As megacap stocks continue to surge, investors should not ignore the bargains below the top tier.

No matter what direction the market is moving, investors understandably seem to like bargains. When one can buy a potentially lucrative stock at a discounted price, it increases the chances of market-beating returns.

Fortunately, the market tends to offer such discounted stocks. Even with a modest investing budget of around $1,000, investors can likely get ahead by investing in the following trio of bargain stocks:

1. Alibaba

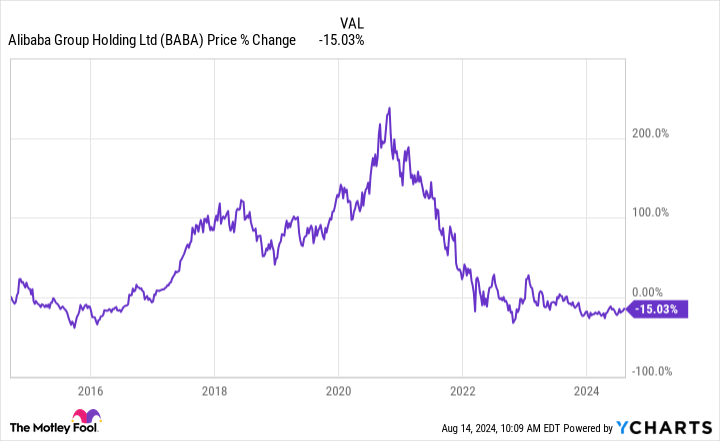

Alibaba (BABA 0.88%) has frustrated investors since its initial public offering (IPO) 10 years ago. The stock surged past $300 per share during the height of the COVID-19 pandemic only to give back all of its gains. Since its inception, the stock has lost around 15% of its value.

Admittedly, much of the decline has been due to geopolitical challenges. Investors became increasingly nervous about the stock as U.S.-China relations deteriorated. Also, a threatened delisting after the Securities and Exchange Commission (SEC) could not access internal audits cast doubt on the stock.

However, the U.S. and China reached an agreement that averted the delisting. Also, amid all the troubles, it is still China’s equivalent of Amazon as it continues to lead the retail sector and the cloud.

Even as Alibaba’s stock is down, its net income has tripled since 2014, rising from 23 billion renminbi in fiscal 2014 ($3.2 billion) to 71 billion renminbi ($9.9 billion) in fiscal 2024. Such increases greatly reduce the likelihood of Alibaba giving back all of its gains again.

Moreover, with its rising profits and stagnant stock price, it has fallen to a P/E ratio of 18. In comparison, Amazon trades at 41 times earnings, and its Latin American counterpart, MercadoLibre, sells at a 68 P/E ratio.

Indeed, with U.S.-China relations still tenuous, dangers remain with Alibaba stock. Nonetheless, its market lead and low P/E ratio have made it worth the risk for many investors.

2. Carnival

Carnival Corp. (CCL 0.91%) stock has sailed in some rough waters in recent years. It became volatile when the pandemic forced the company to suspend operations for more than a year. Although Carnival returned to the seas in mid-2021, it took several more years to return to its 2019 revenue levels.

Still, the cruise line stock appears to have recovered, with bookings at record highs. So popular are its cruises that the company plans to increase capacity by 5% in fiscal 2024.

The one thing that might have discouraged investors is Carnival’s massive debt, which still tops $30 billion. Debt skyrocketed when it had to borrow to keep itself solvent.

Nonetheless, its debt due within one year is $2.2 billion, a level under the $2.7 billion in free cash flow it generated over the last six months. This means the company can retire debt without having to refinance significant debt at higher interest rates. At this rate, it can stabilize its balance sheet while reducing interest costs.

Also, its P/E ratio is 22. While not a record low, it seems reasonable considering Carnival’s improving finances and market lead in the cruise industry. As more passengers cruise and debt falls, it should give Carnival’s shareholders a significant boost.

3. Roku

Roku (ROKU 5.77%) has frustrated investors since its massive price decline in the 2022 bear market. The company’s platform continues to attract new viewers, and as a neutral site aggregator, it appears to offer competitive advantages over the megatech companies that compete in this space.

Still, despite Roku’s attributes, it seems to struggle in key areas. For one, the company has not turned a profit since the pandemic. Although net losses fell substantially from the $108 million loss in the year-ago quarter, Roku still lost $34 million in the second quarter of 2024.

Nonetheless, investors should note the $318 million in positive quarterly free cash flow. Since only noncash expenses such as stock-based compensation stand in the way of profitability, the company is likely in better financial shape than its losses indicate.

Moreover, the lack of growth in average revenue per user (ARPU) has likely disappointed investors, as the $40.68 quarterly ARPU was flat over the previous 12 months. Still, this is under pressure due to Roku’s efforts in international markets, where it has just begun to monetize content.

However, such challenges play into the hands of new buyers, as it sells at a price-to-sales (P/S) ratio of 2, a massive decline from the height of the pandemic when that metric briefly exceeded 30. Should it turn profitable again, Roku will likely not stay at that valuation for long.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Will Healy has positions in MercadoLibre and Roku. The Motley Fool has positions in and recommends Amazon, MercadoLibre, and Roku. The Motley Fool recommends Alibaba Group and Carnival Corp. The Motley Fool has a disclosure policy.