How will the stock market react if we are unable to completely eradicate COVID-19 and instead the virus remains with us indefinitely?

This is a timely question, since evidence is mounting that COVID-19 is here to stay. If you’ve been investing in stocks on the assumption that the COVID-19 pandemic will someday be completely over, you may need to update your information.

The closest analogy to the COVID-19 pandemic is the Spanish Flu pandemic of a century ago. Though that earlier pandemic constitutes a sample of just one, it’s the logical place to start in reading the historical tea leaves for clues about what may happen in coming months. Just as is now being predicted for COVID-19, the Spanish Flu pandemic never came to an abrupt end, but instead gradually receded from the public’s consciousness. Immunologists tell us that mutations and variants of the Spanish Flu virus are still with us today.

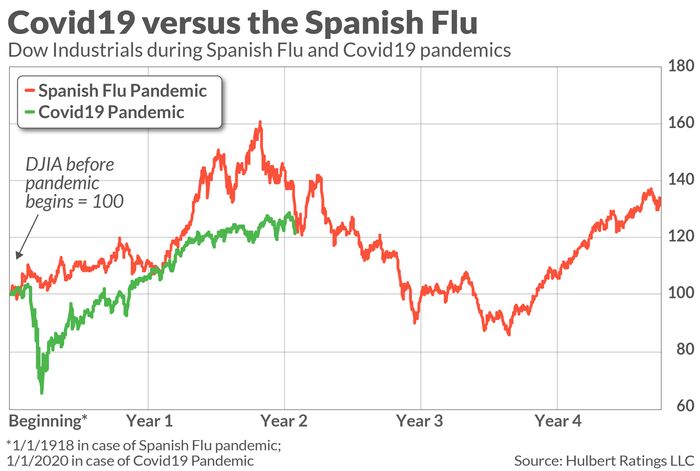

How did the Dow Jones Industrial Average DJIA, +0.81% perform during the Spanish Flu pandemic and after that virus became endemic? The chart below plots the Dow from the beginning of 1918 through the end of 1922. Superimposed on that plot is the Dow’s comparable performance since the beginning of 2020.

Notice that even though the Dow over the first two years of these two pandemics followed somewhat divergent paths, they currently are neck-and-neck for cumulative performance dating back to before their respective pandemics began.

We can only hope that the Dow over the next couple of years does not continue to follow the same script it followed then. Notice from the chart that the Dow fell by almost half from its high-water mark two years into the Spanish Flu pandemic to its low midway through the third year. So much for the “Roaring 20s” scenario that has excited many of today’s bulls. As I’ve written before, it wasn’t until the latter half of the 1920s that the U.S. economy and stock market began to fire on all cylinders.

What caused the 1920-21 bear market?

The main cause of the 1920-21 bear market was a U.S. recession. According to the National Bureau of Economic Research, the U.S. economy contracted between January 1920 and July 1921. Corporate earnings slumped, with the S&P 500’s SPX, +1.45% earnings per share falling by two-thirds. This despite the U.S. economy emerging from its wartime footing during World War I.

Was this recession related to the Spanish Flu pandemic transitioning to becoming endemic? Not in any direct way. Though not all economists agree on that recession’s cause, one widely held school of thought is that the Federal Reserve — which had just been created a few years previously — pursued a far-too-tight monetary policy. If so, that is presumably less of a risk today. While the Fed currently is slated to raise interest rates this year, no one would accuse it of excessive monetary tightening.

It’s also worth emphasizing that valuations were not a cause of that bear market. At its beginning, the S&P 500’s price/earnings ratio was just 10.1, according to data compiled by Yale University finance professor Robert Shiller. That’s well below the last-150-years average of 16.0. Today’s p/e ratio is two-and-one-half times that level, which means that — other things being equal — the stock market today is more vulnerable to a recession than it was a century ago.

Perhaps these two factors balance each other out? Regardless, there is one investment lesson that is fair to draw: Investors often “buy the rumor and sell the news.” The Dow’s high-water mark two years into the Spanish Flu pandemic came as its third (and final) big wave had started to subside. The Dow wouldn’t again trade at that level until the end of 1924, five years hence.

If something similar happens now, and assuming that the COVID-19 pandemic is about to subside and become endemic, then U.S. stocks would soon enter a severe bear market that lasts well into 2023.

Sign up for our Market Watch Newsletters here

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at [email protected]

Also read: The 60%-40% portfolio will deliver anemic returns over the next decade — here’s how to adapt