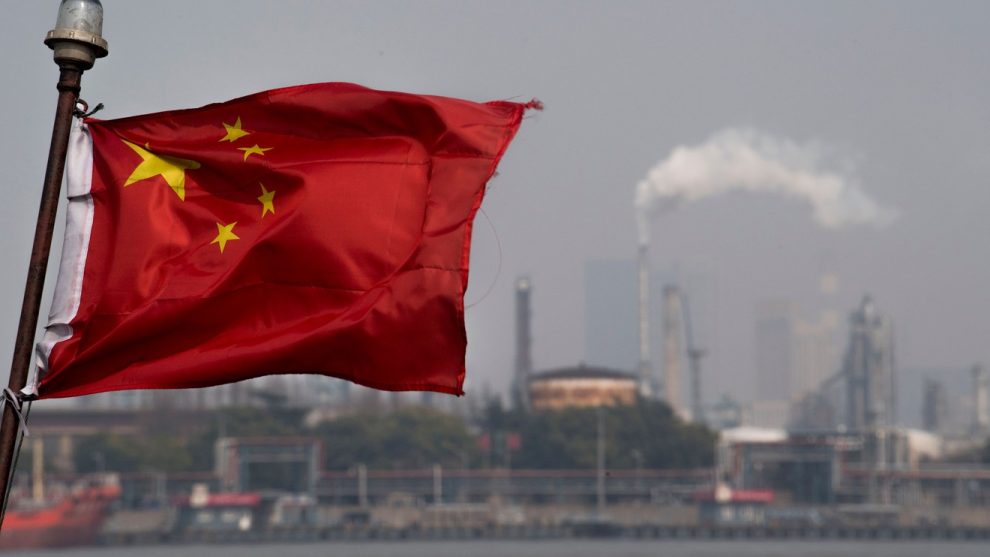

Oil bounced higher Monday, reclaiming some of the ground lost in last week’s tumble, after China and the U.S. both appeared to attempt to tamp down rising trade tensions.

West Texas Intermediate crude for October delivery CLV19, +1.46% rose 61 cents, or 1.1%< to $54.78 a barrel, while October Brent crude BRNV19, +0.96% rose 53 cents, or 0.9%, to $59.78 a barrel on ICE Europe.

“Friday’s selloff in risk is undergoing a significant reversal today,” aid Adam Cole, chief currency strategist at RBC Capital Markets, noting a rebound across assets perceived as risky on Monday after President Donald Trump said U.S. officials had received calls from Chinese negotiators and that the two sides would return to the table.

China’s top trade negotiator, Vice Premier Liu He, on Monday said that Beijing hopes to resolve the trade war through “calm” negotiations and isn’t seeking to escalate tensions, according to Reuters.

Oil plunged Friday after China announced retaliatory tariffs on a range of U.S. goods, including crude, prompting a response from Trump, who announced another round of tariff increases after the market close. Stocks also dropped Friday and in the early Asian session on Monday, though stock-index futures pointed to a higher start on Monday.

China’s decision to include crude on its list of retaliatory tariffs saw WTI, the U.S. benchmark, suffer more than Brent, the global benchmark.

“The decision to include crude oil in the latest list of Chinese 10% retaliatory tariffs on U.S. goods would likely to see flows return to levels seen over the winter of 2018-2019, namely to zero,” wrote analysts at JBC Energy, a consulting firm.

In other energy trade, October heating oil HOV19, +0.86% rose 0.5% to $1.8334 a gallon, while October gasoline futures RBV19, +0.94% gained 0.2% to $1.53 a gallon.

October natural-gas futures NGV19, +1.30% rose 2% to $2.199 per million British thermal units.