General Electric Co. stock is certainly in recovery mode, as it has more than doubled off its 2020 lows, but part of those gains have come at the expense of the industrial conglomerate’s workforce.

In a 10-K filing with the Securities and Exchange Commission on Friday, GE GE, +2.36% said it employed a total of about 174,000 people globally at the end of 2020, down 15.1% from the 250,000 employed at the end of 2019, as the COVID-19 pandemic wreaked havoc on the company’s businesses.

Among GE’s business segments, Aviation’s workforce was cut the most, by 23.1% to 40,000 employees, followed by Healthcare, which lost 16.1% of its workforce to 47,000 employees. Elsewhere, Power cut 10.5% of its jobs to 34,000 employees, while Renewable Energy’s workforce was reduced by 7.0% to 40,000 people.

But it isn’t all about COVID. GE said the job cuts in 2020 were “primarily as a result of restructuring,” including actions to manage risk, reduce the financial impact of the pandemic and business exits. The company has now cut its total workforce by 139,000 people, or 44.4%, over the past three years.

In the U.S., the number of employees at the end of 2020 fell by 14,000, or 20%, to 56,000 from 70,000 at the end of 2019. And over the past three years, the U.S. workforce has been slashed by 50,000 people, or 47.2%.

GE recorded charges of $856 million in 2020, and roughly $2.6 billion over the past three years, related to workforce reductions, and indicated more job cuts are coming.

“We continue to closely monitor the economic environment and expect to undertake further restructuring actions to more closely align our cost structure with earnings goals,” the company stated in its latest 10-K.

The global and U.S. totals are now at the lowest levels since at least 1993, the last year for which 10-Ks were available on the SEC’s website.

U.S. jobs as a percent of GE’s total workforce dropped to just 32.2% in 2020, down from 53.7% in 2000 and 73.4% in 1993.

At GE’s workforce peak in 1999, there were 340,000 employees worldwide, with 57.9%, or 197,000 employees, in the U.S.

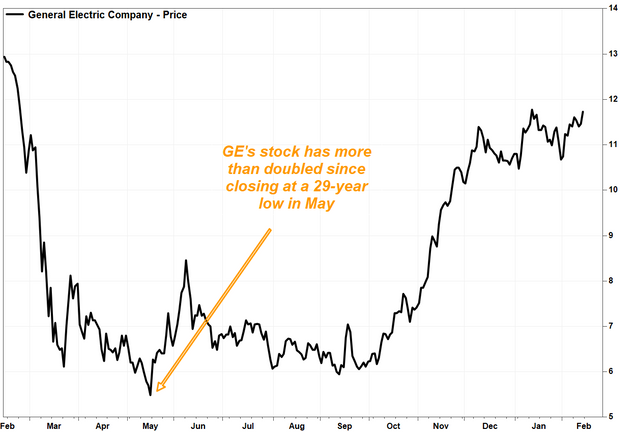

Meanwhile, GE’s stock surged 2.4% Friday to close at a one-month high of $11.73. It has climbed 8.6% so far this year, after rocketing a quarterly record 73.4% in the fourth quarter.

Since closing at a post-COVID low of $5.49 on May 15, which was the lowest close since December 1991, the stock has soared 113.7%. In comparison, the SPDR Industrial Select Sector exchange-traded fund XLI, +0.73% has run up 51.9% since May 15 and the S&P 500 index SPX, +0.47% has rallied 37.4%.

The gains were supported by back-to-back earnings reports in which investors cheered GE’s progress on free cash flow, which surprisingly turned positive in the third quarter, then beat expectations by a wide margin in the fourth quarter.

In conjunction with the release of its 10-K Friday, GE Chief Executive Larry Culp issued a letter to shareholders, in which he praised the “meaningful progress” the company made, and the momentum it has for 2021, in the face of challenges from the COVID-19 pandemic.

“Together with our customers, the GE team kept power flowing, hospitals operating and planes flying,” Culp wrote in the letter.

He also wrote about “Lean,” which he described as a set of principles that emphasizes “customer focus, elimination of waste and ruthless prioritization of work to improve safety, quality, delivery and cost.”

Update on GE’s Baker Hughes stake

Also disclosed Friday, GE sold about 28 million Baker Hughes Co. BKR, +0.75% shares, or 7.4% of its stake, during the fourth quarter. But given the 56.9% surge in the Baker Hughes’s stock price during the quarter, the value of GE’s stake had actually increased by more than $2 billion.

GE said it owned 349,439,701 shares as of Dec. 31, which at the time were valued at $7.28 billion. On Sept. 30, GE had disclosed that it owned 377,427,884 shares, which were valued then at $5.02 billion.

After selling off another 38 million Baker Hughes shares in January, GE’s stake sat at 311,432,660, or 30.1% of the shares outstanding, as of Jan. 22. At Friday’s closing prices, that stake would be worth $7.06 billion.

Add Comment