(Bloomberg) — European stocks retreated, tracking tech-led declines on Wall Street and dragged lower by a slump in the shares of Airbus SE.

Most Read from Bloomberg

The Stoxx 600 Index fell 0.3% as technology firms and industrials weighed on the benchmark gauge. Airbus tumbled more than 10% after lowering its guidance amid persistent supply-chain issues. Germany’s Merck KGaA sank, following a second surprise failure of a promising medicine. Futures on US equities ticked higher after various non-tech sectors advanced on Monday, even as Nvidia Corp. extended its three-day rout.

With the quarter drawing to a close, investors are snatching up value stocks and rotating out of the technology sector into other parts of the market. In Europe, investors are keeping a keen eye on France’s main political parties as they hold a debate Tuesday evening ahead of the first round of legislative elections on Sunday.

“As we approach the quarter-end, global investors are rebalancing their portfolio, selling assets that have performed well recently and buying names that have lagged,” said Hideyuki Ishiguro, chief strategist at Nomura Asset Management Co.

The dollar traded steady and US Treasuries posted small moves.

The retreat in technology shares is “not a macroeconomic story, it is purely an investor/sentiment story about the reversal of the massive AI-related outperformance observed year-to-date,” Danske Bank analysts wrote in a note. “It is challenging to determine whether this marks the beginning of a lasting trend, as the fundamentals remain unchanged from a week ago.”

Corporate Highlights:

-

Airbus now expects to hand over 770 aircraft rather than 800 units in 2024, it said Monday after European markets closed. Adjusted earnings before interest and tax will reach €5.5 billion ($5.9 billion) this year, down from a previous goal of as much as €7 billion.

-

Merck fell 11% on Tuesday, the most since December, after the company said late Monday that it will discontinue development of the drug, xevinapant, for the treatment of head and neck cancer.

-

Eurofins Scientific SE rose more than 5% in Paris after Monday’s 16% decline. The firm rejected allegations made by Carson Block’s Muddy Waters Research that caused its stock to plunge the most in two decades, saying it’s confident in the integrity of its accounts.

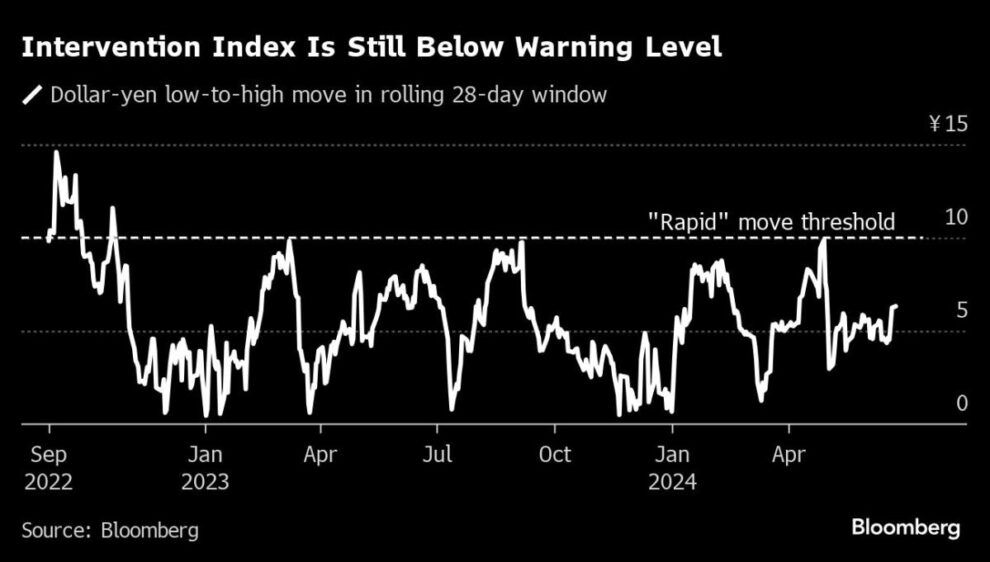

In currencies, the yen is seen at risk of sliding to levels last seen in 1986, with bearish traders unfazed by the specter of government intervention to bolster Japan’s embattled currency.

A slump as far as 170 per dollar is possible amid continued selling of the currency in favor of the higher-yielding greenback, according to Sumitomo Mitsui DS Asset Management Co. and Mizuho Bank Ltd.

Separately, the US is investigating China Mobile, China Telecom and China Unicom over concerns the firms could exploit access to American data through their US cloud and internet businesses by providing it to Beijing, Reuters reported, citing three unidentified people familiar with the matter.

Oil held gains as investors weighed the potential fallout from rising geopolitical tensions. Gold edged lower, while Bitcoin rebounded after falling Monday.

Key events this week:

-

US Conference Board consumer confidence, Tuesday

-

Fed’s Lisa Cook, Michelle Bowman speak, Tuesday

-

US new home sales, Wednesday

-

China industrial profits, Thursday

-

Eurozone economic confidence, consumer confidence, Thursday

-

US durable goods, initial jobless claims, GDP, Thursday

-

Nike releases earnings, Thursday

-

Japan Tokyo CPI, unemployment, industrial production, Friday

-

US PCE inflation, spending and income, University of Michigan consumer sentiment, Friday

-

Fed’s Thomas Barkin speaks, Friday

Some of the main moves in markets:

Stocks

-

The Stoxx Europe 600 fell 0.3% as of 9:37 a.m. London time

-

S&P 500 futures were little changed

-

Nasdaq 100 futures rose 0.3%

-

Futures on the Dow Jones Industrial Average were little changed

-

The MSCI Asia Pacific Index rose 0.9%

-

The MSCI Emerging Markets Index rose 0.2%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was little changed at $1.0734

-

The Japanese yen was little changed at 159.47 per dollar

-

The offshore yuan was little changed at 7.2841 per dollar

-

The British pound rose 0.1% to $1.2701

Cryptocurrencies

-

Bitcoin rose 2% to $60,660.22

-

Ether rose 1.2% to $3,348.65

Bonds

-

The yield on 10-year Treasuries advanced one basis point to 4.24%

-

Germany’s 10-year yield was little changed at 2.41%

-

Britain’s 10-year yield declined one basis point to 4.07%

Commodities

-

Brent crude was little changed

-

Spot gold fell 0.4% to $2,325.99 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Toshiro Hasegawa, Aya Wagatsuma and Sujata Rao.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.