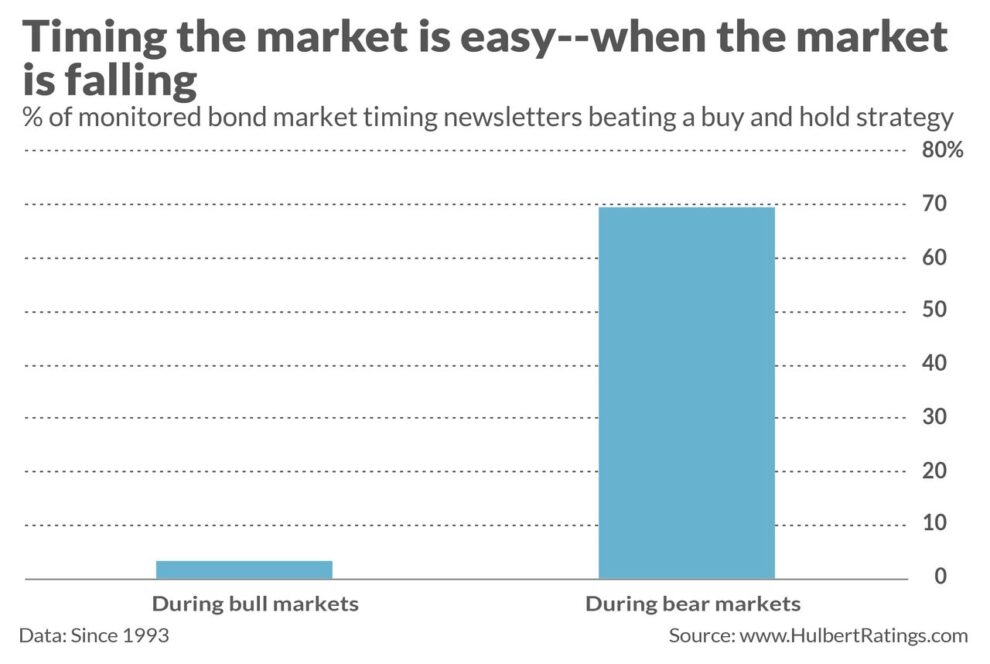

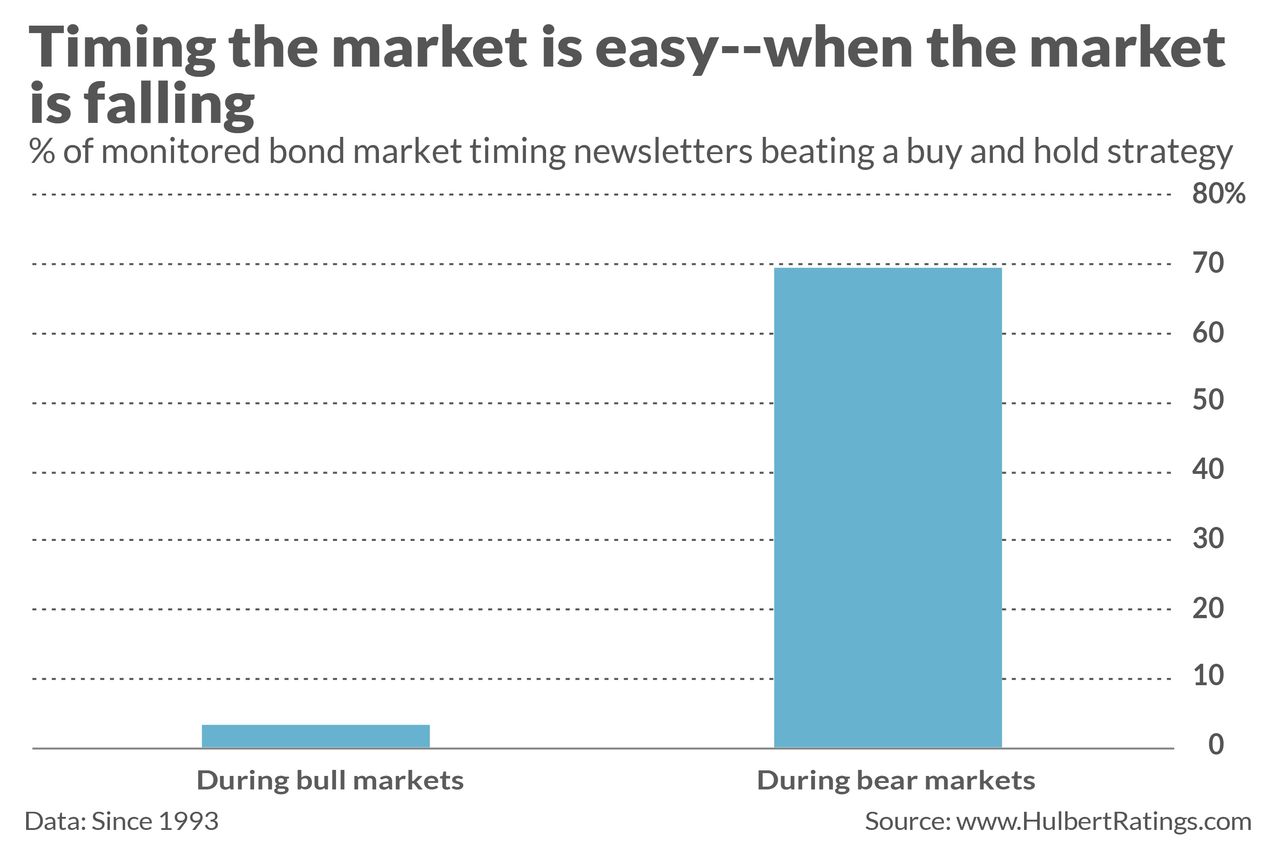

Rising interest rates are not a good reason to invest in an actively managed bond fund. That’s important to know, since the performance data appear to show just the opposite. As you can see from the chart below, a far greater percentage of bond-market timing newsletters beat a buy-and-hold strategy during bond bear-markets.

This would suggest that if interest rates rise from current levels — causing bond prices to decline — then active management would be the way to go.

In fact, the data do not support this conclusion. In order to exploit this pattern, you would first need to know that interest rates are indeed headed up — that bonds are in a bear market, in other words. But if you already knew that, then you wouldn’t need to utilize the services of an active manager; your best course of action would then simply be to get out of bonds and go to cash.

Perhaps you think that interest rates will rise. I’m skeptical. I’ve been hearing such predictions for many years now, and at least so far they’ve not come to pass. If you were to unexpectedly get an interest rate prediction right, it would be more a matter of luck than skill.

This is the implicit message of the data in the accompanying chart. That’s because it takes no skill to outperform the market when it’s declining. Even a monkey flipping a coin to determine when to get in and out of the bond market would come out ahead.

If beating a buy-and-hold strategy in a bear market were a matter of skill, then you’d expect to see just as many market timers beating bull markets. But that is most definitely not the case: In bond bull markets, as the chart shows, the percentage of market timing newsletters beating the market is barely above zero.

To construct this chart, I examined bull and bear markets in the U.S. bond arena back to 1993. While there is no hard-and-fast rule about when bond bull markets begin and end, I defined them according to multi-month up- and down trends in the 10-year Treasury’s yield. By my count there have been five complete market cycles since then.

In the bull and bear phases of each cycle, I calculated the percentage of bond timing newsletters monitored by the Hulbert Financial Digest that had beaten a buy-and-hold. The accompanying chart reports the averages across all five cycles.

