(Bloomberg) — Index-tracking stock funds with $350 billion in assets are due for a big revamp later this month, after S&P Dow Jones Indices retooled its rules to curb the dominance of the largest companies.

Most Read from Bloomberg

With the equity market getting increasingly top-heavy in the era of Big Tech, S&P will now reduce the weightings of the market leaders in proportion to their capitalization — in the event they get even bigger and breach size-related thresholds in key industry benchmarks, it said in a statement this week.

It’s a material departure from the current approach where the smallest of the group gets their weighting trimmed at first, when preset thresholds are triggered.

At issue is rising concentration risk this year. Investment managers are battling to ensure their exposures to a handful of booming technology companies don’t hit decades-old regulatory limits. But the new rules will have ripple effects far and wide — with the benchmark provider introducing the new capping initiative across its sector indexes tracking everything from consumer staples to energy and communications.

The incoming rule, adopted after a month-long consultation with market participants, means passive investment vehicles like Technology Select Sector SPDR Fund (ticker XLK) will need to shuffle their holdings accordingly at their next quarterly rebalance.

When the changes in the S&P’s capping methodology take effect at the market close on Sept. 20, Piper Sandler & Co. estimates $31 billion of trades will be unleashed across major ETFs, with roughly half of that coming from technology.

The revision is welcome news for the fund industry, according to Michael Kantrowitz, Piper’s chief investment strategist. The old way to restrain the behemoths has at times left investment funds under-exposed to key names like Nvidia Corp. and Apple Inc. — and sparked volatile share turnovers earlier this year.

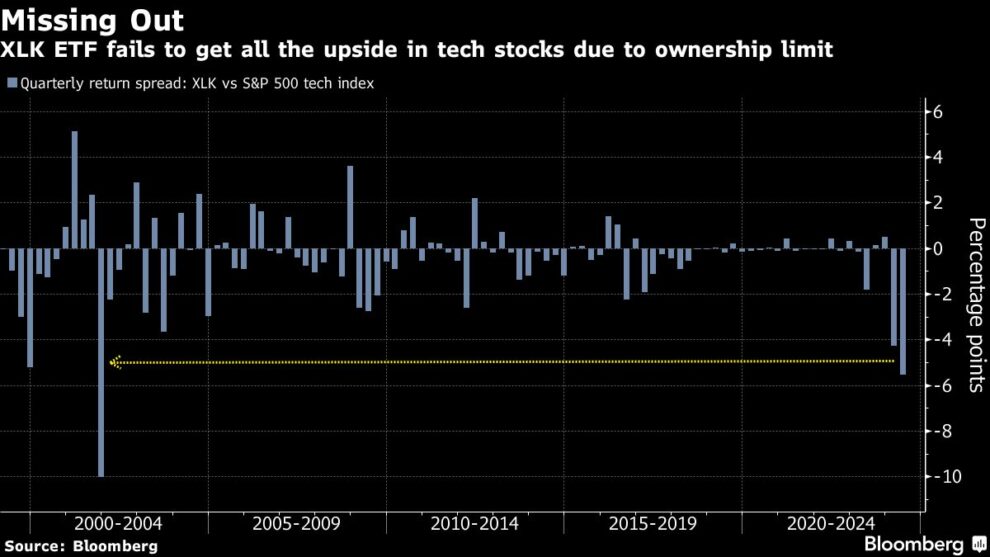

It “appears to be in attempt to enhance the distribution of weightings more evenly across the indices’ construction while reducing unnecessary turnover,” Kantrowitz said. “This should mitigate some of the issues that led to enormous tracking error,” he added, referring to the performance gap between a capped sector index and its uncapped version.

The move is the latest among all-powerful index providers to adapt to a concentrated equity market that pushes against regulatory limits. Similar restrictions last year spurred the overseer of the Nasdaq 100 to carry out a special rebalance to keep index-tracking funds in compliance with the rules. Last month, FTSE Russell conducted a consultation about capping the weighting of the largest members of its widely followed US growth and value gauges.

Creating headaches for these index overlords are longstanding diversification norms for regulated investment companies that limit any single security to 25% of a portfolio and the aggregate weight of the largest holdings — those with a 5% representation or greater — to 50%. Established to safeguard investors from over-exposure to too few names, the 25/5/50 restrictions can be punishing in the modern market where companies such as Nvidia and Apple keep getting bigger.

S&P’s capping trigger levels, which are slightly below the 25/5/50 limits to provide a buffer, have stayed the same as 24/4.8/50 this time. The revisions involve how the capping process is executed.

Right now, three stocks each made up at least 4.8% of the uncapped tech gauge: Apple at 23%, Microsoft Corp. at 22% and Nvidia at 19%. With the total surpassing 60%, their weights will be reduced in proportion to their size to meet the 50% limit at the next rebalance. Then the extra weight will be distributed to the index’s other constituents, with a cap at 4.5%.

The old methodology would require the smallest of the top stocks to get capped first and in that scenario, Nvidia would be cut to 4.5%.

That’s what happened with XLK in the first half of this year, when Nvidia was surging. As a result, the fund trailed the uncapped tech benchmark by 10 percentage points in the period — the worst underperformance on record.

Then, when Nvidia eclipsed Apple in June, it sparked a rebalance in which XLK bought an estimated $11 billion shares of the chipmaker at the expense of the iPhone manufacturer. Since then, Apple has outperformed, with the fund’s investors missing out on some gains.

Under S&P’s new rules, however, XLK is set to avoid another round of a big swap like June even as Nvidia has fallen behind Apple in market value.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.