Google has announced it’s making more changes to how it displays search results in the European Union in response to continued complaints that it’s failing to comply with the bloc’s Digital Markets Act (DMA).

This will include what it bills as a “short test” of plain “blue link” style search results for hotel queries in three EU markets (Belgium, Estonia, and Germany), which will be akin — the company suggests — to how its search engine originally displayed results.

The EU’s flagship market contestability reform carries hefty penalties for noncompliance of up to 10% of global annual turnover (or more for repeat offenses). Alphabet, Google’s parent, has been under investigation since March in relation to new rich features it launched in response to the DMA, but which rivals argue undermine the regulation’s ban on self-preferencing.

Travel comparison sites have been among those that have continued to complain that Google is trying to circumvent its obligations.

Google has fought back by claiming the changes to search have penalized other players in the travel ecosystem. In a new blog post on Tuesday — attributed to Oliver Bethell, director, legal, Google — it suggests that “direct booking clicks” to airlines, hotel operators, and small retailers have dropped by around a third (30%).

The tech giant appears to be attempting a “divide and conquer” strategy in response to the DMA, which seeks to use compliance changes to play its main rivals (“large online travel aggregators”) off against other travel retailers that its search engine has the power to uplift or degrade based on how much traffic it sends them.

Ironically, the DMA is an attempt to prevent gatekeepers from flexing market muscle unfairly, so it will be interesting to see what the European Commission makes of the tactic.

The latest changes Google is proposing to how it displays search results will affect more than just the travel vertical — also impacting product searches and restaurants, per the company’s blog post.

“We think the latest proposal is the right way to balance the difficult trade-offs that the DMA involves,” it writes, adding that it “still hope[s] to be able to reach a solution that complies with the law and continues to provide European users and businesses with access to helpful technology.”

Rival display units

The changes Google’s blog post announces include displaying what it claims will be “expanded and equally formatted” units in search results when users search for products, restaurants, flights, or hotels that will let people choose between results that take them to Google rivals (comparison sites, meta search engines, review sites, etc.) or results that take them directly to supplier or retailer websites.

A lot will hinge on how Google presents this choice, but the blog post does not offer any visual examples. Additionally, the blog post says it will introduce “other new formats that allow comparison sites and suppliers to show more information about what is on their websites, like prices and pictures.” Again, no visual examples are provided.

Finally, Google says it will launch new ad units for comparison sites. But, again, we will have to wait to see what these look like.

A key complaint of travel aggregators over Google’s initial DMA response was that the company was switching from unfairly competing with them by placing its own comparison services in eye-catching box-outs directly at the top of search results to unfairly competing with them by baking comparison site-style features into the top of search results and using a suite of new platform features to try to keep users in Google by discouraging them from clicking away to rival services.

Google’s rejoinder has been to claim it’s being forced to degrade the quality of the search experience it can offer Europeans by making it less useful. Bethell continues this attack line in the blog post, as well as implying the DMA is preventing Google from “innovating and competing.”

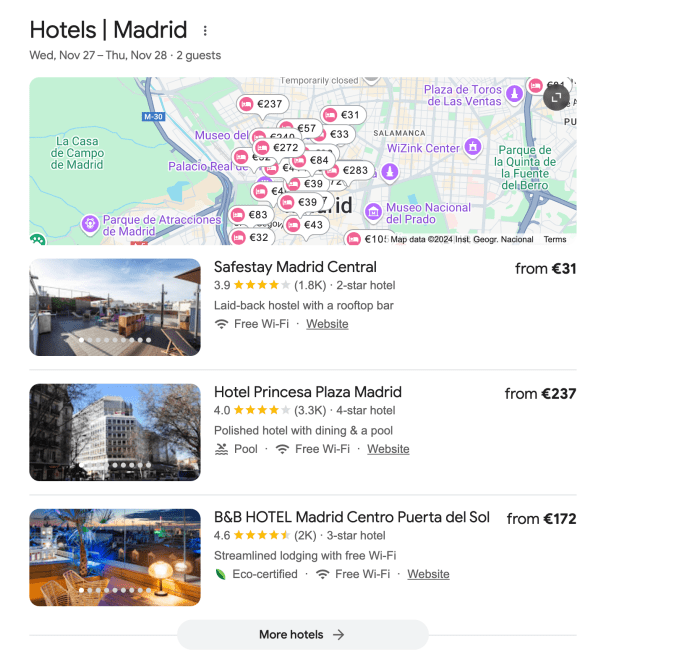

Complaints have continued, however. Travel aggregators are also unhappy about rich features that Google now displays in relation to hotel search queries, which shows a map view of hotels in the desired location along with pricing info and links to featured hotels websites.

The visually rich feature looks intended to drive search traffic direct to suppliers (in that case, hotels) — which could leave comparison sites out in the cold.

“While many stakeholders are happy with our changes, a few sites continue to demand more, such as a complete ban on anything that’s more sophisticated than a simple blue link to a website. This would prevent Google from showing people useful information like prices and ratings,” Bethell goes on — teeing up the announcement of the aforementioned “blue link” test.

“Reluctant” return of blue links

This is not being framed as a DMA change Google wants to make. On the contrary, it’s dubbed a “short test” so it can “understand how such changes would impact both the user experience and traffic to websites.”

“The test will remove some of the features that have been at the focus of the debate, including the map that shows where hotels are and hotel results underneath it. Instead, we will show a list of individual links to websites without any of the additional features — similar to our old ‘ten blue links’ format from years ago,” it adds.

Google claims it’s “very reluctant” to run the test at all, implying it believes it’s being forced to this pass — and forced to degrade the quality of search for EU users — by rivals demanding it wind back the product experience to an earlier internet epoch. (Albeit, web users tired of Google’s endlessly self-serving reshaping of search results might welcome the return of a few plain blue links, TBH.)

It’s not clear how long the test will run, but Google says hotel search results will return to “normal” — whatever that means in this chameleonic context — once the data-gathering exercise ends.

Ultimately, though, it will be up to the European Commission’s DMA enforcers to decide what fair compliance looks like.

We reached out to the Commission for a response to Google’s announcement. “All we can say is that we’re currently assessing Google’s compliance proposals,” EU spokeswoman Lea Zuber said.

Google is not only under pressure over this element of its DMA compliance. Last week privacy-focused search rival DuckDuckGo urged the Commission to widen its investigation of the tech giant — accusing it of failing to provide comprehensive “click and query” data to rivals, and redoubling its complaints that choice screens the DMA requires Google to display are not working as it says they don’t currently allow users to switch away from Google’s products easily enough.