Insights into the Fund’s Latest Portfolio Adjustments and Stock Performances

Harbor Capital Appreciation Fund (Trades, Portfolio), managed by Jennison Associates LLC, continues to implement its investment philosophy focusing on long-term growth opportunities. The fund targets companies with disruptive technologies, strong brands, and significant market potential. Following the leadership of Spiros Segalas until January 2023, the team remains committed to investing in businesses that offer sustainable competitive advantages and robust financial health. This approach is evident in their recent portfolio adjustments during the third quarter of 2024.

New Additions to the Portfolio

Harbor Capital Appreciation Fund (Trades, Portfolio) expanded its portfolio by adding five new stocks. Noteworthy new positions include:

-

GE Aerospace (NYSE:GE) with 1,979,501 shares, making up 1.19% of the portfolio and valued at $336.91 million.

-

Analog Devices Inc (NASDAQ:ADI), holding 1,017,032 shares, which represent 0.83% of the portfolio, totaling $235.32 million.

-

Hilton Worldwide Holdings Inc (NYSE:HLT) with 696,873 shares, accounting for 0.53% of the portfolio, valued at $149.60 million.

Significant Increases in Existing Positions

The fund also increased its stakes in 14 stocks, with significant boosts in:

-

Apple Inc (NASDAQ:AAPL), adding 1,356,643 shares, bringing the total to 7,426,774 shares. This increase represents a 22.35% rise in share count and a 1.06% impact on the current portfolio, valued at $1.65 billion.

-

Boeing Co (NYSE:BA), with an additional 827,227 shares, increasing the total to 1,959,222 shares, marking a 73.08% rise in share count, valued at $373.43 million.

Complete Exits from Certain Holdings

The fund decided to exit completely from five holdings in this quarter, including:

-

Lululemon Athletica Inc (NASDAQ:LULU), selling all 712,806 shares, impacting the portfolio by -0.95%.

-

HubSpot Inc (NYSE:HUBS), liquidating all 365,159 shares, resulting in a -0.82% portfolio impact.

Reductions in Key Positions

Significant reductions were made in 33 stocks, notably:

-

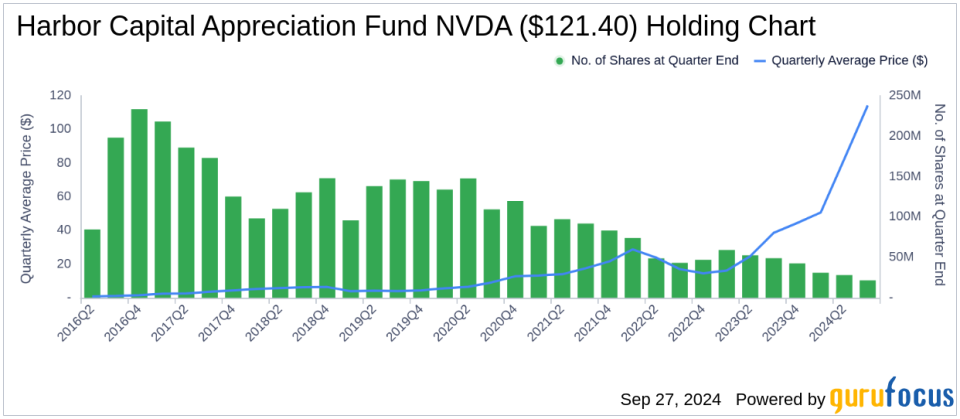

NVIDIA Corp (NASDAQ:NVDA), reducing holdings by 6,540,772 shares, a -23.26% decrease, impacting the portfolio by -2.09%. The stock traded at an average price of $114.24 during the quarter, with a -2.12% return over the past three months and a 145.10% year-to-date return.

-

Advanced Micro Devices Inc (NASDAQ:AMD), cutting back by 2,538,796 shares, a -42.87% reduction, impacting the portfolio by -1.49%. The stock’s average trading price was $160.47 this quarter, with a 3.02% return over the past three months and an 11.45% year-to-date return.

