DETROIT – General Motors beat Wall Street’s fourth-quarter earnings expectations Tuesday, while guiding for another year of “strong financial performance” in 2026.

The Detroit automaker, which slightly missed revenue expectations, also announced a 20% increase in its quarterly dividend and a new $6 billion share repurchase authorization.

GM stock rose 8.75% Tuesday.

Here’s how the company performed in the fourth quarter, compared with average estimates compiled by LSEG:

- Earnings per share: $2.51 adjusted vs. $2.20 expected

- Revenue: $45.29 billion vs. $45.8 billion expected

GM’s 2026 earnings guidance is better than its expectations and results from last year. It includes net income attributable to stockholders of between $10.3 billion and $11.7 billion; adjusted earnings before interest and taxes of $13 billion to $15 billion; and EPS of between $11 and $13 for the year.

Those expectations include anticipated spending of between $10 billion and $12 billion for the automaker, which continues to reevaluate its product portfolio away from all-electric vehicles amid billions of dollars in write-downs.

GM CEO Mary Barra told investors during a call Tuesday that the automaker expects to return to adjusted profit margins of between 8% and 10 % this year in North America. It was 6.8% in 2025, down from 9.2% the prior year.

GM’s 2025 results included $2.7 billion in net income attributable to stockholders, or earnings per share of $3.27; EBIT-adjusted earnings of $12.7 billion, or $10.60 per share; and adjusted automotive free cash flow of $10.6 billion. Those results were largely down double digits compared with 2024.

The company’s 2026 adjusted EPS target is in line with consensus of $11.73 per share, according to LSEG.

GM’s 2025 revenue was down 1.3% compared with 2024 to $185.02 billion, including a 5.1% decline, to $45.3 billion from a year earlier, during the fourth quarter.

During the final quarter of last year, the Detroit automaker reported EBIT-adjusted earnings of $2.8 billion and a net loss attributable to stockholders of $3.3 billion, or a loss of $3.60 a share, compared with a net loss of $2.96 billion, or a loss of $1.64 a share, a year earlier. The loss includes more than $7.2 billion in special charges largely related to its pullback in electric vehicles and restructuring efforts in China.

GM preannounced $7.1 billion of the special charges for the fourth quarter earlier this month. The additional special charges included $357 million in “legal matters,” related to OnStar and airbags, $5 million for its recent headquarters move and $133 million related to its defunct Cruise robotaxi unit.

Automakers commonly exclude “special items” or one-time charges from their adjusted financial results to provide investors with a clearer picture of their core, ongoing business operations.

Barra said the automaker’s significantly downsized headquarters in Detroit is expected to save the automaker hundreds of millions of dollars annually.

Despite the automaker’s ongoing reevaluation, Barra said GM remains in a strong position to return capital to shareholders.

To continue those efforts, the company said Tuesday that its board is authorizing a new $6 billion share repurchase and increasing its quarterly common stock divided by 3 cents to 18 cents per share.

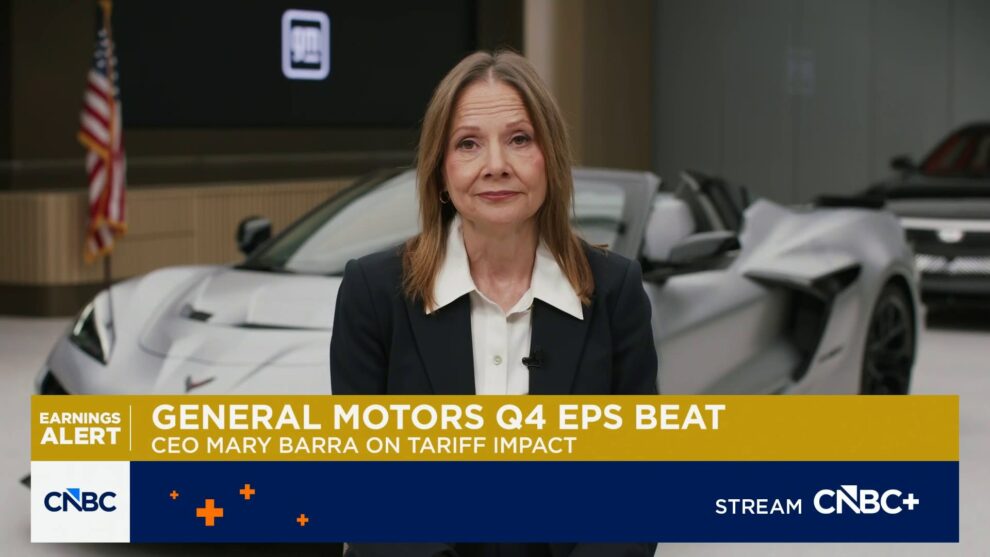

Mary Barra, chairman and chief executive officer of General Motors Co., speaks during the grand opening of General Motors global headquarters at Hudson’s Detroit in Detroit, Michigan, US, on Monday, Jan. 12, 2026.

Jeff Kowalsky | Bloomberg | Getty Images

That continues GM’s ongoing effort to reduce its outstanding shares to help boost its stock price. To end last year, the company had 904 million shares outstanding. That was down from 995 million at the end of the prior year, and 1.2 billion to end 2023.

Regionally, GM’s North American operations continued to lead the automaker’s results, but were down 28.1% last year to $10.45 billion, including a 1.3% loss during the fourth quarter to $2.24 billion.

GM CFO Paul Jacobson said U.S. tariffs cost the automaker $3.1 billion in 2025, below the company’s previous expectations of between $3.5 billion and $4.5 billion.

The Detroit automaker’s international operations — such as South Korea, Brazil and the Middle East — reported adjusted earnings of $737 million last year, up $434 million compared with 2024. Its equity income from China was a loss of $316 million, down from a $4.4 billion loss in 2024.

Barra on Tuesday said GM is “hopeful” the U.S. and South Korea can finalize a new trade deal with South Korea that includes a 15% tariff on vehicles exported to the U.S. from South Korea, which was used in GM’s 2026 forecast.

President Donald Trump on Monday said the U.S. would increase the tariff back to 25% after the South Korean legislature failed to approve the pact.

“We’re really encouraging the countries to get the trade deal done that they agreed to last October,” Barra told CNBC’s Phil LeBeau during “Squawk Box.”

GM is the second-largest U.S. importer of vehicles behind South Korean automaker Hyundai Motor. The Detroit automaker relies heavily on plants in the country for entry-level vehicles such as the Chevrolet Trax and Buick Envista.