European stocks climbed on Wednesday, with markets rebounding from the worst session in months helped by a fresh batch of strong earnings, though concerns over growing global coronavirus cases hovered in the background.

U.S. stock futures were mixed, with techs set to face pressure after weak earnings from Netflix.

The Stoxx Europe 600 SXXP, +0.55% rose 0.7% to 436.64, after suffering its biggest one-day percentage drop since December 21 on Tuesday, according to FactSet. The German DAX DAX, +0.17% rose 0.4% and the French CAC 40 PX1, +0.50% gained 0.7% after the biggest respective one-day falls January and December, respectively. The FTSE 100 UKX, +0.53% was up 0.6% following its worst one-day drop since February.

U.S. stock futures ES00, -0.03% YM00, +0.04% were mixed, with Nasdaq-100 futures NQ00, -0.32% lower after streaming entertainment giant Netflix NFLX, -0.88% forecast the worst quarter for streaming growth in its history and shares tumbled 9% in late trading. Wall Street stocks closed lower on Tuesday as concerns over global coronavirus cases overshadowed upbeat corporate earnings.

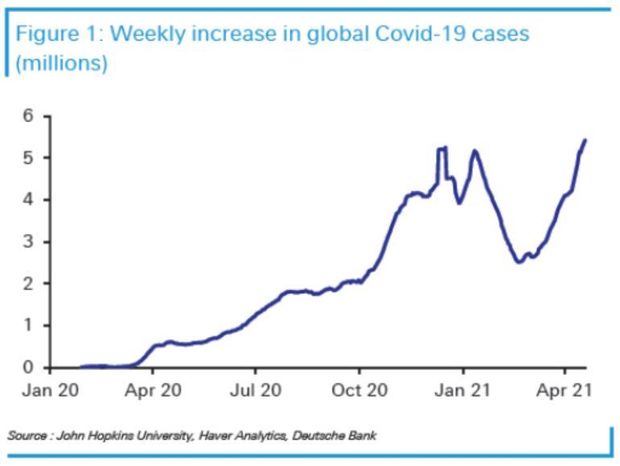

Weekly global pandemic cases are now at the highest since the start of the crisis, noted strategists at Deutsche Bank. That tally is led by India where the overwhelmed health system is on the verge of collapse, while Japan is another country facing soaring cases.

Source: John Hopkins University, Haver Analytics, Deutsche Bank

“For markets, the risk is that this latest increase in cases starts to undermine the narrative that the global economy is on an inexorable path back to normality as the world gets vaccinated, with multiple economies facing the threat of fresh restrictions on mobility,” a team of Deutsche Bank strategists led by Jim Reid told clients in a note.

But corporate results from Europe appeared to dominate on Wednesday. Stoxx Europe 600 gainers were led by shares of ASML Holding ASML, -2.09%, up 5% after the Dutch semiconductor equipment maker boosted its revenue guidance for 2021 due to a strong demand. First-quarter net profit soared on net sales that came in ahead of its forecasts.

Dutch brewer Heineken HEIA, +3.95% reported higher net profit in the first quarter on the back of stronger volumes in more than 40 of its markets. Those shares climbed 4%.

French grocer Carrefour CA, +3.44% reported higher first-quarter sales and said it would launch a share buyback worth at least €500 million. Shares rose nearly 4%.

Swiss pharmaceutical group Roche Holding ROG, +1.57% reported a slight fall in sales for the first quarter, but confirmed its outlook for the year. Shares rose 1.4%.

Shares of Kering KER, +1.25% rose 1.2% after the French luxury-goods group’s sales grew above expectations in the first quarter as leading brand Gucci returned to growth, the company said Tuesday. Revenue grew 21%.

Airlines were also stronger on Wednesday, with shares of International Conslidated Airlines IAG, +3.20%, easyJet EZJ, +3.74% up more than 3% and Deutsche Lufthansa LHA, +2.04% up 1.9%.

Elsewhere, shares of Juventus Football Club JUVE, -11.52% slid 10% in Milan after all six English teams backed out of plans for an elite Super League, bowing to intense backlash from supporters and warnings from the U.K. government. The Super League said in a statement that the project would be reshaped, although only the Spanish and Italian clubs remain officially involved at this point.

Shares of Manchester United MANU, -6.03% dropped 6% in New York on Tuesday. Shares of Borussia Dortmund BVB, -2.39%, which isn’t part of the league as yet, slipped 2%.