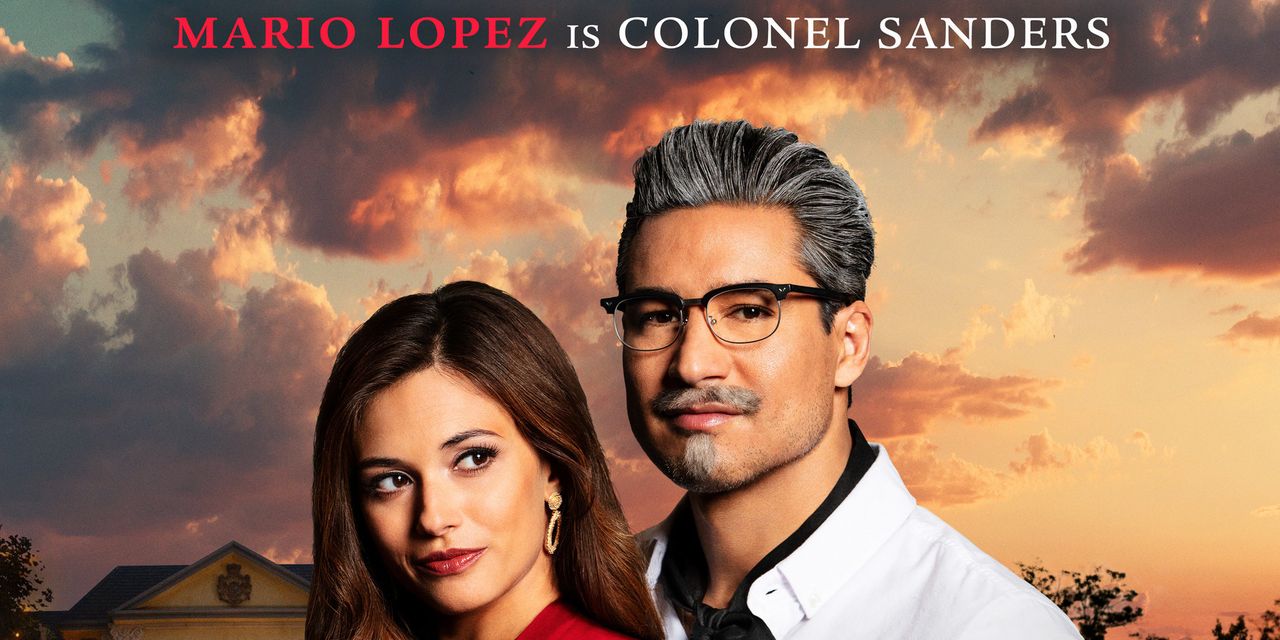

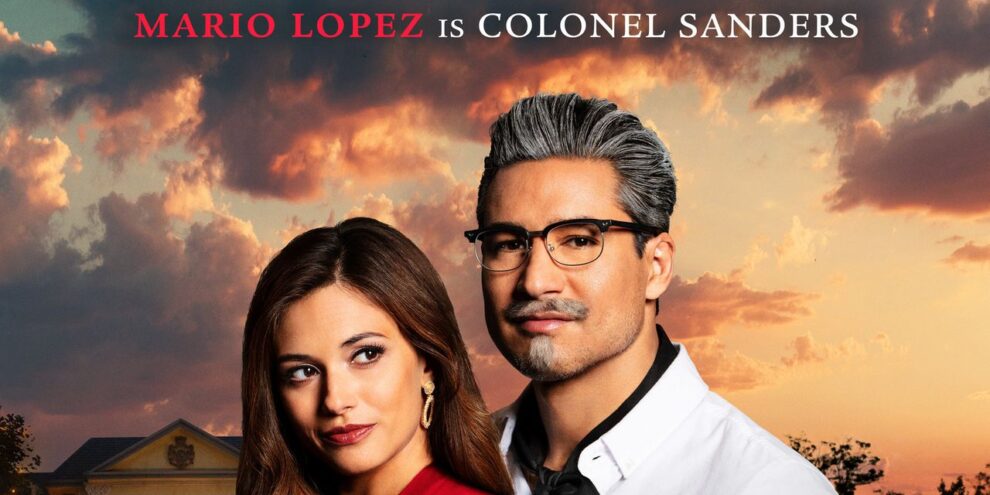

In a year when it seems like just about anything can happen, people were still surprised to see that KFC is airing a Lifetime network movie starring “Saved By the Bell” alum Mario Lopez as Colonel Harland Sanders.

