You might be surprised to hear that a surging but low-yielding growth stock like Nvidia (NASDAQ:NVDA) is the top holding for a dividend-focused ETF, but that’s exactly the position it occupies in the Fidelity High Dividend ETF (NYSEARCA:FDVV). Just because Nvidia and other stocks like it feature a low yield doesn’t mean that dividend funds should automatically count it out, and FDVV is a good example of why, as we’ll discuss in this article.

I’m bullish on this $2.9 billion ETF from Fidelity based on its portfolio, which consists of an attractive combination of “new-school” dividend stocks like Nvidia with “old-school” dividend stalwarts like Pepsi (NASDAQ:PEP) and Philip Morris (NYSE:PM). The ETF also boasts a strong performance track record in recent years, a 3.0% dividend yield, and reasonable fees.

What Is the FDVV ETF’s Strategy?

According to Fidelity, FDVV invests in an index “designed to reflect the performance of stocks of large and mid-capitalization dividend-paying companies that are expected to continue to pay and grow their dividends.”

Nice Mix of Dividend Stocks

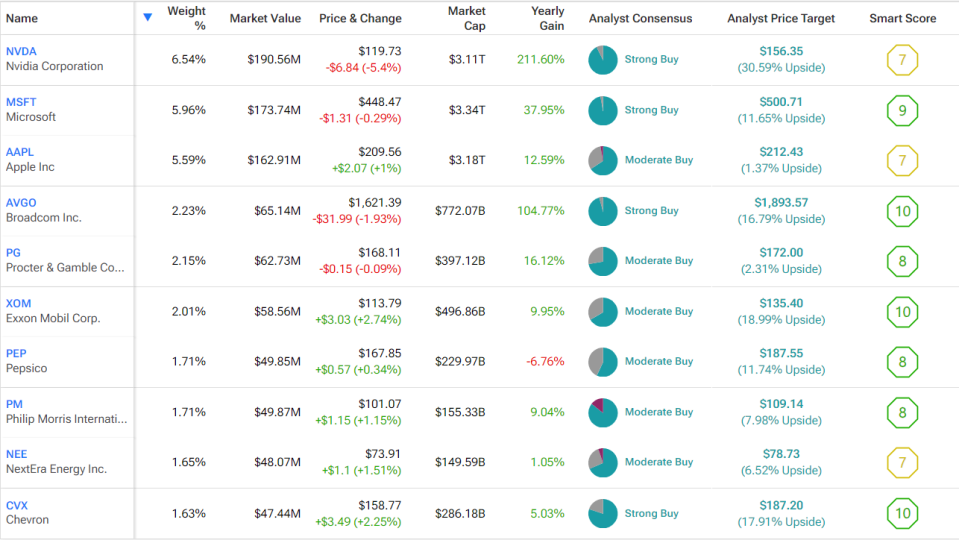

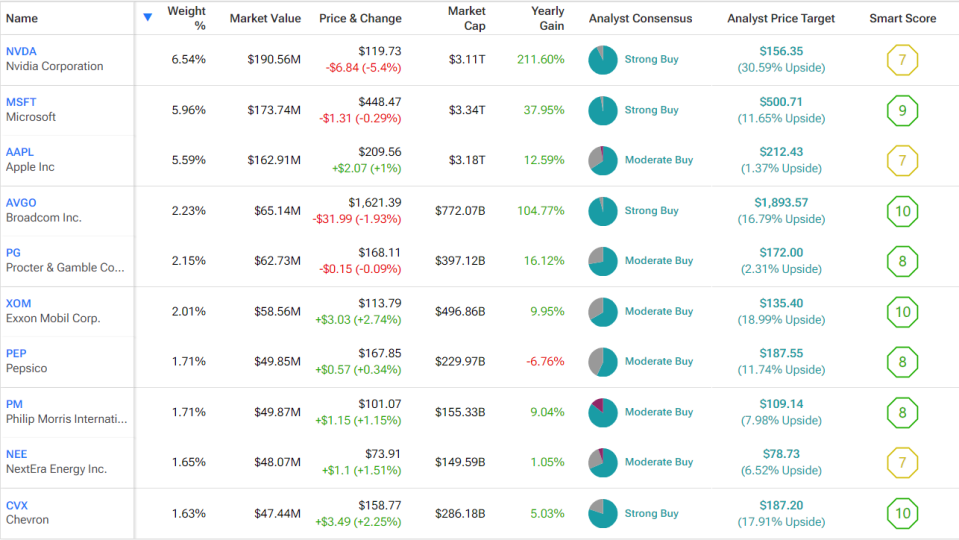

FDVV offers decent diversification with 105 holdings, and its top 10 holdings make up a reasonable 31.2% of assets. Below, you’ll find an overview of FDVV’s top 10 holdings using TipRanks’ holdings tool.

As you’ve surmised from the article’s title, Nvidia is the ETF’s top holding, with a weighting of 6.5%.

And Nvidia isn’t the only high-growth, lower-yielding dividend stock from the tech sector that is prominent in FDVV’s top holdings. Microsoft (NASDAQ:MSFT), Apple (NASDAQ:AAPL), and Broadcom (NASDAQ:AVGO) are the fund’s next three largest holdings.