Portfolio Overview

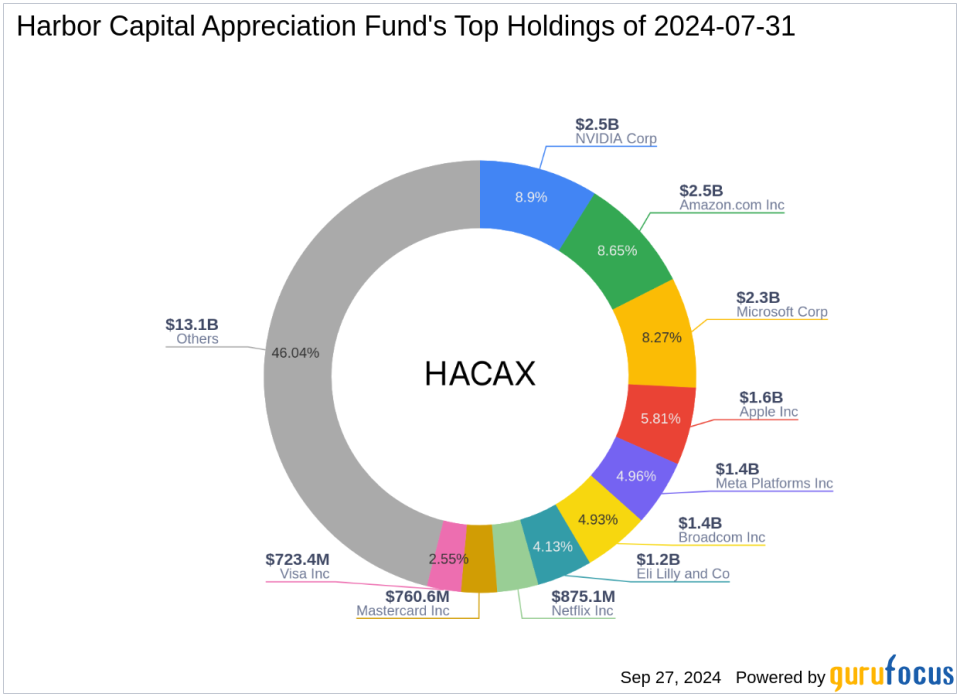

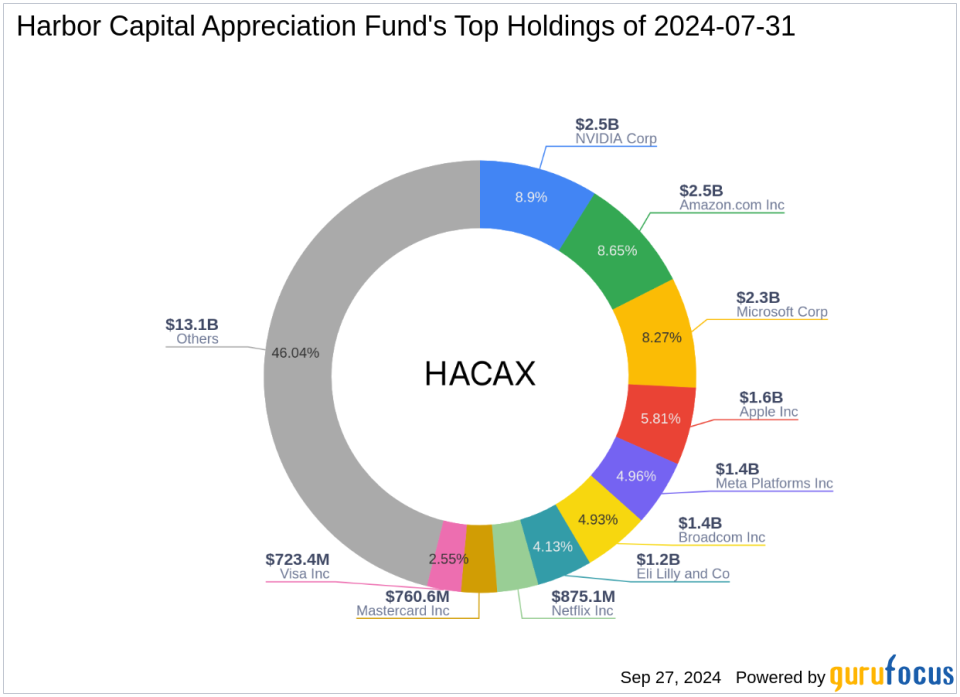

As of the third quarter of 2024, Harbor Capital Appreciation Fund (Trades, Portfolio)’s portfolio comprises 52 stocks. The top holdings include 8.9% in NVIDIA Corp (NASDAQ:NVDA), 8.65% in Amazon.com Inc (NASDAQ:AMZN), 8.27% in Microsoft Corp (NASDAQ:MSFT), 5.81% in Apple Inc (NASDAQ:AAPL), and 4.96% in Meta Platforms Inc (NASDAQ:META). The fund’s investments are primarily concentrated across seven industries: Technology, Consumer Cyclical, Communication Services, Healthcare, Financial Services, Industrials, and Consumer Defensive.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.