Intel stock may have bounced back in 2025, but I’m betting on the chip industry’s best in 2026.

One tech company that investors have bet on to turn it around is Intel (INTC +4.91%). Intel was a key computing innovator during the early 2000s, but it has slowly lost its edge. Its foundry business, which other chip design companies can contract with to produce their chips, is struggling to find large clients. However, late in 2025, Intel got a lifeline.

Investors are excited that Nvidia (NVDA +8.01%) has purchased a $5 billion stake in Intel and will be collaborating with it on a host of products — a plan that will also involve Nvidia embedding Intel’s central processing units (CPUs) into some of its computing units. Intel’s stock has been on fire as a result, and is now up by more than 100% since the day before that deal was announced in September. While I’m cheering for the prospect of an Intel turnaround, I think investors would still be better off scooping up shares of Nvidia.

Image source: Getty Images.

Intel’s stock isn’t cheap

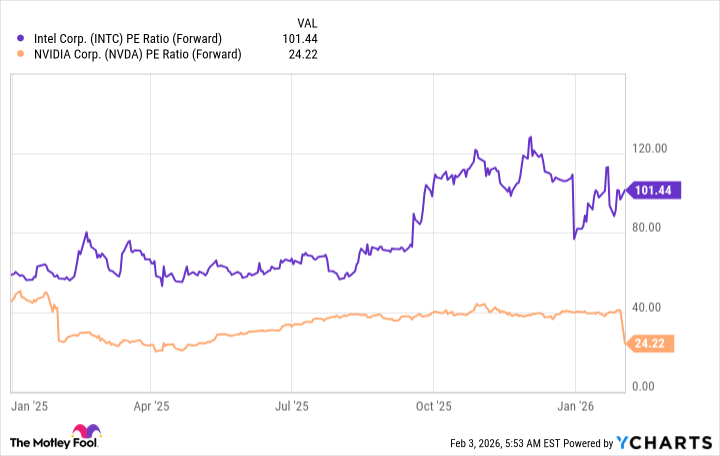

Part of the reason why investors were excited about Intel’s stock for so long was how relatively cheap it was. However, that description no longer fits. Right now, Intel trades for more than 100 times forward earnings. Nvidia is far cheaper at 24 times forward earnings.

INTC PE Ratio (Forward) data by YCharts.

The market is clearly excited about Intel’s turnaround prospects and is willing to give it the benefit of the doubt, even if revenue growth hasn’t returned yet.

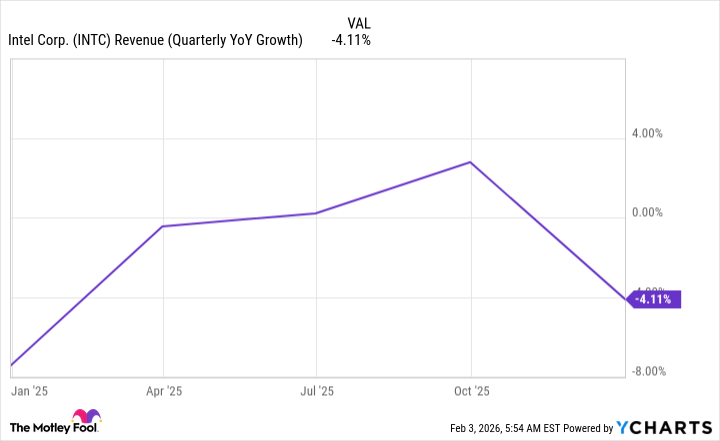

INTC Revenue (Quarterly YoY Growth) data by YCharts.

I think investors are a bit too bullish on Intel, as the turnaround could take a long time to complete. Furthermore, there’s no guarantee that one will even take place. It’s far easier and safer to bet on a winner like Nvidia, as winners tend to keep on winning.

Intel’s growth isn’t anything special

Wall Street analysts are also skeptical of Intel’s turnaround prospects. For its fiscal 2026, they expect on 2% revenue growth. For fiscal 2027, that figure rises to nearly 8%. Compare that to Nvidia, which is expected to grow at a 52% rate for its fiscal 2027 (which will end in January 2027), and one can see that there’s really no reason for any investor to pick Intel over Nvidia.

The AI computing market is driven primarily by graphics processing units (GPUs), not CPUs. While CPUs have their purposes in AI computing, GPUs do the lion’s share of work because they are parallel processors — they break down complex computations into thousands of smaller calculations and handle those simultaneously, rather than in sequence. The types of workloads that underpin AI are perfectly suited to that approach. CPUs are still vital in AI data centers, as they direct where workflows go, but far fewer of them are needed.

Today’s Change

(4.91%) $2.37

Current Price

$50.61

Key Data Points

Market Cap

$253B

Day’s Range

$48.84 – $51.30

52wk Range

$17.66 – $54.60

Volume

4.1M

Avg Vol

102M

Gross Margin

34.77%

This is a key concept to remember: Nvidia’s presence in data centers will remain far greater than Intel’s, regardless of whether Intel can achieve a turnaround. As a result, Nvidia is the far better buy.

One thing that investors may be worried about regarding an Nvidia investment is the health of the AI trend. Many are worried that an AI bubble is forming or has already, but I don’t think that’s happening at all. While valuations for generative AI companies may be soaring, that doesn’t have anything to do with Nvidia. Most AI hyperscalers have committed to spending tens of billions of dollars on computing infrastructure annually, and Nvidia receives a healthy fraction of that spending.

We’re still a few years out from learning if generative AI will be as transformative a technology as many expect. Still, to reach that point, the hyperscalers will have to have built trillions of dollars of computing capacity. Nvidia is primed to benefit from that buildout.

Today’s Change

(8.01%) $13.77

Current Price

$185.65

Key Data Points

Market Cap

$4.5T

Day’s Range

$174.62 – $187.00

52wk Range

$86.62 – $212.19

Volume

8.9M

Avg Vol

183M

Gross Margin

70.05%

Dividend Yield

0.02%

There may be a bubble among generative AI companies, but I do not think investors need to fear that Nvidia is going to get wrapped up in that bubble — at least, not for some time. As long as data centers keep being constructed at a rapid rate, Nvidia will be a top stock to own. While an Intel turnaround would be great for the U.S., I don’t think that it’s worth investing in at this time.