Why is beating a buy-and-hold strategy so much easier in bear markets?

The reason a monkey’s market timing would most likely beat a buy-and-hold during a bond bear market: When bonds are falling in price, odds are high that going to cash will gain an advantage over the falling market — even if the timing of going to cash is picked at random. So beating a buy-and-hold during a bear market is not a sign of any special ability.

During bull markets, in contrast, just the opposite will be true: Any time spent in cash will most likely cause a market timer to fall behind a buy-and-hold, which will be continuing to gain as the market rises. That’s why the majority of bond market timers look like geniuses when the market is falling and yet appear to have no ability when the market is rising.

This is simply a matter of probabilities, of course, and not unique to the bond market. Four decades of performance tracking by the Hulbert Financial Digest has shown the same phenomenon to be true among stock and gold timers as well.

Hardly any bond timers beat a buy-and-hold over an entire cycle

Another way to illustrate the very low probability of successfully timing the bond market is to measure how timers do over an entire market cycle. The picture that emerges from Hulbert Financial Digest data isn’t pretty. For each complete (bull-plus-bear) market cycle since 1993, I calculated the percentage of monitored bond market timers who made more money than buying and holding. On average for all market cycles since 1993, the market-beating percentage is just 8%.

This is slightly lower than the comparable percentages for monitored stock and gold timers, and I think that makes sense. Market timers thrive on market volatility, and the bond market is far less volatile than either equities or gold. Over the last several decades, for example, the monthly volatility of the U.S. Treasury market has been 65% less volatile than the stock market’s. Gold’s monthly returns have been 8% more volatile.

The bottom line: Be on your guard against arguments that bond market timing is about to be more important than ever. Though the data appear to support those arguments, in fact they do not.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at [email protected]

Plus: Why value stocks could rally in the Biden administration’s first 100 days