What just happened?

One of the enduring quirks of the 2020-21 coronavirus period may be in how it unleashed our collective inner Kardashian.

Even as lockdowns forced the acceleration of trends like working from home and holding video meetings, they also seem to have remade American life as one giant Truman Show.

Our living rooms and offices became television sets, and were critiqued, sometimes mercilessly. Our kids and dogs and private parts were overshared. Our kitchens mimicked reality shows and our driveways became marathon courses.

Now our penchant for performance art is remaking finance. Dave Portnoy spent much of 2020 marshalling a band of bored Americans to trade stocks as a social pastime, in public.

iframe { position: absolute; left: 0; top: 0; width: 100%; height: 100%; }

]]>

Robinhood gets a lot of attention, but it’s just the plumbing. What’s more important is that financial markets have now become not just the high school football game, but the cafeteria as well. The sportos, the motorheads, geeks, sluts, bloods, waistoids, dweebies and dickheads all adore Portnoy.

That’s why it’s important to watch his latest steps.

By working with VanEck to launch an ETF with the ticker BUZZ, Portnoy is making a business case for the power of social groups and media — and social media — to influence markets. We all know that’s a thing, but now it will be tested and tracked.

And by creating BUZZ, Portnoy is also making a business case for the ETF model — for diversification, mostly. If meme finance as played out through GameStop GME, +4.07% was an awkward first draft — think of Pets.com from the dot-com bust — meme finance as played out through ETFs may be more enduring. Chewy, for example.

All this means it’s time to think seriously about what the social-ization and meme-ification of finance will mean for the ETF industry in the future. A financial instrument that once seemed like a risky upstart is now one step closer to being the main attraction: the “suit,” as it were.

Thanks for reading, as always.

One door closes, another one reopens…

As Americans hunkered down at home last spring, the financial-services community sprang into action, producing lists of the stocks likely to benefit and launching funds based on those ideas. More recently, publications, including MarketWatch, have published suggestions on how to invest in the “reopening” economy.

But a funny thing happened on the road to recovery. Even as funds like the ETFMG Travel Tech ETF AWAY, -0.03% and U.S. Global Jets ETF JETS, -0.35% fly to the sky, investors continue to reward many of the work-from-home plays.

The WisdomTree Cloud Computing Fund WCLD, -0.49% has picked up $54 million in the year to date, for example, though the Direxion Work from Home ETF WFH, +0.70% has lost $32 million, according to FactSet data. Many online retail ETFs are going gangbusters: the Amplify Online Retail ETF IBUY, +1.22% has seen $192 million in inflows, while the ProShares Online Retail ETF ONLN, +0.98% has hoovered up $253 million.

“Many of the trends that started in 2020 are likely to persist through the rest of the year even as people are vaccinated and begin to venture out,” said Todd Rosenbluth, head of mutual fund and ETF research at CFRA. “I don’t think of this as either/or. This is a situation where both trends can succeed.”

Rosenbluth thinks the diversification that ETFs offer compared to picking individual stocks will serve investors well during the transition. For example, companies will continue to rely more on tools like Zoom in the future than before the pandemic, even if it doesn’t account for as many of our meeting venues as it did during lockdown, he said in an interview. That diversification may also help calm some of the concerns around the ability of high-flying tech concerns to keep growing at the same rate, Rosenbluth argues.

It’s striking, however, that for all the many ways investors can play the stay-at-home boom, there are fewer options designed to capitalize on the reopening. Many stocks like cruise lines and restaurant chains make up small chunks of the portfolios of non-thematic ETFs, and few REIT ETFs have concentrations of mall stocks, arguably the property type most likely to benefit.

There are some obvious plays, of course: AWAY, which MarketWatch profiled in November, and JETS, which grabbed attention in 2020. Rosenbluth also likes the VanEck Vectors Gaming ETF BJK, -0.47%, which offers a mix of online and in-person betting stocks, such as Las Vegas Sands LVS, +0.14%.