But these sorts of over-the-top marketing stunts are normal for the Yum Brands Inc.’s YUM, +1.35% lineup, which also includes Pizza Hut and Taco Bell.

In addition to the Col. Sanders Lifetime movie, KFC sold fried chicken-scented firelogs at Walmart Inc. WMT, -0.79% and Pizza Hut put its “Original Pan Pizza” on a $150 weighted blanket in the past couple of months.

Go back even further and you’ll find a Taco Bell resort in Palm Springs that sold out quickly, and the opportunity to get married at the Mexican fast-food chain’s location on the Las Vegas Strip.

“At KFC, we take our food seriously but always want our brand to show up in interesting and unexpected ways in popular culture,” KFC said in a statement sent to MarketWatch.

See: KFC to air holiday ‘mini-movie’ on the Lifetime network called ‘A Recipe for Seduction’

“Lifetime is known for bringing joy through its holiday movies and KFC is known for bringing people together over a meal. So, during a holiday season unlike any other, we wanted to create a way to celebrate the season from the comfort of home and in a way that only KFC and Lifetime could do.”

Yum Brands is certainly not the only company with elaborate marketing campaigns.

A couple of years ago, Dine Brands Inc. DIN, +0.12% temporarily changed the name of its IHOP pancake chain to IHOb to promote its new line of burgers. Dine Brands said the stunt helped to double its burger sales.

But Yum Brands does these sort of things consistently. And each new campaign seems more outlandish than the one before.

“This goes back to Yum’s heritage,” said Mark Kalinowski of Kalinowski Equity Research.

Yum was spun off from PepsiCo Inc. PEP, +0.12% in 1997.

“It was birthed from a company that has wacky marketing as part of its corporate DNA and that shows through to this day,” Kalinowski said.

Nowadays, Yum is also marketing in an environment where consumer expectations are high.

“We live in an age where consumers are used to bigger, better faster, more,” Kalinowski said. “That plays to the heart of Yum Brands and what its constituent brands can be. It’s supposed to be fun to get something from Taco Bell and KFC.”

Unlike many of the marketing campaigns these days that rely on social-media platforms like TikTok, Yum Brands is also a bit old-school. For instance, the press release says the Lifetime movie will premiere on Dec. 13 at noon rather than being pushed out on a streaming service like Netflix Inc. NFLX, -3.72%.

“KFC and Pizza Hut have embraced their vintage-ness over the last few years,” Kalinowski said.

Analysts don’t often discuss these marketing efforts in their business assessments.

UBS analysts recently met with Yum Brands executives and the note that followed doesn’t make specific mention of a weighted blanket or a fried chicken firelog.

“Management’s tone was generally positive despite industry uncertainties and challenges, believing brands are well positioned for growth given a value, digital and off-premise focus,” wrote analysts led by Dennis Geiger.

And: McDonald’s McRib is back, adding to the big names popping up on the fast-food chain’s menu

The note also highlighted menu innovation, like potential new chicken sandwiches at KFC that “will likely leverage core assets and traditional brand flavor profiles, shifting away from previous bold products (Cheetos Chicken Sandwich).”

UBS rates Yum Brands stock buy with a $114 price target.

And KeyBanc Capital Markets analysts led by Eric Gonzalez talked about how Yum has managed through the challenges brought on by the coronavirus in a recent note.

“Yum has managed through the pandemic well by leveraging its off-premise capabilities and technology infrastructure. These efforts have helped recover same-store sales growth and allow it to restore its buyback program in 4Q20,” analysts said.

KeyBanc rates Yum Brands stock sector weight.

When asked specifically about these stunts, KeyBanc said the KFC movie “is more of a branding effort aimed at generating buzz/impression, and since it’s a bit more intangible, it’s not necessarily a direct driver of sales results.”

Still, there is value to buzz.

“I expect they’ll get a good cost benefit from this,” Kalinowski said. “They’re creative, they get a lot of attention from the media and general public from what they’re doing, and that accomplishes the goal of why they’re doing it.”

Yum stock has gained 7.4% over the past year, and is up 15.4% for the last three months. The S&P 500 index SPX, -0.79% has rallied 17.3% over the past year.

Add Comment