What just happened?

Another week, another roller-coaster ride: the best week for stocks since midsummer, two paused coronavirus treatment tests, fading hope for fiscal stimulus, better-than-expected earnings.

We covered a big jump in ETFs holding shares of ON Semiconductor ON, -0.15% when an activist investor announced he’d taken a stakethose that hold Concho Resources CXO, +1.13%, which surged more than 10% Wednesday after Conocophillips COP, +1.36% was said to be interested in buying the smaller company. And, while Prime Day is now over, it might be worth a refresher on the role of Amazon in ETFs.

Fund flows over the past week were a little more mixed than in recent weeks: banks performed badly but master limited partnerships, or MLPs, did well. And the behemoth Invesco QQQ Trust picked up the most money. More about that ahead.

The rise of “mini-me” ETFs

On Tuesday, Invesco launched a smaller version of its powerhouse ETF QQQ Trust QQQ, -1.38%. It is an attempt to diversify its investor base by attracting buy-and-hold clients to the same portfolio as the wildly popular ($137-billion) QQQ, for a lower fee.

“Invesco is following in the footsteps of State Street Global Advisors with a mini-me version,” said Todd Rosenbluth, head of ETF research for CFRA. That’s a reference to State Street’s decision, late last year, to roll out a new, cheaper version of the oldest ETF in existence, S&P 500 ETF Trust SPY, -0.70%.

Rosenbluth thinks the move toward offering two versions of the same fund—one for institutional investors or traders, and another for buy-and-hold audiences—is a win-win-win.

“Invesco is likely to continue to retain the $140 billion of assets in QQQ,” he told MarketWatch. “Many investors buy it because they know the fund, they know the liquidity, they want the history that shows how well it’s performed over the last decade.” For individual investors, a cheaper version of the same portfolio makes sense, and if the liquidity doesn’t match that of the original fund at first, that’s just fine.

Perhaps just as important, though, is how these new offerings may make advisers’ lives easier too, by providing a broadly commoditized lineup to offer clients.

Rosenbluth likes to emphasize that QQQ, which is often thought of as a “tech” fund, really isn’t. It tracks the 100 largest nonfinancial companies listed on the Nasdaq exchange. That definitely includes many tech heavyweights—Apple Inc. AAPL, -0.74% and Amazon.com Inc. AMZN, -1.77% are the top two holdings—but Paypal PYPL, -1.49%, Costco COST, -0.93%, and PepsiCo PEP, -1.21% are in the top 20.

Importantly, it’s also the only ETF tracking the Nasdaq-100, he noted.

The new fund is called the Invesco NASDAQ 100 ETF QQQM, -1.14%.

Is there an ETF for that?

It is hard out there for anyone seeking income. But investors keep trying: through September, about $151 billion had flowed into bond ETFs, according to CFRA’s First Bridge data.

One longtime market participant thinks there’s a good case to be made for a fixed-income strategy that may fly under the radar for investors and advisers.

“Laddered bond portfolios” aren’t exciting, said Harry Whitton, head of ETF sales and trading at Chicago-based market maker Old Mission, but the strategy has stood the test of time, and is available in ETF form.

The idea is to build a portfolio of bonds that have staggered maturities. In theory, it can smooth out cash flow, as well as any issues around reinvesting or accounting for capital gains. Using ETFs to do the investing helps manage liquidity and diversify risk, Whitton said—not to mention being far easier than picking individual bonds.

“People like these funds and the idea that they can build their own personalized model,” he said in an interview.

Right now, only two ETF issuers offer the products. iShares has a suite called “iBonds,” which comes in Treasury, municipal, investment-grade corporate, and high-yield strategies, and Invesco offers its “BulletShares” in emerging markets, municipal, investment grade and high yield.

The expense ratio, or fee for the fund’s upkeep, are nominal—from 10 basis points to about 43 for BulletShares products, and only about 7 for iBonds. In other words, the funds will cost you between $1, $4.30 and 70 cents for every $1,000 you invest, respectively.

More important, they fill a need in investor portfolios, Whitton thinks. “People are all about safety,” he said.

| Top 5 gainers of the past week | |

| InfraCap MLP ETF AMZA, -0.39% | 7.2% |

| Alerian MLP ETF AMLP, -0.36% | 6.6% |

| WisdomTree Cloud Computing Fund WCLD, -1.43% | 5.8% |

| Global X MLP ETF MLPA, -0.13% | 5.8% |

| Invesco Dynamic Semiconductors PSI, -1.29% | 5.6% |

| Source: FactSet, through close of trading Wednesday, October 14, excluding ETNs and leveraged products | |

| Top 5 losers of the past week | |

| First Trust Nasdaq Bank ETF FTXO, +1.03% | -1.5% |

| VanEck Vectors BDC Income ETF BIZD, -0.17% | -1.5% |

| Invesco KWB Regional Banking ETF KBWR, +1.13% | -1.4% |

| SPDR S&P Regional Banking KRE, +1.30% | -1.4% |

| ALPS REIT Dividend Dogs RDOG, -0.51% | -1.4% |

| Source: FactSet, through close of trading Wednesday, October 14, excluding ETNs and leveraged products | |

| Top 5 biggest inflows of the past week | |

| Invesco QQQ Trust QQQ, -1.38% | $3.7 billion |

| iShares Russell 2000 ETF IWM, +0.06% | $2.3 billion |

| iShares ESG Aware MSCI USA ETF ESGU, -0.74% | $1.5 billion |

| iShares iBoxx $ High Yield Corporate Bond ETF HYG, -0.40% | $1.3 billion |

| Vanguard Total Stock Market ETF | $1.2 billion |

| Source: FactSet, through close of trading Wednesday, October 14, excluding ETNs and leveraged products | |

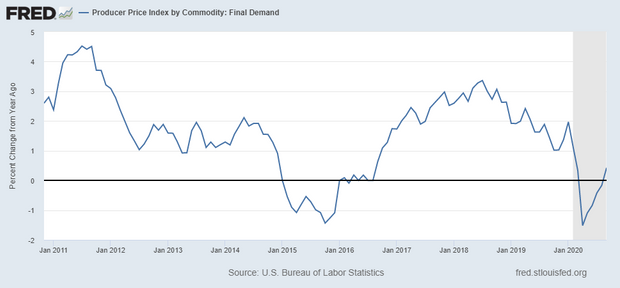

Visual of the week

Add Comment