How are you sleeping lately?

The next recession will likely begin in 2020, according to the result of a recent panel of more than 100 real-estate economists polled by real-estate site Zillow Z, +5.27%. Half of those surveyed said the next recession will start in 2020, with nearly one in five identifying the third quarter as the likely beginning. Another 35% of experts think the current expansion will end in 2021.

The U.S. housing market is already heading into a potential correction.

“Housing slowdowns have been a major component, if not catalyst, for economic recessions in the past, but that won’t be the case the next time around, primarily because housing will have worked out its kinks ahead of time,” Skylar Olsen, Zillow’s director of economic research, said.

“Housing markets across the country are already heading into a potential correction a solid year before the overall economy is expected to experience the same,” he added. “The current housing slowdown is in some ways a return to balance that will help increase the resiliency of the housing market when the next recession does arrive.”

Read MarketWatch’s Moneyist advice column on the etiquette and ethics of your financial affairs and, this week: ‘ My children’s stepmother won’t return family heirlooms and gifts they gave their late father — how can we get them back?’

Morgan Stanley’s MS, +1.80% chief U.S. economist, Ellen Zentner, recently said there’s a 20% chance of recession in the year ahead. “For now, the path to the bear case of a U.S. recession is still narrow, but not unrealistic,” she said. And that was before the latest drop in the Dow Jones Industrial Index DJIA, +1.21% and S&P 500 SPX, +1.30% as U.S.-China trade fight intensifies.

However, Zentner added, “If trade tensions escalate further, our economists see the direct impact of tariffs interacting with the indirect effects of tighter financial conditions and other spill-overs, potentially leading consumers to retrench.”

The escalation in trade and tariff tensions appears to have shaken consumers’ confidence.

Some Americans have already been feeling uneasy. The escalation in trade and tariff tensions appears to have shaken consumers’ confidence in recent months. Consumer confidence fell to a two-year low in June of 124.3 before rebounding to 135.7, the highest level since November, according to the Conference Board. The latest stock-market drop, if prolonged, could flatten that bounce.

Many people are living with wildly fluctuating income, a recent report from the Board of Governors of the Federal Reserve System said. “Volatile income and low savings can turn common experiences — such as waiting a few days for a bank deposit to be available — into a problem.”

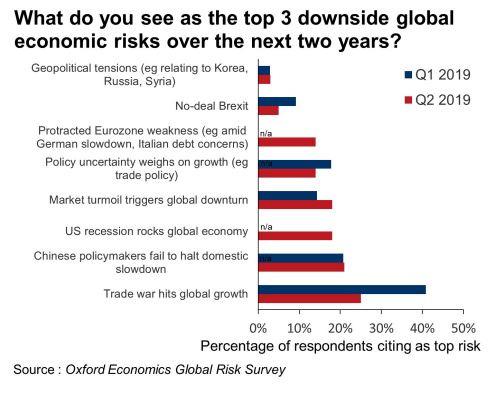

Despite unemployment hitting a 49-year low, plus low interest rates and inflation, people are feeling skittish. “A major trade war between the U.S. and China represents our greatest economic risk,” said Lynn Reaser, chief economist of the Controller’s Council of Economic Advisors.

Despite unemployment hitting a 49-year low, people are feeling skittish.

All of these worries are taking their toll. 78% of adults are losing sleep over work, relationships, retirement and other worries, according to a study released Thursday by personal-finance site Bankrate.com. Over half (56%) of Americans are lying awake at night worrying about money.

So what’s preventing people getting enough shut eye? They’re tossing and turning over retirement (24%), health care and/or insurance bills (22%), the ability to pay credit-card debt (18%), mortgage/rent payments (18%), educational expenses (11% versus 26%) and stock-market volatility (5%). The site polled over 2,500 people.

The good news: A higher number of U.S. adults (62%) were losing sleep over money three years ago, and more people were lying awake over retirement (39%), health care and/or insurance bills (29%), mortgage/rent payments (26%), educational expenses (11%) and stock-market volatility (5%). But are sleepless Americans stuck between a rock (the last recession) and a hard place (the longest economic expansion in U.S. history)?

Don’t miss: Why U.S. stocks remain vulnerable as Trump trade tweets revive global growth jitters

Millions of American believe it can’t last for much longer and fear a downturn is coming: 40% of people in a separate poll by that site say they feel the next recession has already begun or will begin within the next 12 months. These worries, however, are divided along political lines. Democratic Americans are almost twice as likely as Republican Americans to believe it’s already begun.