Nvidia yields less than 0.1%, Microsoft and Apple feature yields below 1.0%, and Broadcom is only slightly higher, with a yield of 1.2%.

You might wonder what these low-yielding tech stocks are doing in a “high dividend” ETF.

FDVV’s strategy is to invest in companies expected to continue paying and growing their dividends, not simply the dividend stocks with the highest yields. Growth stocks like Nvidia and Broadcom are expected to grow their earnings over time and thus have the capacity to increase their dividend payouts in the future, making them a good fit for dividend funds like FDVV.

This expected earnings growth also makes them more attractive investments than many dividend stocks that feature high yields but feature low or no growth and are essentially businesses in decline.

FDVV is prudent to include these stocks as, despite their lower yields, they have generated exceptional total returns over time through a combination of price appreciation and dividends. For example, Broadcom has generated an exceptional total return of 2,907% over the past decade, while Nvidia has returned a stunning 26,839% over the same time frame.

To be clear, past performance is no guarantee of future results. It’s unlikely that these stocks will continue to rise at this pace in the years to come, but this illustrates why it’s worth it for dividend investors (and funds) to include lower-yielding dividend-paying growth stocks within their strategies.

FDVV does a good job of mixing lower-yielding, strong performers with higher-yielding, more traditional dividend stocks investors are accustomed to seeing in dividend ETFs. These include energy giants like ExxonMobil (NYSE:XOM) and Chevron (NYSE:CVX) and consumer staples blue chips like Pepsi, Philip Morris, and Procter & Gamble (NYSE:PG).

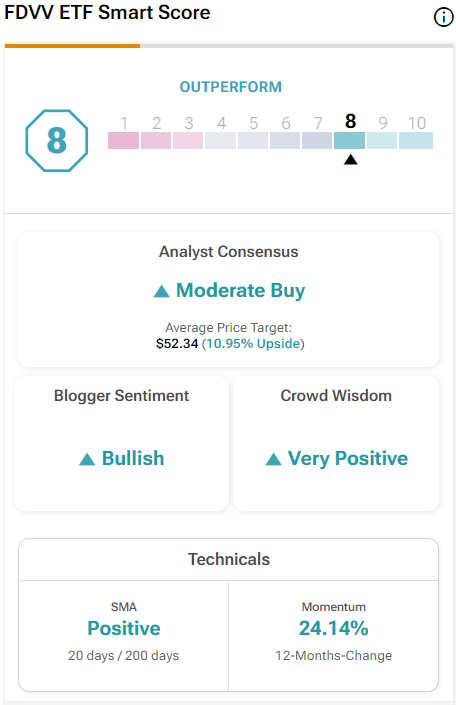

FDVV’s holdings collectively receive favorable ratings from TipRanks’ proprietary Smart Score system. The Smart Score is a quantitative stock scoring system created by TipRanks. It gives stocks a score from 1 to 10 based on eight market key factors. A score of 8 or above is equivalent to an Outperform rating. Seven of FDVV’s top 10 holdings feature Outperform-equivalent Smart Scores of 8 or above, and Broadcom, ExxonMobil, and Chevron feature “Perfect 10” ratings.

FDVV itself features an Outperform-equivalent ETF Smart Score of 8 out of 10.

FDVV’s Performance Has Been Solid

This combination of new-school growth stocks that pay dividends and old-school dividend stocks has generated solid returns over time. As of May 31, FDVV has generated a strong 11.1% annualized return over the past three years and a solid 14.6% annualized return over the past five years.

This means that the dividend-focused FDVV has actually outperformed the broader market over the past three years, as the Vanguard S&P 500 ETF (NYSEARCA:VOO) has generated an annualized return of 9.6% over this time frame (as of May 31).

However, FDVV has slightly lagged VOO over the past five years, as VOO has returned 15.8% annually over a five-year period.

That said, this is still an admirable five-year return, and FDVV investors can feel good about the total returns the fund has generated for them. An investor who put $100,000 into the fund five years ago would have $186,240 today.

Above-Average and Growing Dividend

FDVV yields 3.0%, so its dividend yield is double that of the S&P 500. FDVV has been paying a dividend for seven years and has grown its dividend payout for the last three years in a row.

Moderate Fees

FDVV charges a very reasonable expense ratio of just 0.15%. This means that the fund charges just $15 annually for every $10,000 invested. Assuming the fund returns 5% per year going forward and maintains this expense ratio, an investor putting $10,000 into the fund will pay just $85 in fees over a five-year period.

Is FDVV Stock a Buy, According to Analysts?

Turning to Wall Street, FDVV earns a Moderate Buy consensus rating based on 83 Buys, 22 Holds, and one Sell rating assigned in the past three months. The average FDVV stock price target of $52.32 implies 11.6% upside potential from current levels.

Investor Takeaway

I’m bullish on FDVV because I like the way the fund invests in both lower-yielding but high-performing dividend-paying growth stocks like Nvidia and Broadcom and more traditional, higher-yielding but lower-growth dividend stocks like ExxonMobil and Chevron. This sound strategy has led to attractive double-digit annualized returns over time.

Furthermore, FDVV sports an above-average dividend yield of 3.0% and charges an expense ratio of 0.15%. Adding it all up, FDVV looks like a sound choice for investors.