(Bloomberg) — Alphabet Inc.’s Google headed back to court Monday to face US Justice Department allegations that it manipulates the $677 billion display advertising market in violation of antitrust laws, just one month after losing a landmark ruling that it illegally dominates online search.

Most Read from Bloomberg

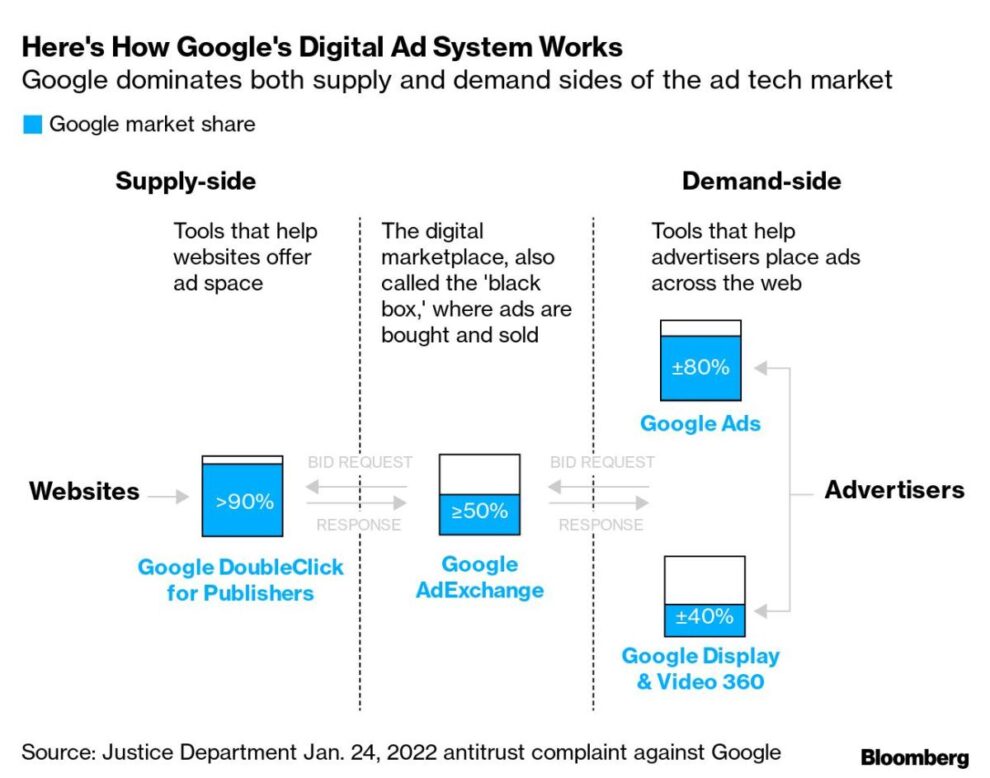

The US and a coalition of eight states accused Google of building up a “trifecta of monopolies” to lock up the technology behind website ads and harm publishers and advertisers — claims Google had denied.

“Google is not here because they are big,” the Justice Department’s trial attorney Julia Tarver Wood said in opening statements. “They are here because they used that size to crush the competition.”

Wood said during the start of the trial that Google adopted a “classic monopolist playbook” by buying up potential competitors, locking in its customers and then changing the rules to benefit itself. “Google acquired its way to success,” beginning with its 2008 purchase of DoubleClick, she said. The company has also refused “to allow customers the freedom of choice.”

The trial, which is taking place in Alexandria, Virginia, marks the first case brought by the Biden administration against Big Tech to have its day in court. The Justice Department’s earlier lawsuit accusing Google of illegally monopolizing internet search is the biggest antitrust case in tech since a ruling against Microsoft Corp. more than two decades ago. It was filed in October 2020 under former President Donald Trump.

Google’s attorney asserted that the government’s case is based on an outdated understanding of digital ad markets and that its tools work seamlessly with competing products.

“Today we are one big company among many others,” Google attorney Karen Dunn said, adding that the firm is “intensely competing” with dozens of others including Microsoft and Amazon.com Inc. among others.

Dunn pushed back on the Justice Department’s contentions that Google controls what they’ve termed “open web display advertising,” saying that advertisers don’t limit themselves in that way. Instead, advertisers buy across a variety of channels including social media, video and within apps — all of which, the US claims are separate from the market in the case.

“There is no such thing as open web display advertising,” Dunn said, accusing the government of trying to open a “time capsule” that would reveal “a BlackBerry, iPod and Blockbuster video card.”

Google holds the top spot in the global digital ad market, which has grown to $677 billion, according to 2024 projections by research firm EMarketer. Of Alphabet’s nearly $260 billion in revenue in 2023, about $31.3 billion came from the display advertising at issue in the case, according to the company’s most recent annual earnings report.

Justice Department antitrust lawyers say that Google, using its position as a middleman that controls the market from end-to-end, drives up the price of ads while paying less to the websites that show them. Because of its dominance across the technology, Google has the ability to force publishers and advertisers to use its suite of products, generating monopoly profits: Google keeps about $36 out of every $100 in advertising spent through its tools, according to the US lawsuit, which was filed last year.

Websites show more than 13 billion display ads every day, bringing in roughly $12 billion in revenue annually, according to the Justice Department.

Google plans to argue that as the internet has evolved, so has the advertising technology that supports it. Google says it now faces competition from major players across social media, apps and streaming TV services, including Meta Platforms Inc., ByteDance Ltd.’s TikTok, Amazon and Netflix Inc.

The tech giant also argues that end-to-end integration in its web advertising tools makes the technology more efficient, secure and reliable. Marketers and publishers choose its products because they are superior, not because they don’t have other options, Google says.

In laying out its case, the government plans to show how Google amassed power in digital advertising starting more than a decade ago, buying up early ad networks like DoubleClick. That deal, the agency alleged in its complaint, “was a first step in Google’s march to monopoly.”

Before its DoubleClick purchase, Google used its burgeoning ad business to place ads next to results on its own search engine. But, according to the DOJ’s lawsuit, it struggled to launch a technology known as an ad server, which would allow it to place ads on other websites. The company also hadn’t yet built up relationships with top advertisers.

The DoubleClick deal helped in both areas. The startup made the leading ad server, and had multiple connections to top publishers and blue-chip advertisers. The Justice Department claims that Google now controls 91% of the market for publishers to offer space to sell ads, and can unfairly raise ad prices on a whim. To argue its case, the agency plans to call Neal Mohan, now the CEO of Google-owned video site YouTube and previously a vice president at DoubleClick, to testify.

Google notes that the federal government cleared the DoubleClick deal, as well as other acquisitions like its 2011 purchase of the ad optimization platform AdMeld, when they happened.

Google’s actions have harmed publishers, the DOJ argues, some of which had to move away from advertising to subscription business models, while others had to shut down. Testimony from current and former executives from News Corp., The Daily Mail and Gannett Co. may be featured at the trial.

Google said it plans to call on small publishers and businesses as witnesses. A breakup of its advertising technology business “would slow innovation, raise advertising fees and make it harder for thousands of small businesses and publishers to grow,” the company said in a statement when the Justice Department’s suit was first filed.

Federal prosecutors may also tap top Google leaders who have held key roles in its advertising businesses to testify. Its witness list includes Google AI executive Sissie Hsiao, who was previously a director of the company’s display, video and app advertising businesses, and Jerry Dischler, now a Google Cloud executive, who once oversaw Google’s advertising products and was also called to testify in the DOJ’s search antitrust trial.

(Updates with additional details beginning in second paragraph.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.