David Solomon, Goldman Sachs

Andrew Harrer | Bloomberg | Getty Images

Goldman Sachs beat Wall Street’s expectations for second-quarter results Tuesday with outperformance in its investment banking and trading division.

Here’s how the company did compared with what Wall Street expected:

- Earnings: $5.81 per share vs. $4.89 per share forecast by Refinitiv

- Revenue: $9.46 billion vs. $8.83 billion forecast by Refinitiv

- Total investment banking revenue: $1.86 billion vs. $1.77 billion projected by FactSet

The New York bank also notched better-than-expected equities revenue with $2.01 billion in the second quarter, vs. $1.80 billion forecast by analysts. That was helped by a better market environment with more trading activity compared with the first quarter of this year, the bank said.

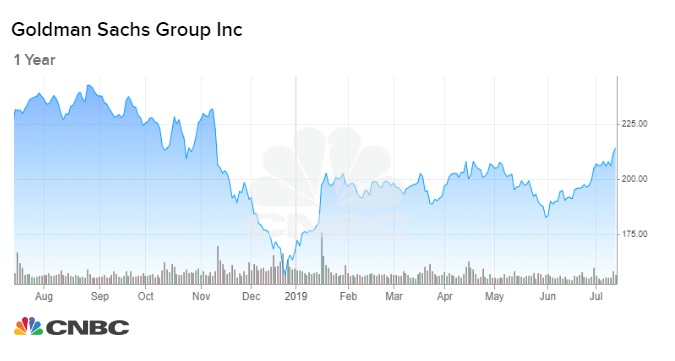

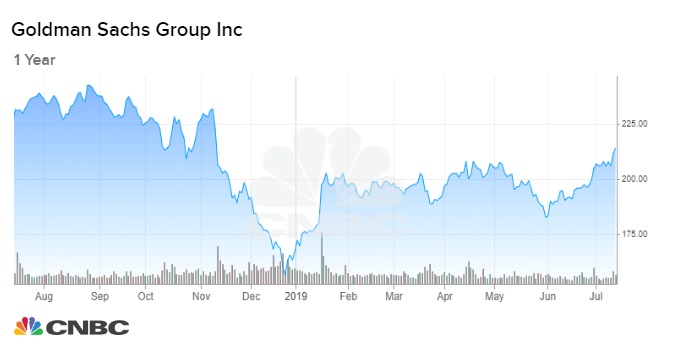

Shares of Goldman Sachs rose 1.1% in pre-market trading Monday.

“We’re encouraged by the results for the first half of the year as we continue to invest in new businesses and growth to serve a broader array of clients,” Goldman Sachs Chairman and CEO David Solomon said in a press release Tuesday. “Given the strength of our client franchise, we are well positioned to benefit from a growing global economy.”

Goldman Sachs raised its quarterly dividend to $1.25 per share from 85 cents, which was first announced in June after the bank passed the Federal Reserve’s annual stress test. Goldman also authorized a $7 billion stock repurchase program, up from $5 billion a year ago.

Net revenues for fixed Income, currency and commodities, known as FICC, were slightly below Wall Street’s expectations, coming in at $1.47 billion in the quarter vs. $1.52 billion expected, according to Refinitiv. That reflected “significantly lower” revenue in interest rate products and currencies, and a backdrop of “low levels of volatility and low client activity,” Goldman Sachs said in a press release.

Goldman posted first-quarter revenue below Wall Street estimates as executives cited tougher market conditions for the firm’s trading and investing divisions. But the shares have rallied this year anyway with the stock up 26% this year compared to a 17% gain and 12% increase for shares of rivals JP Morgan Chase and Morgan Stanley respectively.

Of the six biggest U.S. banks, Goldman Sachs is the most dependent on Wall Street activities like trading. But the bank — historically known for its list of wealthy corporate and hedge fund clients — also moved into consumer finance three years ago with its Marcus business. Goldman’s consumer arm, which offers high-interest savings and personal loans, and has gathered about $48 billion in deposits and made $5 billion in loans so far.

The New York bank announced its first credit card with Apple in March. Analysts will be looking for any more detail of what the Apple deal may eventually mean for Goldman’s bottom line.

This report marks CEO David Solomon’s third quarter running the bank. He is expected to field questions about the capital markets environment and a widely expected July Federal Reserve interest rate cut, which could put pressure on the bank’s lending business.

Analysts will also be looking for any updates on the bank’s ongoing 1MDB scandal, in which an ex-Goldman partner admitted to helping a Malaysian financier loot an investment fund of billions of dollars. Uncertainty from the investigations has weighed on Goldman’s stock, especially in 2018 when it was the worst performer of the top six banks.

— CNBC’s Hugh son contributed reporting.