Gilead Sciences Inc. beat Wall Street’s expectations for revenue in the fourth quarter, but the drug maker’s earnings were hit by $2 billion in unexpected costs, most of it due to a legal settlement

Gilead’s GILD, -0.31% stock tumbled 2.9% in after-hours trading on Tuesday after the company shared results from the fourth quarter of 2021, which showed growth for its top-selling HIV drug Biktarvy and better-than-expected sales of its COVID-19 drug, Veklury. Gilead reported earnings of $382 million, or 30 cents per share, in the fourth quarter of 2021, compared with $1.5 billion, or $1.23 per share, in the fourth quarter of 2020. Gilead reported adjusted earnings of 69 cents a share, against a FactSet consensus of $1.46.

The drug maker cited a $1.25 billion legal settlement with ViiV Healthcare Co., a pharmaceutical company focused on HIV and AIDS that is operated by GlaxoSmithKline GSK, +0.83%, Pfizer Inc. PFE, +0.72% and Shionogi, as well as a $625 million charge related to a deal with Arcus Biosciences Inc. RCUS, +2.18% that closed in December. The two charges collectively subtracted $1.18 a share from Gilead’s earnings, the company stated.

Gilead’s revenue was $7.2 billion in the fourth quarter of 2021, down from $7.4 billion in the same quarter in 2020. The FactSet consensus was $6.6 billion.

Gilead shares fell more than 3% in after-hours trading following the release of the results, after closing with a 0.3% decline at $68.47.

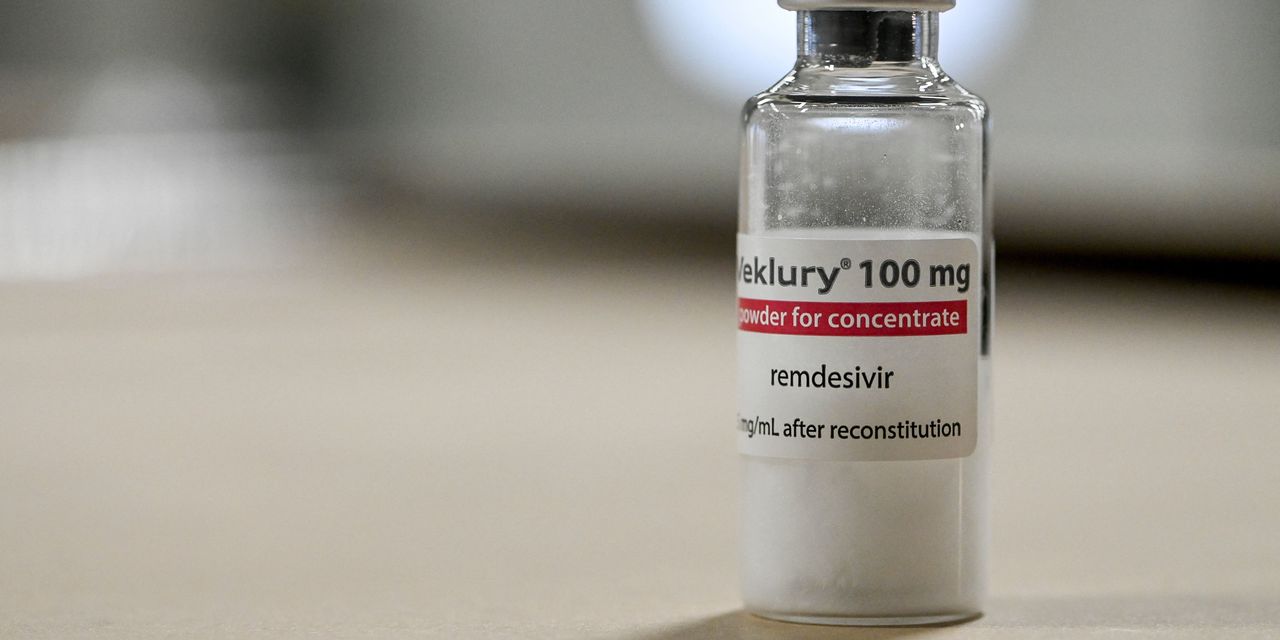

Gilead’s top-selling therapies are Biktarvy, which Gilead said is the most prescribed HIV drug in the U.S., and remdesivir, the COVID-19 treatment long used to treat severely ill patients during the pandemic. (The drug, which uses Veklury as its brand name, recently received authorization to be used for patients with mild to moderate forms of the disease if they are at high risk of disease progression.)

Biktarvy brought in $2.5 billion in sales in the fourth quarter of 2021, up from $2.0 billion in the fourth quarter of 2020. The FactSet consensus was $2.4 billion. Veklury had sales of $1.3 billion in the final quarter of the year, down from $1.9 billion in the same quarter in 2020. The FactSet consensus for Veklury was $895 million.

The company issued guidance for 2022, saying it expects product sales between $23.8 billion and $24.3 billion, about $2.0 billion in sales of Veklury, and earnings per share between $4.70 and $5.20.

Though Wall Street is paying attention to the company’s quarterly performance, analysts also have questioned Gilead’s long-term strategy, including how the company will build out its oncology business.

Analysts are looking at Trodelvy, Gilead’s breast-cancer and bladder-cancer drug that was first approved by the Food and Drug Administration in mid-2020 and had $118 million in sales in the fourth quarter, against a FactSet consensus of $119 million.

“The key question that perhaps 2022 will answer, though investors are skeptical currently, is whether Gilead has a path to sustainable growth,” Mizuho Securities analysts told investors in a Jan. 19 note.

Gilead’s stock is up 4.4% over the past year, while the broader S&P 500 SPX, +0.69% has gained 21.%.