Shares of General Electric Co. turned lower on heavy volume Wednesday, erasing earlier sharp gains, as the industrial conglomerate’s earnings and free cash flow beats, and raised full-year outlook, weren’t quite enough to inspire investors.

Taking some of the shine off GE’s results, the company said Chief Financial Officer Jaime Miller will step down after less than two years in the role. In addition, GE said it expects the negative impact from the grounding of Boeing Co.’s 737 Max fleet to ramp up in the second half of the year.

The stock GE, -2.80% swung to a loss of 3.7% in morning trading, reversing a premarket rally of as much as 6.0% and an earlier regular-session gain of as much as 2.6% to a five-month high. Volume ballooned to 61 million shares, already more than the full-day average of 43.4 million shares.

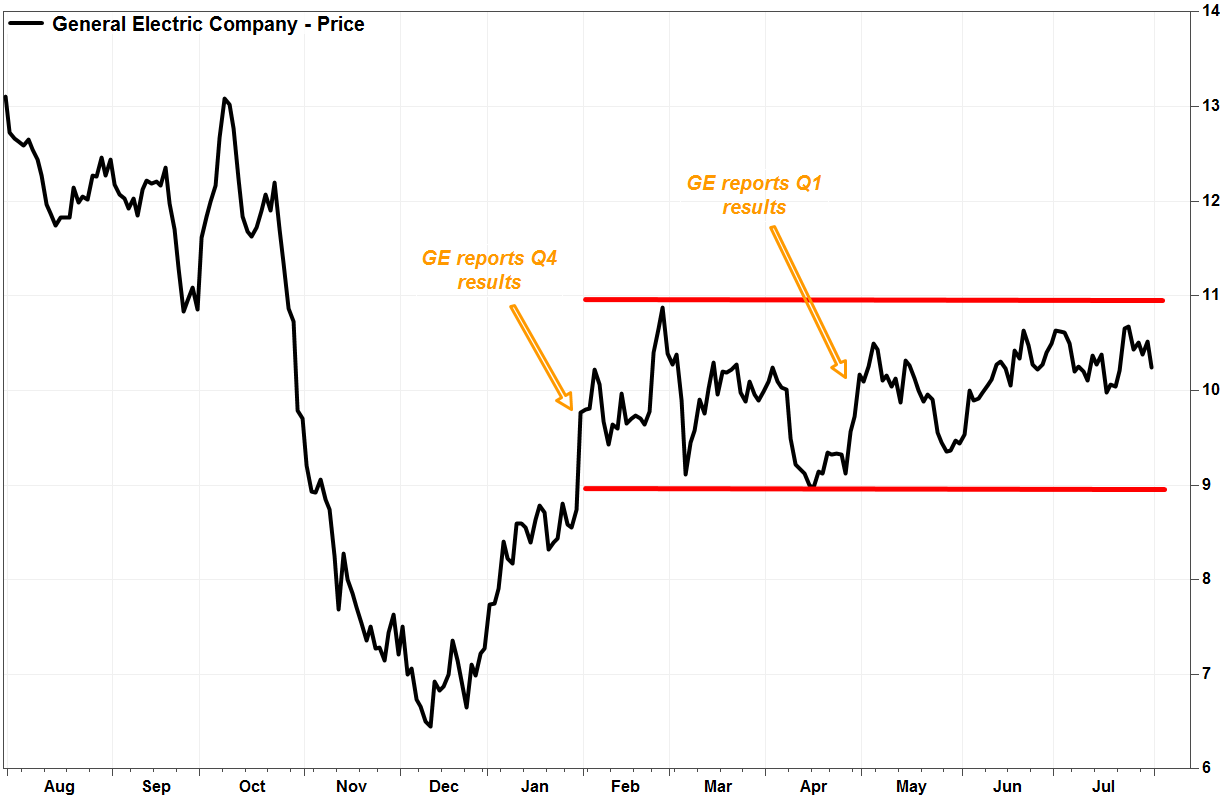

The stock’s selloff from earlier highs keeps it hemmed within a six-month long trading range, in which it has seesawed between $9 and just below $10. Read more about stock’s technical outlook.

“2019 remains a reset year at GE,” said Chief Executive Larry Culp, on the post-earnings conference call with analysts. “Our year-to-date performance is ahead of our outlook in several areas,” with the power business showing “early signs” of stabilization.

Don’t miss: GE to ‘reset’ this year, start turning around over the next two years.

FactSet, MarketWatch

FactSet, MarketWatch

GE swung to a net loss of $61 million, or 1 cent a share, in the latest quarter, from income of $615 million, or 7 cents a share, in the same period a year ago. Excluding non-recurring items, adjusted earnings per share slipped to 17 cents from 18 cents, but were above the FactSet consensus of 12 cents.

Adjusted industrial free cash flow (FCF) was negative $1 billion, but that beat the FactSet consensus of negative $1.25 billion. For 2019, GE raised its FCF guidance range to negative $1 billion to positive $1 billion from negative $2 billion to flat.

See related: GE stock sinks as negative cash flow outlook wipes out gains from biopharma deal.

Total revenue fell 1% from a year ago to $28.83 billion, above the FactSet consensus of $28.68 billion.

Within GE’s business segments, power revenue dropped 25% to $4.68 billion, well below the FactSet consensus of $5.84 billion, while renewable energy revenue grew 26% to $3.63 billion, or well above expectations of $2.37 billion.

For power, GE said it now expects 2019 cash flow to be flat to down, from previous guidance of simply down.

FactSet, MarketWatch

FactSet, MarketWatch

Elsewhere, aviation revenue rose 5% to $7.88 billion, just shy of expectations of $7.91 billion; health care revenue declined 1% to $4.93 billion to miss expectations of $5.04 billion; and oil and gas revenue grew 7% to $5.95 billion to beat expectations of $5.73 billion.

In aviation, CFO Miller said the grounding of Boeing’s BA, -0.25% 737 Max fleet, for which GE makes engines, has negatively impacted cash flow by about $300 million per quarter in the first half of the year. She said the impact will ramp to $400 million for each quarter that the fleet remains grounded.

GE said it continues to “work closely” with Boeing to “actively manage” its engine production while Boeing’s 737 Max fleet remains grounded.

Analyst Jim Corridore at CFRA reiterated his buy rating on GE’s stock and his $12 price target. “GE’s turnaround is slowly progressing and we believe the company has a good plan in place to turn around power and focus on renewables, aviation and health care,” Corridore wrote in a note to clients.

Looking ahead, GE raised its 2019 adjusted EPS guidance to a range of 55 cents to 65 cents from 50 cents to 60 cents. The company also cut its restructuring expense outlook to $1.7 billion to $2.0 billion from $2.4 billion to $2.7 billion and its restructuring cash guidance to $1.5+ billion from $2.0+ billion.

GE’s stock has now lost 0.4% over the past three months, while the SPDR Industrial Select Sector exchange-traded fund XLI, -0.19% has gained 0.6% and the Dow Jones Industrial Average DJIA, +0.08% has advanced 2.3%.

“It’s early in a multi-year transformation,” Culp said. He said the “cultural shift” is beginning to take hold, based on “candor, transparency and humility” and with a “hyper-focus” on the customer and seeing GE through the customer’s eyes.

“In summary, we’re on our way,” Culp said.