Shares of Fastenal Co. soared to a record high Friday, as the industrials company managed to fend off a continued slowing in economic activity and a mysterious weakening in its local construction business to produce a third-quarter profit and sales that rose above Wall Street forecasts.

The stock FAST, +17.15% shot up 17.2% to close at $36.34. That was the second-biggest one-day gain since the stock went public in August 1987, behind only the record rally of 18.6% on Oct. 30, 1987. Trading volume ballooned to 28.8 million shares, compared with the full-day average of about 4.2 million shares.

The company, which makes industrial vending machines, tools and other manufacturing and construction equipment, reported net income for the quarter to Sept. 30 that increased to $213.5 million, or 37 cents a share, from $197.6 million, or 34 cents a share, in the year-ago period, topping the FactSet consensus of 35 cents a share.

Sales increased 7.8% to $1.38 billion, above the FactSet consensus of $1.37 billion, amid higher unit sales and higher product pricing.

Meanwhile, gross margin fell to 47.2% from 48.1% a year ago, because of increased sales of lower-margin products, inflation and higher freight expenses.

Fastenal managed to beat expectations, although the company said that the “general slowing in economic activity,” which resulted in a profit and sales miss in the second quarter, “continued in the third quarter of 2019.”

See related: U.S. manufacturers experience worst month since 2007-2009 Great Recession, ISM finds.

Also read: Service side of the economy grows at slowest price in 3 years, ISM finds, adding to recession worries.

Chief Executive Daniel Florness said in the post-earnings conference call with analysts that he believed the growth in product sales was a “tremendous accomplishment” in an economy “where things have weakened.”

There was a hiccup in the company’s business, however, that Florness said he decided to bring up, basically in the interest of full disclosure.

“That is, the one item in the quarter that kind of makes me scratch my head is our construction business,” Florness said. “That growth has slowed dramatically as we’ve come into 2019 and in all honesty, we don’t completely understand it.”

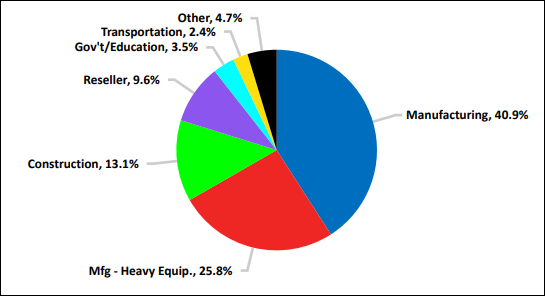

Fastenal Co.

Fastenal Co. He said the weakness seemed to be concentrated in the company’s smaller customer accounts, as the larger account business continues to grow well. Although some of the weakness in local businesses can be attributed to the closing of 5% of locations a year, Florness said that’s not a new phenomenon, as the closings have been happening for the past four to five years.

Florness said he talked to peers that sell into the same arena, and they have also observed that while their larger accounts aren’t seeing the weakness, their smaller account businesses are slowing as well.

“It’s more of an observation than a conclusion,” Florness said. “I apologize for that.”

With Friday’s gain, Fastenal’s stock has now run up 39.0% year to date. Meanwhile, the SPDR Industrial Select Sector exchange-traded fund XLI, +1.88% , of which Fastenal is a component, has rallied 19.2% and the S&P 500 index SPX, +1.09% has advanced 18.5%.

Add Comment