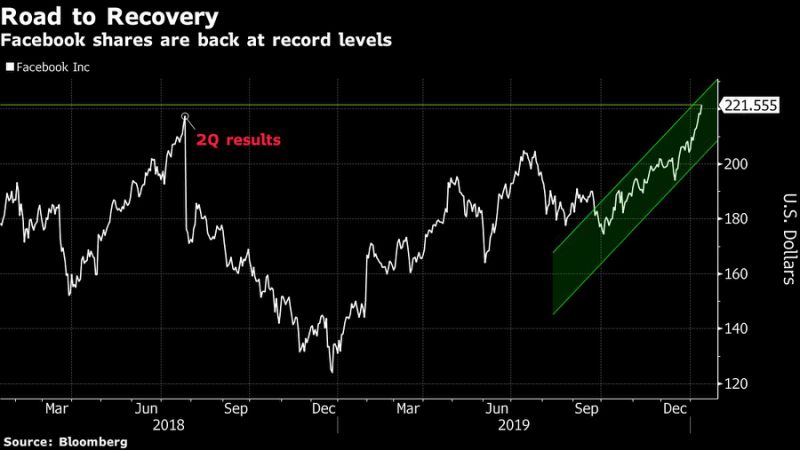

(Bloomberg) — Facebook Inc. shares hit an intraday record on Monday, eclipsing a level that was last reached in mid-2018 as growing optimism over its 2020 prospects were seen as overshadowing risk related to regulation.

Wall Street has been growing more positive on the social-media company for months, with most analysts citing a tailwind from growth in the digital advertising market, as well as the company’s ability to further monetize its massive user base.

Earlier on Monday, Evercore ISI raised its price target on the stock to $280 from $235, touting the company’s moves into e-commerce via its Instagram app. Consensus forecasts “under appreciate the revenue and narrative benefits associated with the blurring lines between advertising and e-commerce on Instagram,” wrote analyst Benjamin Black, who named the company one of his best ideas for 2020.

Mizuho Securities also named Facebook a top Internet pick for 2020 on Monday, expecting the stock to outperform this year “given its significant portfolio of assets which are yet to be fully monetized.”

The stock rose as much as 1.7%, having climbed more than 25% off a recent low in October. Facebook jumped more than 55% over the course of last year, the stock’s best annual performance since 2013. The return to record levels means that Facebook has completely recovered from a historic sell-off from July 2018, when disappointing quarterly results sparked a one-day drop of about 19%.

The advance comes as Wall Street increasingly looks past what is seen as a “fraught” regulatory environment, one focused on a variety of issues, including user privacy, ad policies and competition. Mizuho, in its Monday research report, wrote that regulatory concerns were “overstated” and already priced into the stock price.

Wall Street is broadly positive on Facebook. According to data compiled by Bloomberg, 49 firms recommend buying Facebook, while five have a hold rating on the shares. Just three advocate selling the stock. The average price target is around $238, suggesting upside of more than 7% from current levels.

Facebook’s fourth-quarter results will be released on Jan. 29.

To contact the reporter on this story: Ryan Vlastelica in New York at [email protected]

To contact the editors responsible for this story: Catherine Larkin at [email protected], Steven Fromm

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="For more articles like this, please visit us at bloomberg.com” data-reactid=”50″>For more articles like this, please visit us at bloomberg.com

©2020 Bloomberg L.P.

Add Comment