Oil futures climbed on Monday, with U.S. benchmark prices settling above $70 for the first time in nearly six weeks, and natural-gas futures rallied by almost 6%, supported by a slow recovery in Gulf of Mexico energy production in the aftermath of Hurricane Ida.

“While offshore output typically returns in a matter of days, that timeline has been much slower in Ida’s aftermath,” said Robbie Fraser, global research and analytics manager at Schneider Electric, in a daily note. “Still, there are signs of improvement, as roughly 50% of offshore output appears to be returning online to start the week, compared to less than 25% a week earlier.”

Indeed, Gulf of Mexico output has been slow to come back after Ida made landfall on the Louisiana Gulf Coast on Aug. 29. The Bureau of Safety and Environmental Enforcement on Monday said 43.6% of Gulf of Mexico oil output, equal to 793,522 barrels a day of production, remained shut in. The BSEE estimated that more than 51.6% of natural-gas output in the Gulf was also shut in.

“There had been an expectation that a lot of the damage to the infrastructure caused by the storm wouldn’t take too long to fix,” Michael Hewson, chief market analyst at CMC Markets UK, in a note. “This turns out to be a little wide of the mark, and could well go on for a few weeks more,” particularly with Tropical Storm Nicholas in the Gulf of Mexico.

The National Hurricane Center warned that the tropical storm will likely lead to heavy rainfall for portions of the Texas and Louisiana costs through the middle of the week, and may result in “life-threatening flash and urban flooding.”

West Texas Intermediate crude for October delivery CL00, +1.16% CLV21, +1.16% rose 73 cents, or nearly 1.1%, to settle at $70.45 a barrel on the New York Mercantile Exchange, the highest front-month contract finish since Aug. 3, according to Dow Jones Market Data.

November Brent crude BRN00, +0.03% BRNX21, +0.03%, the global benchmark, added 59 cents, or 0.8%, at $73.51 a barrel on ICE Futures Europe — the highest settlement since July 30.

U.S. oil production, following the damage caused by Hurricane Ida to infrastructure in the Gulf of Mexico, has dropped by about 1.4 million barrels a day since late August, said Ricardo Evangelista, senior analyst at ActivTrades, in a note.

Read: Winter weather could send oil to $100 per barrel, Bank of America analysts say

“Meanwhile, the consensus, despite the uncertainty caused by the growing number of coronavirus cases, is that oil demand will continue to increase in the run-up to the end of the year, in a dynamic that could support further increases in price,” Evangelista said.

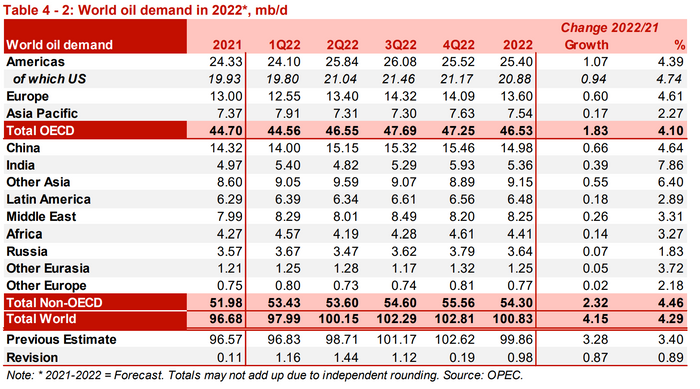

Oil remained higher after the Organization of the Petroleum Exporting Countries boosted its forecast for growth in crude demand next year. OPEC now expects demand to grow by 4.2 million barrels a day next year, up nearly 900,000 barrels a day from its previous forecast (see table below).

World oil demand is estimated at 100.8 million barrels a day in 2022, exceeding pre-pandemic levels, OPEC said.

Among the oil products traded on Nymex, the October contract for gasoline RBV21, +0.40% settled at $2.16 a gallon, up 0.3%, while October heating oil HOV21, +0.55% tacked on 0.6% to $2.16 a gallon.

Natural-gas futures rallied, with the October contract NGV21, +5.33% settling at $5.23 per million British thermal units — the highest since Feb. 24, 2014 — up 5.9% for the session.

“Most offshore natural gas production remains offline while above-normal temperatures are predicted to continue across the eastern and central U.S. through the end of the month,” said Christin Redmond, global commodity analyst at Schneider Electric. “This is expected to reduce the storage injection pace as power generation demand ramps up, while the market remains short supply.”