Jesse Colombo, analyst at Clarity Financial, cautioned readers of his Real Investment Advice column not to underestimate the severity of the next recession. “Virtually everyone is underestimating the tremendous economic risks that have built up globally during the past decade of extremely stimulative monetary policies,” he wrote.

Also see: Scarred by the Great Recession, Americans see storm clouds on the horizon

Other signs that people are feeling under pressure and losing sleep. They’re working longer hours to keep up. Nearly half — 45% — of U.S. workers require a side hustle to make ends meet, and even middle-aged workers are feeling the pinch. This includes 48% of millennials, 39% of Generation Xers and 28% baby boomers.

The good news: More people were losing sleep over money three years ago.

The expected benefits of a strong economy has not helped everyone keep up with their daily expenses. Wage growth showed signs of an upswing earlier this year, but disappointed in May. Wages increased just 3.1% on the year in May, not including inflation, slowing from 3.2% the previous month.

But there are global issues that may be far more troubling. After a decade-long economic expansion and stock market growth, some economists say it’s only a matter of time before there’s another downturn. Oxford Economics, a U.K.-based forecasting firm, predicts that fallout from the next recession could trigger a 30% drop in the S&P 500 SPX, +1.30%.

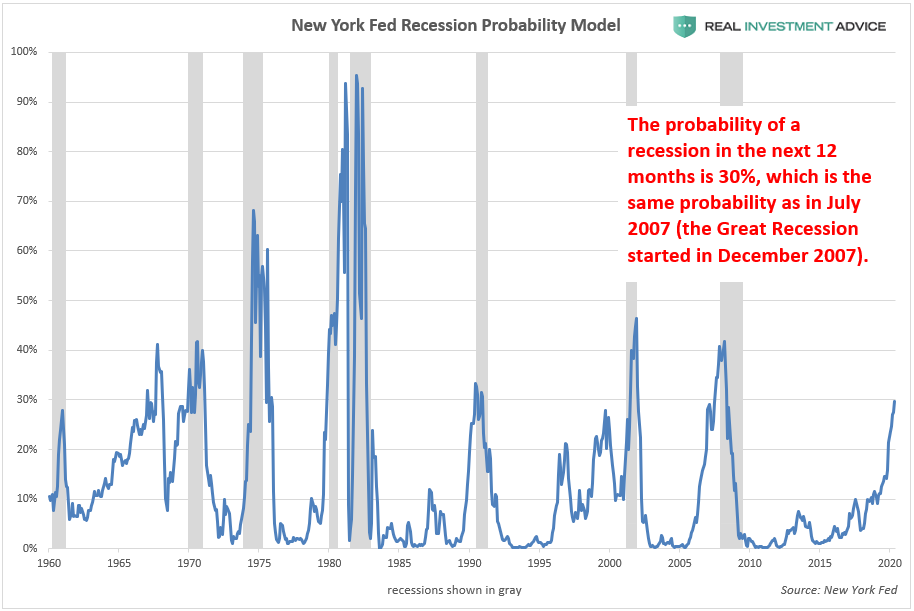

According to the New York Fed’s yield curve-based recession probability model, there is a 27% probability of a U.S. recession in the next 12 months. “The last time that recession odds were the same as they are now was in early 2007, which was shortly before the Great Recession officially started in December 2007,” Colombo added.

‘Everyone should be terrified of the coming recession.’

However, he sees a 64% likelihood of a recession within the next year. “The New York Fed’s recession probability model has underestimated the probability of recessions in the past three decades because it is skewed by the anomalous recessions of the early 1980s,” he added. The New York Fed’s model is based on the Treasury yield curve, which is based on U.S. interest rates.

And, Colombo adds, that model was skewed by a then-Federal Reserve Chairman Paul Volcker’s “unusually aggressive interest rate hikes that were meant to ‘break the back of inflation.’ Looking at the New York Fed’s recession probability model data after 1985 gives more accurate estimates of recession probabilities in the past three decades, he said.

Don’t miss: Is your boss a psychopath?

He has a long list of “new bubbles” that people should be losing sleep over. They include global debt, China, Hong Kong, Singapore, the art market, U.S. stocks, U.S. household wealth, corporate debt, leveraged loans, U.S. student loans (currently topping $1.5 trillion), U.S. auto loans, tech startups, global skyscraper construction, U.S. commercial real estate “and U.S. housing once again.”

“I believe that the coming recession is likely to be caused by — and will contribute to — the bursting of those bubbles,” he said. In other words, Colombo argues that Americans have plenty of reasons to lie awake at night wondering when America’s decade-long expansion will finally come to an end. “Everyone should be terrified of the coming recession,” he added.