Despite short-term market concerns, these companies stand a lot to gain long term from AI developments.

There has been no shortage of artificial intelligence (AI) talk in the past two years. In fact, some would probably argue that there has been too much AI talk recently. Whether it’s social media, company earnings reports, or financial media, there hasn’t been a hotter topic in the tech and business world than AI.

For companies, AI has the chance to improve efficiency and increase innovation. For investors, AI presents a unique opportunity to capitalize on the growth of the technology. If you’re part of the latter group and have $3,000 available to invest, putting $1,000 into each of these three stocks is a choice that could pay off well in the long run.

1. Microsoft

Microsoft (MSFT 0.20%) has taken a smart approach to AI, developing a strategic partnership with OpenAI, the developer of the ultra-popular ChatGPT. The partnership between the two involves a trade-off: OpenAI gets to use Microsoft’s cloud platform, Azure, for its infrastructure and computing ability, and Microsoft gets to integrate OpenAI’s AI models into its products and services.

The outsourcing versus in-house approach is smart because it doesn’t tie up a lot of Microsoft’s resources (talent and money) in developing large language models and other relevant AI technology. OpenAI has solidified itself as a leader in AI research and development, and it took billions of dollars and years to get to that point.

Sure, Microsoft has the talent and bank account to develop AI in-house, but this partnership looks to be a more efficient route. It also allows Microsoft to spend its time and resources on integrating these AI models into its products and services, which are already some of the best available.

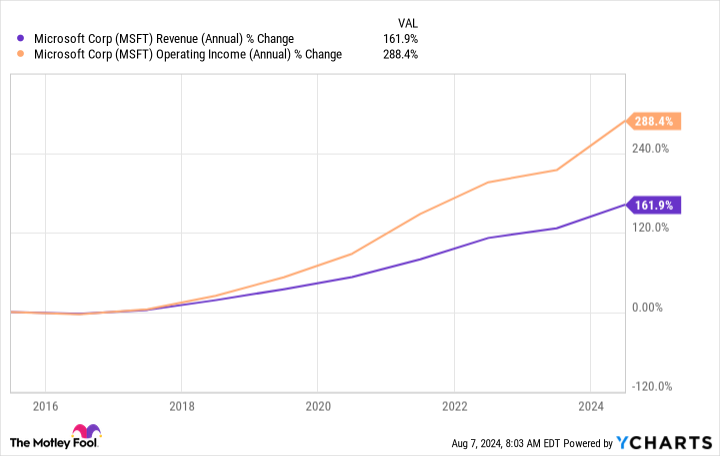

Countless companies and people use Microsoft’s Office products (Excel, Teams, PowerPoint, etc.) and devices, and adding AI capabilities should boost up its competitive advantage and appeal and continue the great path its financials have been on for quite a while now.

MSFT Revenue (Annual) data by YCharts

2. Apple

While many tech companies were seemingly racing to develop and showcase their new AI capabilities, Apple (AAPL 0.71%) took a much more patient stance. Some investors critiqued this approach, saying Apple was falling behind, but I’d argue it was on brand for a company known for being intentional with its plans.

Apple recently unveiled its version of AI: Apple Intelligence. Like other AI tools, Apple Intelligence is designed to seamlessly integrate into Apple’s state-of-the-art hardware products like iPhones, iPads, and Macs and enhance the user experience.

Apple’s bread and butter has always been hardware, accounting for close to 72% of its revenue in its latest quarter (ended June 29). However, a slowdown in the smartphone market has caused Apple’s revenue growth to slow noticeably from past years. With the iPhone accounting for around 46% of Apple’s revenue, it’s easy to see the correlation.

AAPL Revenue (Quarterly YoY Growth) data by YCharts

Apple Intelligence will only be available in Apple’s next-gen products releasing this fall, so the hope is that the allure of the new AI-powered products will give Apple’s financials a nice boost as consumers upgrade devices to have access to the features.

3. CrowdStrike

Well, I think it’s safe to say cybersecurity company CrowdStrike (CRWD -0.65%) has seen better days. After a faulty software update sparked the largest global IT outage in history, investors hopped off the CrowdStrike train and sent the stock plunging. Its stock is now down over 40% in the past month.

Despite the biggest mishap in company history, the one silver lining is that the problem wasn’t caused by CrowdStrike’s product being ineffective. It’s one thing for a software update to go left; it’s a completely different story for a premier cybersecurity company to fall victim to a cyberattack. Luckily, the former only seems true.

CrowdStrike is one of the pioneers of pure AI-based cybersecurity solutions, and it has attracted many big-name customers because of its effectiveness. It was placed highest for its ability to execute in endpoint protection (endpoint devices like smartphones, computers, smart devices, etc.), and this hasn’t changed because of its software update incident.

The short term has a lot of questions for CrowdStrike — including how many customers choose to jump ship (I don’t think many will) — but it still seems to have great value for long-term investors. This is especially true considering the stock is the cheapest it has been since December 2023, giving investors a much more attractive entry point.

The total addressable market for cybersecurity is huge, and CrowdStrike should be a pivotal player in the industry for quite a while.

Stefon Walters has positions in Apple, CrowdStrike, and Microsoft. The Motley Fool has positions in and recommends Apple, CrowdStrike, and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.