With the U.S. presidential election looming and the COVID-19 pandemic taking new turns, investors are struggling to navigate through one of the most nerve wracking, uncertain market environments in modern history.

Even the most experienced investors have found themselves in search of answers and clear-cut direction. Despite these headwinds investors should address these challenges straight on by proactively building a resilient portfolio intended to withstand periods of uncertainty, paying particular attention to these three strategies:

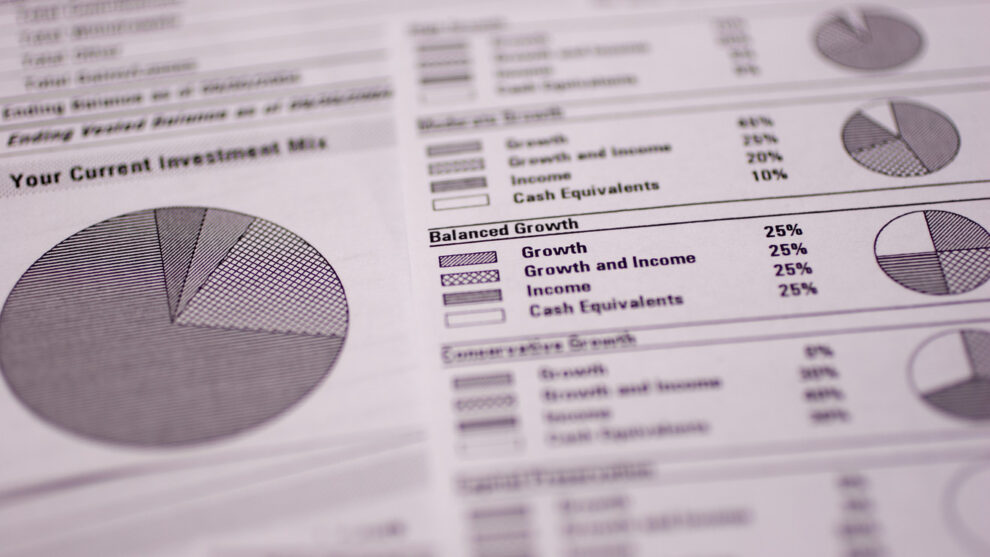

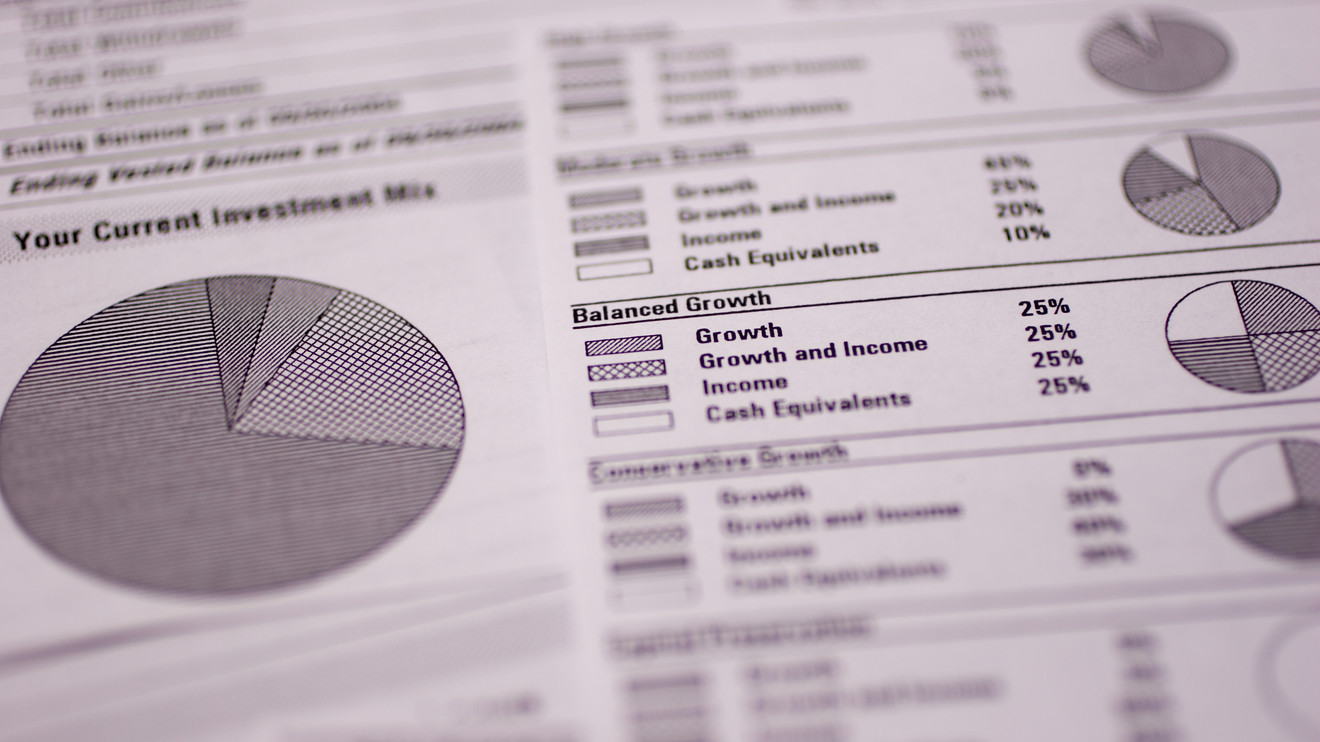

1. Establish, review and confirm your long-term financial objectives: Designing a portfolio according to specific goals is especially important during turbulent times because market returns will be choppy, and allowing near-term performance results (absolute, benchmark-relative, or peer-relative) to inform allocation decisions can lead to suboptimal results with your money.

Take an investor whose primary investment objective is generating income. This investor’s strategic and tactical asset allocation will primarily be driven by a collection of yield-producing assets (both stocks and bonds). If equity markets were to (temporarily) generate outsized near-term returns, this income-oriented portfolio would likely underperform, which under traditional portfolio construction mandates, may cause the investor (an allocator) to reconsider the client’s underlying asset mix.

Yet if the portfolio is evaluated within the guidelines of the personal mandate defined at the onset of the allocation process (generate income), then results can and should be judged relative to the success or failure to achieve the agreed upon outcome. For example, did my portfolio underperform the S&P 500 SPX, -0.63% ? Did my portfolio generate the income I need? Constructing and evaluating portfolios relative to specific goals and outcomes strengthens the portfolio’s resiliency and reduces the likelihood of an investor chasing recent returns.

2. Be aware of fees and after-tax returns: If we agree that markets experience choppiness during periods of uncertainty, then the probability of accompanying returns failing to live up to historic returns is quite high. This likelihood presents challenges for savers and spenders alike, and supports the notion that every penny of return counts — especially at times like now.

Being aware of the costs associated with portfolio management doesn’t mean investing in the cheapest products. Rather, it is encouraging asset allocators, financial professionals and individual investors to be aware of all of the associated fees tied to an investment plan, decide whether the fees are reasonable given the expected outcomes associated with that investment, and take action if there is a disconnect between costs and expectations.