Another option: the Invesco S&P 500 Equal Weight Consumer Discretionary ETF RCD, +2.11%, which offers some of the biggest allocations to many travel stocks among domestic ETFs. A MarketWatch analysis shows travel plays like Expedia Group Inc. EXPE, +5.08% and Carnival Corp., CCL, -4.78% as well as restaurant chains like Darden Restaurants Inc. DRI, +2.94% make up nearly one-quarter of the portfolio, while another hefty tranche is devoted to stocks ancillary to reopening, such as auto repair companies.

Exchange-traded sundries

The first mutual fund to ETF conversion is set for March. Guinness Atkinson Asset Management has filed with the SEC to convert two of its existing funds, the company said in a statement. “The establishment of an accepted legal framework for such a conversion is a milestone for the asset management industry and a positive development for fund providers seeking to offer their clients additional ways to access their investment strategies.”

Asset manager Alger on Monday launched the Alger Mid Cap 40 ETF FRTY, +0.70%, the firm’s first active ETF, to be managed by Amy Zhang, who currently manages the existing Alger Small Cap Focus, Alger Mid Cap Focus and Alger Small Cap Growth mutual funds. Zhang’s Alger Mid Cap Focus Fund returned nearly 85% in 2020 and 9.7% so far in 2021, the company said in a release.

Is there an ETF for that?

How would you like a fund that invests in profitable companies — 20% growth rates per year — which have strong corporate governance, do well in an inflationary environment, and diversify exposure away from the U.S.?

Meet the Nifty India Financials ETF INDF, +0.26%, the first pure-play fund of its type, according to co-founder Amit Anand. “Financials have long been the crown jewels of the Indian stock market,” Anand told MarketWatch.

Financials have been the best-performing sector in India for the past decade and Anand expects it will continue to outperform. India has a well-deserved reputation as an emerging-market growth story, and while INDF doesn’t compete explicitly with Chinese ETFs, many of the points in Anand’s investment case for the fund draw clear contrasts with that sector.

Among them: Indian banks are run by private-sector firms and are heavily regulated, Anand said. “Historically, their good corporate governance is why share prices have risen so well.”

INDF also checks an unusual ESG box. India’s economy still has a low penetration of the financial sector throughout society, with an estimated 300-400 million citizens considered unbanked or underbanked.

The fund also benefits from another emerging-market idiosyncrasy: the leapfrogging over legacy technologies to adopt up-and-coming ones alongside the rest of the world, without being encumbered by the old industry.

Whereas China “has taken a very heavy hand toward regulating fintech, in India it’s very early days,” Anand said. “Fintech is disrupting cash and gold and the government is very open toward it.” Fintechs must use the financial system infrastructure set up by the banks, and the banks themselves dabble in fintech offerings.”

The ETF, which launched in October, has gathered about $5 million in assets and charges a 75-basis point management fee. Over the past three months, it’s appreciated over 17%, easily beating both the 4.2% gain in the S&P 500’s and the 8.4% increase in the ishares MSCI China ETF MCHI, +0.46%.

It’s worth noting that because the fund invests overseas, it can trade at a steeper premium or discount to net asset value than many ETF investors may be accustomed to.

