance |

| SPDR S&P Biotech ETF XBI, +1.09% | 9.3 |

| ARK Genomic Revolution ETF ARKG, +2.85% | 7.2 |

| ARK Innovation ETF ARKK, +4.09% | 4.3 |

| iShares Biotechnology ETF IBB, +1.72% | 4.2 |

| First Trust NYSE Arca Biotechnology Index Fund FBT, +1.66% | 3.3 |

| Source: FactSet data through Wednesday, June 22, excluding ETNs and leveraged products. Includes NYSE, Nasdaq and Cboe traded ETFs of $500 million or greater. |

…the bad

| Worst Performers | %Performance |

| SPDR S&P Oil & Gas Exploration & Production ETF XOP, +1.20% | -15.5 |

| First Trust Natural Gas ETF FCG, +2.16% | -14.9 |

| iShares U.S. Oil & Gas Exploration & Production ETF IEO, +1.87% | -13.2 |

| First Trust Nasdaq Oil & Gas ETF FTXN, +1.94% | -12.7 |

| Invesco S&P 500 Equal Weight Energy ETF RYE, +0.98% | -12.0 |

| Source: FactSet |

New ETFs

- ProShares announced June 20 that it was launching the ProShares Short Bitcoin Strategy ETF BITI, -1.76% that gives investors a way to profit from the decline in the price of bitcoin BTCUSD, +0.09%. The fund is designed to provide the inverse performance of the S&P CME Bitcoin Futures Index.

- VanEck on Thursday announced the launch of the VanEck CLO ETF CLOI, -0.19%, which provides exposure to the $1 trillion collateralized loan obligation market.

- IndexIQ said Thursday it was launching its first active, semi-transparent ETFs, the IQ Winslow Large Cap Growth ETF IWLG, +3.37% and IQ Winslow Focused Large Cap Growth ETF IWFG, +3.01%.