(Bloomberg) — Facebook Inc. shares climbed on Friday following reports detailing the company’s plans to launch a digital currency, due to be unveiled next week.

Details emerged late this week concerning plans to roll out a cryptocurrency strategy on June 18. The Wall Street Journal reported it had signed up a number of major companies — including Visa, Mastercard, PayPal and Uber — to back the project. Separately, a Facebook spokeswoman confirmed reports that U.K. bank lobbyist Ed Bowles is joining the company, but declined to comment further. Bowles’s new title at Facebook will be public policy director for Northern Europe, according to a person familiar with the situation.

The cryptocurrency plan “may prove to be one of the most important initiatives in the history of the company to unlock new engagement and revenue streams,” RBC analyst Mark Mahaney wrote in a June 13 note. Mahaney, who rates the stock outperform, didn’t give an estimate of the potential upside the company could see.

The stock rose as much as 2.5% in morning trading, extending a recent uptrend, to rank as the best-performing stock in the Nasdaq 100, which slipped 0.4%. Shares of the social-networking company are on track for their eighth rise in the past nine trading days, and they are up more than 10% from a low earlier this month.

The crytpo push could facilitate platforms including payments, shopping, applications and gaming, and would leverage its broad user base in Asia, where it has nearly 4 times as many monthly active users as it does in North America, Mahaney notes.

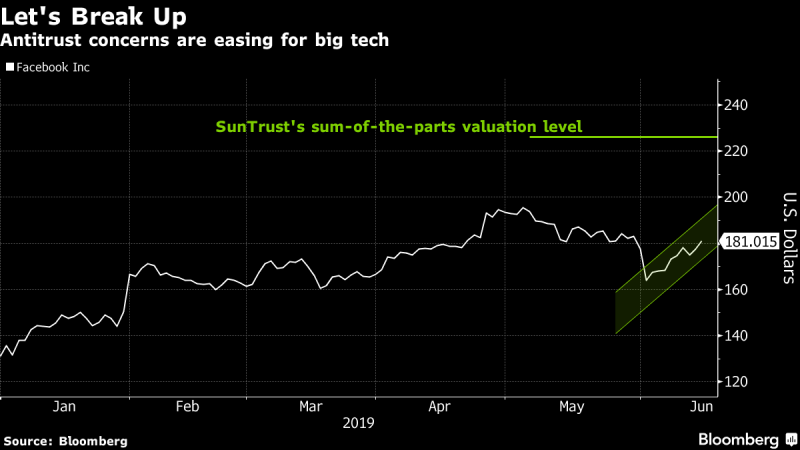

Friday’s gain comes as concerns continue to ease over the prospect of greater regulatory scrutiny with some analysts predicting a possible breakup could mean an upside to shares.

“Investors may be getting relatively comfortable with the underlying regulatory risk” facing major Internet and technology stocks, wrote Youssef Squali, an analyst at SunTrust Robinson Humphrey. “There may be a growing realization that even in case of a breakup of these behemoths, the value of the parts may be higher than the whole over time.”

According to the firm’s calculations, Facebook’s five main businesses — the namesake social network, Instagram, Facebook Messenger, WhatsApp and Oculus — have a sum-of-the-parts valuation that implies a share price of $226, or 27% above Facebook’s Thursday close.

SunTrust added that it was “likely to take years” for any regulatory measure to be implemented and enforced, but the commentary echoes an argument that has been repeatedly made about Google-parent Alphabet Inc., which is also facing antitrust scrutiny.

Currently, 45 analysts recommend buying Facebook shares, while six have hold ratings on the stock and two recommend selling it. The average price target of about $220 represents upside of about 24%.

Earlier this week, MoffettNathanson upgraded its view on the stock, writing that “improving underlying fundamentals” and new growth opportunities would offset “the risk of greater regulatory scrutiny.” On Thursday, Deutsche Bank also wrote that Facebook’s video-streaming service could grow to generate $5 billion in annual ad revenue over the next few years.

(Updates with Facebook, analyst comment starting in the second paragraph.)

–With assistance from Kurt Wagner.

To contact the reporter on this story: Ryan Vlastelica in New York at [email protected]

To contact the editors responsible for this story: Catherine Larkin at [email protected], ;Courtney Dentch at [email protected], Jennifer Bissell-Linsk, Morwenna Coniam

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="For more articles like this, please visit us at bloomberg.com” data-reactid=”55″>For more articles like this, please visit us at bloomberg.com

©2019 Bloomberg L.P.