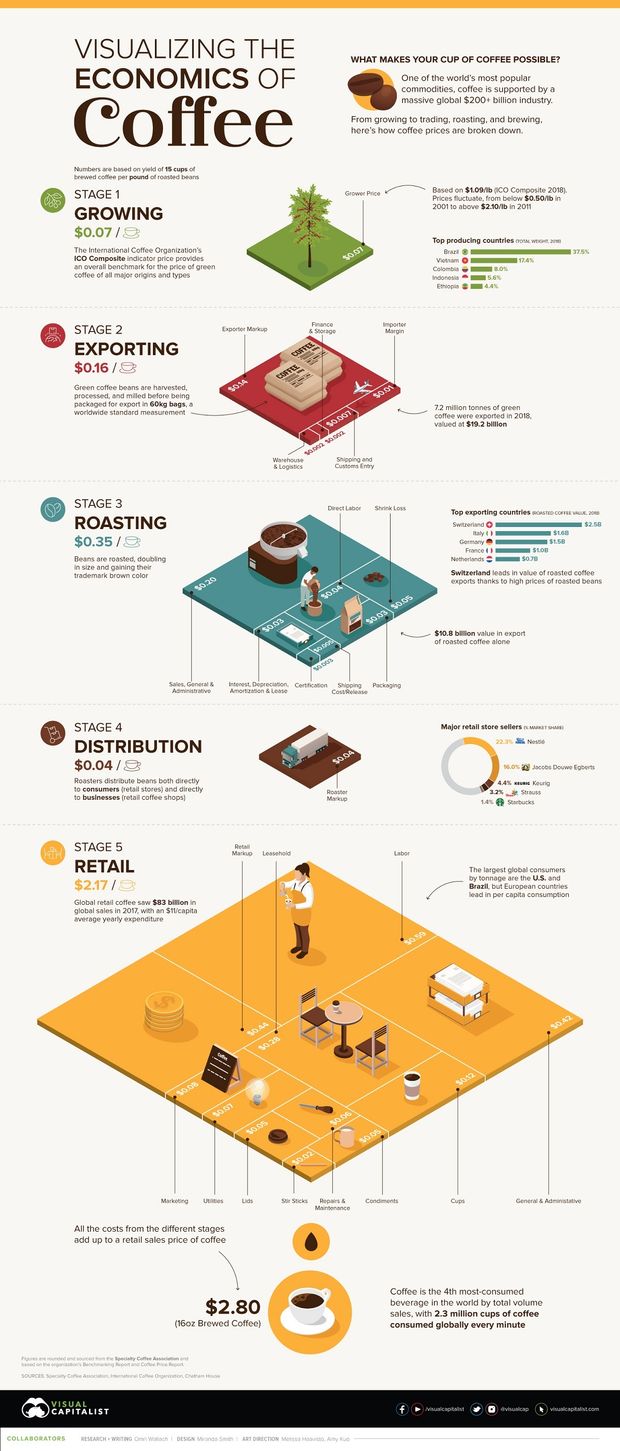

Visual of the Week

Just some eye candy, courtesy of Visual Capitalist.

Weekly rap

| Top 5 gainers of the past week | |

| Breakwave Dry Bulk Shipping ETF BDRY, +6.49% | 14.8% |

| Invesco Dynamic Leisure & Entertainment ETF PEJ, +1.36% | 6.3% |

| Global X MSCI Greece ETF GREK, +1.38% | 5.3% |

| iShares Currency Hedged MSCI Mexico ETF HEWW, +0.68% | 4.9% |

| Alerian MLP ETF AMLP, +1.41% | 4.9% |

| Source: FactSet, through close of trading Wednesday, March 3, excluding ETNs and leveraged products | |

| Top 5 losers of the past week | |

| ETFMG Prime Junior Silver Miners ETF SILJ, +1.04% | -9.2% |

| iShares MSCI Global Silver Miners ETF SLVP, +0.85% | -8.6% |

| ETFMG Treatments Testing and Advancements ETFGERM | -8.1% |

| Global X Silver Miners ETF SIL, +1.08% | -6.9% |

| Simplify Volt Fintech Disruption ETF VFIN, -1.98% | -6% |

| Source: FactSet, through close of trading Wednesday, March 3, excluding ETNs and leveraged products | |

MarketWatch has launched ETF Wrap, a weekly newsletter that brings you everything you need to know about the exchange-traded sector: new fund debuts, how to use ETFs to express an investing idea, regulations and industry changes, inflows and performance, and more. Sign up at this link to receive it right in your inbox every Thursday.