Oracle can’t keep up with demand for its industry-leading artificial intelligence (AI) data centers.

Oracle (ORCL 0.31%) has participated in almost every technology revolution. Over the last 25 years, it has helped businesses prepare for the dawn of the internet, cloud computing, and now, artificial intelligence (AI).

The company operates some of the best AI data center infrastructure in the industry. It allows developers to scale up to 32,768 of Nvidia‘s graphics processing units (GPUs), more than many of its top competitors. More GPUs translate into larger AI models.

Oracle’s random direct memory access (RDMA) networking technology moves data from one point to another faster than traditional Ethernet networks. Since developers pay for computing capacity by the minute, that leads to substantial cost savings.

Chairman Larry Ellison says Oracle’s Gen2 AI data centers can train AI models twice as fast and for half the cost of competing infrastructure.

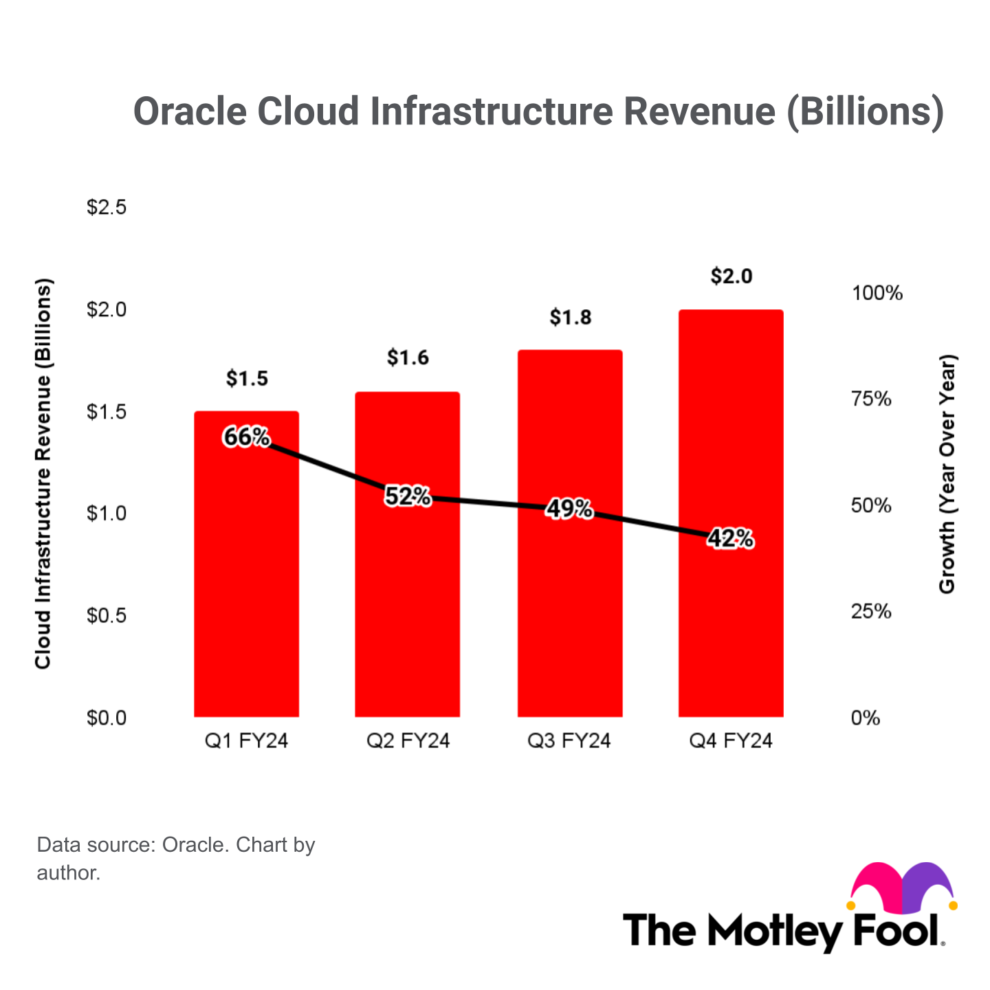

Oracle sells data center capacity under its Cloud Infrastructure (OCI) segment. Its revenue has increased by more than 40% year over year in each of the last four quarters, making it the fastest-growing part of the entire organization:

Oracle forecasts OCI revenue growth of more than 50% during fiscal 2025. The company will report its results for the first quarter (ended Aug. 31) in early September, so investors should keep a close eye on the segment.

Growth could potentially accelerate in the coming quarters because demand for Oracle’s infrastructure is outstripping supply. That was evident in the company’s remaining performance obligations in the recent fiscal 2024 fourth quarter (ended May 31), which soared 44% to a record $98 billion. That included $12.5 billion worth of deals from over 30 AI companies.

Oracle is rapidly building new data centers to fill that demand. Its revenue growth will benefit as the new locations come online.

Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia and Oracle. The Motley Fool has a disclosure policy.