Alibaba Group could be a steal of a deal at its current valuation.

If you’re thinking about buying shares of Nvidia now, one issue you might be finding it hard to get around is its valuation. While the chipmaker’s growth prospects are undoubtedly amazing, is the stock really worth paying more than 70 times earnings for? For many investors, the answer has been a resounding yes — the chipmaker’s market cap is up by around 150% this year to $3 trillion.

But if you’re worried that Nvidia’s high valuation could limit its returns in the future, then you might want to consider other stocks involved with artificial intelligence (AI) that could have more upside. One worth considering is Alibaba Group (BABA -0.39%).

Alibaba is using AI to grow internationally

Alibaba is a tech giant in China, but it has promising growth opportunities in other markets as well. And it’s taking a page out of the handbooks of some of its e-commerce peers with its efforts to use AI to make it easier for sellers on its platform to reach customers in other countries.

With the help of AI, merchants can overcome foreign language barriers, sort out disputes with customers, and easily create descriptions for products. This is similar to how Shopify uses AI tools to make it easier for merchants on its platform to reach more customers. Alibaba, however, has the advantage of having its own large language model, Tongyi Qianwen, so it could potentially offer more customized and enhanced assistance.

Zhang Kaifu, Alibaba’s head of AI development in its international e-commerce business, said that in internal tests, AI tools helped merchants achieve order growth up to 30%.

A big opportunity for the company

The international commerce segment remains a fairly small slice of Alibaba’s overall business, and it could have a lot more room for growth.

During the first three months of 2024, Alibaba reported $3.8 billion in revenue from its international commerce segment — 12% of its $30.7 billion top line. But what was encouraging is that with 45% year-over-year growth, it was its fastest-growing business unit. Chinese commerce revenue was still the company’s largest segment, with revenue from Taobao and Tmall bringing in $12.9 billion in sales in that quarter.

By focusing on international growth in a modestly sized area of its operations, Alibaba can position itself for much greater opportunities for expansion in the future, especially as it leverages AI to help with that growth.

Alibaba’s valuation is incredibly low

Chinese stocks struggled in recent years due to a myriad of issues, including concerns about Chinese government interference with its domestic companies, and tensions between the U.S. and China. In the past three years, Alibaba’s stock fell by 64%, largely due to those concerns.

Investors are discounting the stock severely for risks that may be overblown. China is a huge market and Alibaba is a big name there, with cloud, e-commerce, and digital media business units that give it great diversification. And at a time when many tech stocks are trading at lofty earnings multiples, Alibaba looks incredibly cheap, even based on its own historic levels.

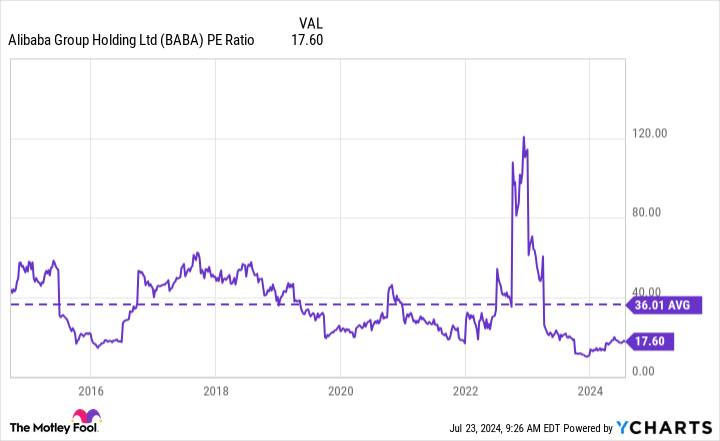

BABA PE Ratio data by YCharts.

Over the past decade, its average P/E ratio was around 36, and over the past five years, it has had an average P/E of around 30. It’s well below both of those levels now. The counterargument would be that Alibaba’s growth has been slowing down, so it’s not worth such a premium anymore. But in its last reported quarter, its sales expanded at a rate of 7%, and if AI proves to be a catalyst for its international e-commerce business, its growth rate may improve.

While investors may still be putting a discount on the stock because it’s a China-based company, I don’t think the stock warrants this much of a discount.

AI investors should consider buying Alibaba stock

Alibaba is an underrated AI stock to buy right now. Its growth rate isn’t terribly impressive, but there’s still loads of potential here for the business in the long run. While some have been concerned that the Chinese government will take actions that inhibit the company’s growth, so far, those moves haven’t materialized, and concerns that Beijing will hinder it appear to be overblown.

Investors who are willing to look past the uncertainty and take a chance on what looks to be an incredibly cheap stock right now could be rewarded with some strong gains in the long run.

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia and Shopify. The Motley Fool recommends Alibaba Group. The Motley Fool has a disclosure policy.