(Bloomberg) — Europe’s leaders may be united on the need to throw money at economies during the coronavirus crisis, but they have yet to confront how to pay for it all.

That reckoning could force governments across the region into tough choices about where to lay the burden among voters already disillusioned with political establishments — a decade after the global financial crisis presented them with previous bills to settle.

Europe’s austerity experiments since then, from Greece to the U.K., provide cautionary tales of either the economic damage or electoral fatigue that spending cuts can cause. With those bitter experiences in mind, politicians are already fielding questions about tax hikes on either wealth or income — even if they too might threaten to hurt growth.

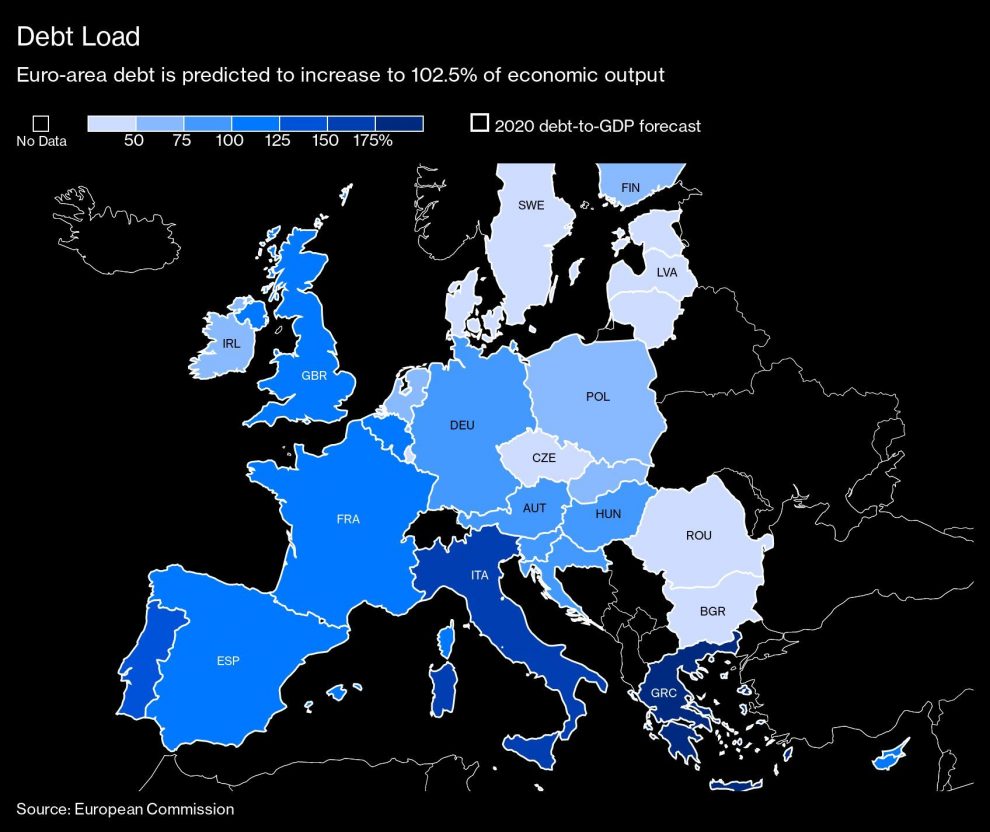

Alternatives include tolerating higher debts such as Japan does, or perhaps trying to inflict a dose of inflation to erode them away — itself a tax of sorts. With sovereign borrowing costs historically low, such approaches may look tempting as the bills rack up fast. Debt ratios in the euro area and U.K. may top the 100% milestone this year.

“There are very few easy or politically attractive ways to deal with this,” said James Athey, a money manager at Aberdeen Standard Investments. “The ideal way to pay for this is to generate growth that’s higher than your cost of funding. Unfortunately, I think that’s going to be very difficult.”

As European governments rapidly ramp up borrowing to aid economies, the region’s experience of austerity is framing the debate on how to tackle debt. Applying such medicine too forcefully in Greece in 2010 led the International Monetary Fund to conclude that it had caused more harm than good to public finances and growth.

In the U.K., whose 2010 deficit also ballooned to a Greek-like level, austerity under former Prime Minister David Cameron coincided with years of negligible growth. Whether or not that followed from spending cuts, it did fuel discontent that contributed to his political demise when the country voted to leave the European Union.

“European governments got worried about the large increase in debt and shifted to fiscal austerity, probably excessively slowing the recovery,” said former IMF Chief Economist Olivier Blanchard.

One discussion in Europe is whether taxes should rise when the recovery takes hold. Switzerland’s Social Democrats want higher income taxes, and the U.K. media is also awash with speculation about potential tax increases.

A further argument is focused on wealth taxes. The minority partner in Spain’s coalition is mulling such a proposal, while in France, where the government recently reduced wealth tax, economist Thomas Piketty says history shows such measures are the best way of bringing down huge public debt. Camille Landais, a professor of economics at the London School of Economics, even suggests a time-limited, Europe-wide wealth tax.

“If there needs to be some form of mild rebalancing of public finances it must be in a way that is fair, and essentially targets individuals that are most able to weather this,” said Landais.

German Chancellor Angela Merkel has already been forced to deny any plans for higher taxes for now, while French Finance Minister Bruno Le Maire said he doesn’t want to reapply the country’s levy on wealth. Athey says such reactions are understandable.

“The notion of raising taxes that don’t retard growth is very difficult,” he said.

The crisis may also reignite calls to change the mindset in the euro zone at least, where German-stipulated limits on deficits and debt were cemented into its monetary union. In Japan and the U.S., higher outright debt loads are accepted for longer while governments stabilize spending and curb borrowings through economic growth, conveniently shifting some of the burden to future generations of politicians too.Helping governments to keep debt costs under control are the actions of central banks. Their hoovering up of bonds has largely removed concerns over spiralling borrowing costs which dominated the early 2010s, and provide a foundation for public finances to start fixing themselves.

“The only sensible way out of over-indebtedness or high debts is more economic dynamism,” Marcel Fratzscher, President of DIW German Institute for Economic Research, said this month. “That’s the lesson after the global financial crisis.”

Central banks may also face pressure from governments to keep monetary policy loose for longer, tolerating inflation that erodes the value of government debts — a tactic that helped the U.K. to bring its borrowings under control in the era after World War II.

Inflation, while long craved by monetary authorities since the financial crisis, would also hurt savings and evoke painful memories for some countries, from Germany in the 1930s to the U.K. in the 1970s. Fratzscher says that as a policy to reduce debt, it’s “damaging.”

But what if debt just can’t be brought under control? William White, a senior fellow at the C.D. Howe Institute in Toronto and a former chief economist at the Bank for International Settlements, says that outcome is a real possibility.

“We’re on a bad path here of debt accumulation,” he said. “Thinking much more seriously about debt restructuring in an orderly way is required.”

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="For more articles like this, please visit us at bloomberg.com” data-reactid=”68″>For more articles like this, please visit us at bloomberg.com

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="Subscribe now to stay ahead with the most trusted business news source.” data-reactid=”69″>Subscribe now to stay ahead with the most trusted business news source.

©2020 Bloomberg L.P.

Add Comment