Additionally, it is critical to understand the after-tax implications for certain investment products, for assets held outside of qualified accounts. Taxes are an often-overlooked barrier to realizing long-term financial objectives, so it is of uptmost importance (especially if future market returns fail to match or exceed historical market returns) to make sure the aggregate tax liability of an investor’s portfolio is minimized, within certain constraints.

Consider employing a fee budget — where higher fees are paid to active managers who have demonstrated skill and differentiation within their specific asset class or sector. Consider lower cost options when that skill is difficult to find. Additionally, strategic/smart beta ETFs offer excellent compliments to actively managed strategies, while attempting to control aggregate costs and potential tax impacts.

3. Ensure that all decisions (both strategic and tactical) are informed by clear logic and well-grounded philosophical beliefs: This is especially timely given the upcoming U.S. presidential election. Hartford Funds conducted a survey recently that asked investors several questions tied to politics and investing. The results were illuminating:

• 45% of respondents plan to make portfolio changes ahead of the election.

• 47% of respondents believe a Donald Trump victory would be better for their portfolios, while 37% believed their investments would benefit from a Joe Biden win.

• 78% of respondents believe that a unified government (president, House and Senate all of the same party) is best for their personal finances.

• 62% of respondents plan to make portfolio changes in the 12 months following the November election.

These results indicate that there is a good amount of misinformation out there, which if acted upon could lead to sub-optimal portfolio decisions. Consider what our research shows:

• From 1993 to 2019 the average real return (inflation-adjusted) for the S&P 500 during Democratic presidents was 10.2% and 6.9% under Republicans. Strip away outliers such as the dot-com bust and the Great Financial Crisis, and the return differential is essentially zero.

• Since 1937, the S&P 500 has averaged a 12-month return of 14.6% when an election results in a divided government vs. 13% when the election yields a unified government.

I use this as an example of many people planning to make portfolio changes based on misconceptions tied to the assumed correlation between governing party and stock market returns. The construction of a resilient portfolio should not rely on bias or unfounded notions of potential return influencers.

Investors instead should use this opportunity to review their investment goals and market trends and to conduct their own research. If applicable, work with a trusted financial professional to help make educated, strategic investment decisions. Periods of uncertainty are optimal times to better understand your investments and strengthen your portfolio. Now is not the time to recoil; it’s a time to recalibrate and move forward.

Brian Kraus is head of investment consulting at Hartford Funds.

More: Be prepared: A return to normal is still a long way away, warns banking billionaire Jamie Dimon

Also read: Politics has no place in your 401(k) but that’s just what the U.S. government is trying to do