Nvidia may seem like the de facto choice for AI investors these days, but it’s not the only option.

Few stocks are associated with artificial intelligence (AI) the way Nvidia is. The company has a dominant market share with the GPUs that power the AI industry. And if the AI market takes off as much as expected over the long term, it’s hard not to see Nvidia as a major winner.

But there’s a problem: Nvidia’s market cap is already approaching $3 trillion. There may be plenty of growth ahead, but the company is unlikely to sustain the pace it’s seen in recent years. After all, it will be significantly more difficult for Nvidia to double its annual revenue at $96 billion than it was a year ago at $45 billion.

If you want to maximize your growth potential when betting on AI, you’ll have to look at smaller competitors. Fortunately, there’s a much smaller company to consider, one that Nvidia actually invested nearly $4 million of its own funds into in the past year. This is your chance to follow Nvidia’s lead.

This AI stock has sizable upside

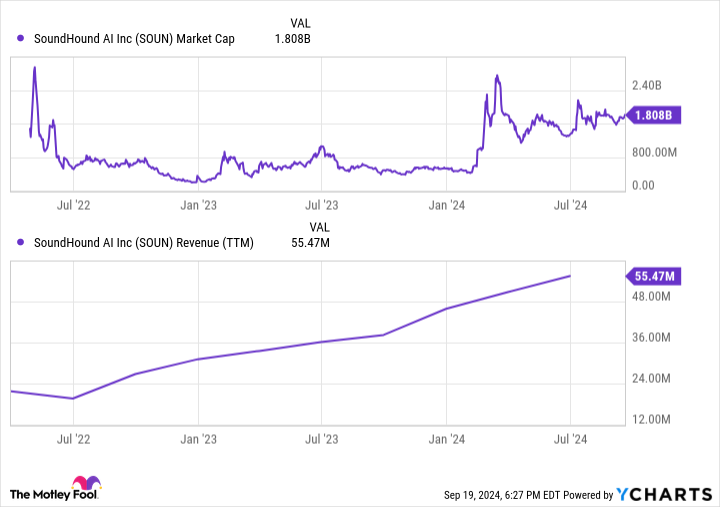

With a market cap of just $1.8 billion as of this writing, it’s not hard to see significant upside potential in SoundHound AI (SOUN -1.81%). As its name suggests, SoundHound has developed a portfolio of AI technologies that deal with voice applications. Five Guys and Papa Johns, for example, have signed up as customers to use SoundHound’s voice recognition and natural language processing software to reduce costs and improve the phone ordering experience. Hyundai and Dodge have also signed deals to incorporate the technology into their vehicles so drivers can chat with their cars about directions, messages, and maintenance issues. Companies like Snap and Vizio, meanwhile, have used SoundHound’s AI software to improve the customer experience of their own products.

Market estimates range widely, but the total addressable market for voice and speech recognition software is, at minimum, valued at $16 billion today, according to Fortune Business Insights. Yet future growth is expected to be extremely high with demand forecast to grow at least 20% per year over the next decade. By 2032, the market size could be around $85 billion. Compared to SoundHound’s $55 million revenue base, the upside potential is clear.

In recent years, SoundHound has used its technology portfolio — which is backed by more than 200 patents — to sign dozens of new clients across a wide range of industries. Whether the customer is piloting the technology or implementing it in full, these customer additions have reputational benefits while also giving SoundHound more data to train its AI models. In the second quarter, sales rose 54% year over year. And judging by the market forecast, SoundHound’s growth journey could just be getting started. However, there are a few risks investors must consider.

Data by YCharts.

Don’t go all in on SoundHound

SoundHound has plenty of growth potential, as well as an early-mover advantage, but it’s far from settled whether the company will be a major industry player a few years down the road. That’s partially due to its size. Its relatively small revenue base of $55 million is hardly enough for the company to generate a profit.

Last quarter, the company lost $37 million — its biggest loss in years. This lack of profitability limits its ability to deploy capital, especially in critical areas like research and development. Last quarter, research and development expenses totaled just $16 million, the same level of spending the company reported three years ago.

As a result, SoundHound’s small size presents both opportunity and risk. It provides investors with plenty of upside potential, but it also limits the company’s ability to invest in its technology, something its better-financed competitors like IBM and Alphabet have no trouble doing.

If SoundHound can maintain or grow its market share in the coming years, it should be able to ride the tailwinds of rising AI spending. In this scenario, investors would likely win big. But if it falls behind deeper-pocketed competitors, there could be significant downside from here, especially considering shares trade at nearly 25 times sales.

Aggressive growth investors looking for multibagger return potential should sidestep Nvidia and look at SoundHound. But even then, SoundHound stock should occupy only a small slice of your portfolio.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet and Nvidia. The Motley Fool recommends International Business Machines. The Motley Fool has a disclosure policy.