The U.S. economy is at risk of contracting again in the next few months but should see a strong rebound beginning in the spring, says chief economist Christophe Barraud of Paris-based Market Securities, who won MarketWatch’s Forecaster of the Year contest for 2020.

Barraud ousted reigning champion Jim O’Sullivan of TD Securities, who had won MarketWatch’s annual forecasting contest nine years in a row.

Related story: ‘Trillion on top of a trillion’ in stimulus will push 10-year Treasury yields to 2% by year-end, Forecaster of the Month says

Rough patch

As the world suffers from dramatic record levels of infections and deaths from the coronavirus amid a discouraging rollout of the vaccines, Barraud thinks renewed restrictions on congregating in crowds could lead to negative economic growth in the U.S., Europe and elsewhere.

“ Strong headline growth and job numbers could be deceiving. The uneven impact of the pandemic and recovery on different sectors and populations could leave a lot of inequality between and within countries. ”

Barraud is one of the few forecasters who covers Europe, China and the U.S. economies. He’s won multiple awards from Bloomberg News for his global forecasting prowess.

“U.S. economic activity is under pressure right now,” he says.

However, later this spring, the arrival of more fiscal stimulus, the vaccination of a growing share of the population, and the warmer weather that will allow more economic and social activity to occur outdoors should propel the U.S. economy higher.

Breaking news: Janet Yellen champions Joe Biden’s economic plan at confirmation hearing

“The uncertainty will end,” Barraud says. “The U.S. economy could rebound much faster than the consensus expects.”

The U.S. economy should grow faster than 4% this year, he says. The pre-pandemic level of gross domestic product should be surpassed in the second half of the year.

“The recovery can be driven by consumption and investment,” which means it could be self-sustaining.

However, he warns that strong headline growth and job numbers could be deceiving. The uneven impact of the pandemic and recovery on different sectors and populations could leave a lot of inequality between and within countries.

“ In 2020, the MarketWatch median forecast was more accurate than the more widely followed Bloomberg consensus 60% of the time. ”

In France, for instance, there’s been a big jump in savings, but only among the wealthiest 20% of families. The same is true in the U.S.

Social tensions rising

“The others are not benefiting,” he says, raising the possibility of a lot of social tension and unrest, not only in the U.S. but in European countries such as France and Germany as well. It could affect confidence, but he thinks tensions should ease with stronger growth and fewer restrictions.

Global output should hit 5% this year, with almost all countries returning to growth.

The speed of recovery could surprise central banks and markets, he says. Inflationary pressures should rise in the second half of the year as supply chains lag behind a surge in demand. He thinks housing prices are heading for double-digit increases.

The Federal Reserve could begin to taper its asset purchases earlier than expected, particularly if policy makers decide to stop buying mortgage-backed securities as part of an effort to cool the housing market.

Markets could be disrupted by another “taper tantrum,” he warns.

Competitive contest

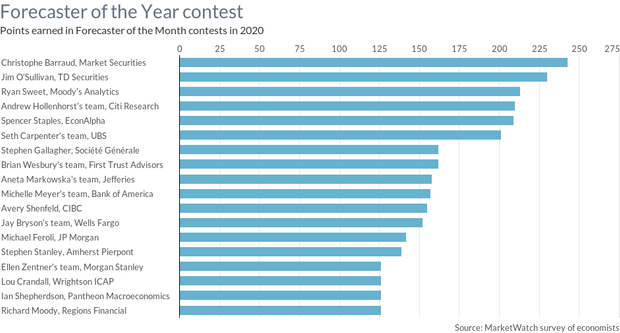

The 2020 forecasting contest was unusually competitive, with six economists with at least a theoretical chance of winning it going into the final month. All six competitive teams finished with more than 200 points from the 12 monthly contests. Forecasters earn points based on their relative accuracy on 10 economic indicators each month, plus the first estimates of GDP each quarter.

The median consensus that MarketWatch published in the Economic Calendar in 2020 came from estimates submitted by the 15 forecasting teams that had scored the most points in our contest over the previous 12 months.

In 2020, the MarketWatch median forecast was more accurate than the more widely followed Bloomberg consensus 60% of the time when the two differed, based on forecasts of 431 indicators throughout the year. It’s been that way for years.

Ryan Sweet of Moody’s Analytics was more accurate than the Bloomberg consensus 57% of the time in 2020. Barraud, O’Sullivan and Spencer Staples of EconAlpha were each more accurate than Bloomberg 53% of the time.

The top three finishers in the 2020 were also the top three finishers in the 2019 contest. They were all in the top four in 2018 and the top five in 2017. They’ve proven their forecasting skills over time.