Enough time has elapsed since investment legend John Neff passed away to step back and take a sober look at the performance of the mutual fund he ran for more than three decades.

That’s not because Neff’s record was anything short of impressive. But a dispassionate analysis of how much money an investor could have made from his considerable investing skills would have looked unseemly in the immediate aftermath of his passing.

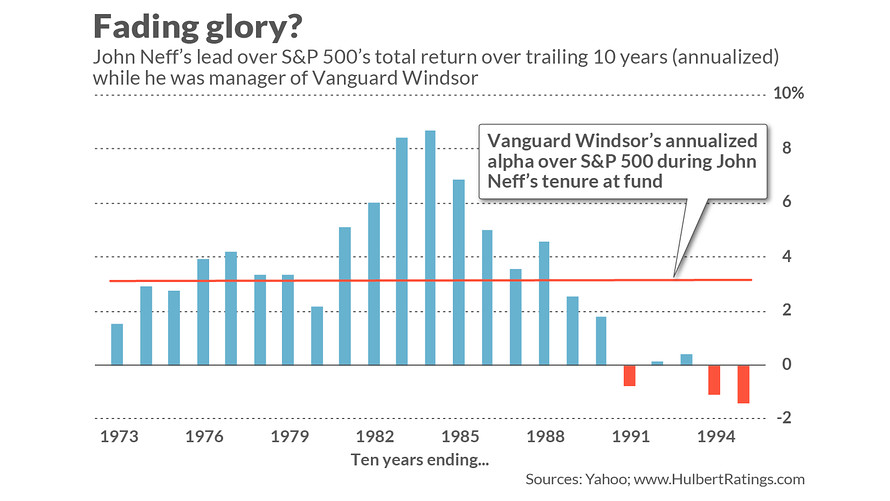

Neff died June 4 at the age of 87. From 1964 through 1995 he ran Vanguard Group’s respected Windsor Fund VWNDX, -0.24% . Over his 31 years at the helm, the fund beat the S&P 500’s SPX, -0.34% total return by an extraordinary average of 3.1 annualized percentage points. Indeed, few managers are able to beat the market at all over a long stretch, and most of those who do excel by only a slim margin.

So Neff clearly deserves to be in the pantheon of investment greats. Nevertheless, it’s not clear that you would have beaten the market by following Neff’s fund beginning in the middle of his career. Notice from the chart below that his alpha — the amount by which he beat the market—declined steadily beginning in the 1980s. By the time he retired from his fund in 1995, Windsor over the trailing 10 years lagged the S&P 500 on a total-return basis by 1.4 annualized percentage points.

Neff is not alone among managers whose hot performance cools after they become well-known and money pours into their fund. Other investment greats who have experienced the same include:

- Bill Miller, who at Legg Mason Value Trust LMVTX, -0.42% turned in an incredible 15 calendar years in a row of beating the S&P 500. But from then until he left the fund, Miller incurred such sizeable losses that his fund lagged the broad market when viewed over his entire tenure at the fund

- Bruce Berkowitz, whose flagship Fairholme Fund FAIRX, -0.47% has beaten the U.S. market over the period since 1999 but has lagged over the past decade.

So pointing out weakness in Neff’s record doesn’t diminish his reputation as an investment guru. It’s impressive that Windsor’s return in the years prior to the mid-1980s was so good that Neff can lag the market over the last decade of his career and still post a lifetime alpha of 3.1 annualized percentage points.

Still, many investors’ investment horizons are less than 10 years, so they can’t look to the longer term to bail them out. And lagging the market is lagging the market, no matter who is the manager.

The fundamental reality investors face, of course, is that performance over both the short- and even intermediate term is often more luck than skill, and it’s tough to know which is which. I’m reminded of Ben Graham’s revealing confession in the postscript to the 4th edition of his classic book “The Intelligent Investor”: “One lucky break, or one supremely shrewd decision — can we tell them apart? — may count for more than a lifetime of journeyman efforts,” he wrote.

Graham added an additional thought that is relevant to drawing investment lessons from Neff’s career: “Behind the luck, or the crucial decision, there must usually exist a background of preparation and disciplined capacity. One needs to be sufficiently established and recognized so that these opportunities will knock at his particular door. One must have the means, the judgment, and the courage to take advantage of them.”

In the end, it is his preparation and discipline for which Neff deserves to be known, and not the magnitude of his annualized alpha. Possessing these qualities doesn’t guarantee the ability to beat the market over the long term, but not having them almost certainly will doom the attempt. This is Neff’s legacy.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. Hulbert can be reached at [email protected]

Read: The S&P 500 just hit a record high — so did these stocks

Related: Vanguard’s Jack Bogle, mutual-fund industry agitator, got the last laugh