Check out this “Magnificent Seven” alternative and a small company you may not know.

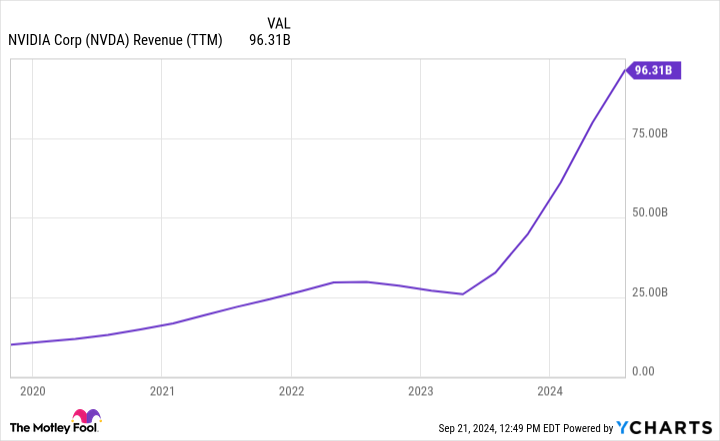

Don’t let the title of this article mislead you; Nvidia (NVDA 2.18%) is perhaps the most important company on the planet today. Its graphic processing units (GPUs) are critical for high-performance data centers, which power vital applications and artificial intelligence (AI) and machine learning (ML). The company is also partially responsible for the stock market’s all-time highs since it makes up more than 7% of the Nasdaq and 6% of the S&P 500. Nvidia’s revenue growth is remarkable, as shown below.

NVDA Revenue (TTM) data by YCharts

But this doesn’t mean it is the best stock to buy now. The stock is expensive, and the competition is fierce. Of the $96 billion in sales shown above, 40% reportedly comes from other big tech companies, which are racing to develop their own competing products. Nvidia isn’t a bad investment, but others have more potential. Here are two suggestions.

Amazon

Let’s start with Amazon (AMZN -0.74%). Amazon benefits tremendously from AI. First, Amazon Web Services (AWS), the world’s leading cloud services provider, continues growing as data needs increase. Generative AI requires ridiculous amounts of data and processing power. Amazon’s total revenue reached $148 billion last quarter on 10% growth, but the highly profitable AWS segment grew 19% to $26 billion, showcasing its long runway.

Amazon Bedrock is another AI application that lets customers create custom applications using pre-fab foundational models running on AWS. Amazon is also involved in AI through advertising, logistics, and developing chips and accelerators. Also, its product business should benefit from lower interest rates that will boost consumers and the economy. What separates Amazon from some other Magnificent Seven stocks is its undervaluation.

The stock is well below its three-year average valuation based on sales, cash flow, operating income, and earnings, as depicted below.

AMZN PS Ratio data by YCharts

The undervaluation remains true based on five-year averages, making the stock enticing for investors.

Evolv Technology

Let’s move from a company with a market cap of more than $2 trillion to one of less than $1 billion.

Technology is constantly changing the way we conduct everyday transactions. For instance, consider the difference between today’s self-checkout lines and debit and credit card payments versus human cashiers and people writing paper checks for groceries. One thing that hasn’t changed in a long time is how we securely get into venues — until now. Evolv Technology (EVLV -0.95%) wants to make the old single-file, empty your pockets, walk through a metal detector, and then get a wand scan security obsolete using AI.

Evolv systems use AI to alert security staff of concealed weapons while distinguishing between benign items like wallets and keys. Its sensors detect things like metal composition, shape, and size without people going through them single-file. You will see Evolv systems in schools, hospitals, stadiums, and other large venues. As shown below, subscriptions have skyrocketed.

Image source: Evolv Technology.

The company has more than 800 customers and is being tested in New York’s subway system. Annual recurring revenue (ARR) reached $89 million last quarter, up 64% from the prior year, and management forecasts $100 million in ARR by year end. Evolv has a market cap of only $700 million; however, the stock is difficult to value because the company isn’t profitable during this high-growth phase. Its ultimate success (or failure) will boil down to securing customers and maintaining cutting-edge technology. Smaller companies like Evolv are riskier investments than most large-cap stocks, but the long-term upside potential is enormous.

Nvidia is a terrific company, and its stock price reflects this. Amazon and Evolv are excellent alternatives for tech investors.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Bradley Guichard has positions in Amazon and Evolv Technologies. The Motley Fool has positions in and recommends Amazon and Nvidia. The Motley Fool has a disclosure policy.