Coinbase (NASDAQ:COIN) is the largest publicly traded crypto-specific exchange in the U.S. according to Market Watch. They have over 68 million verified users, which trade approximately $462 billion in crypto volume! This makes Coinbase the 13th most popular exchange in the world according to Statista. Binance is the number one most popular exchange in terms of number of users, but Binance isnt public yet. Coinbase was a crypto exchange pioneer. Founded in 2012, they were one of the first “easy-to-use and trustworthy” crypto exchanges. Binance launched five years later in 2017.

Business model

Coinbase enables investors to trade over 140 various crypto assets which include Bitcoin, Ethereum, Cardano and even Dogecoin. The firm makes the majority of revenue from “Order Flow” and the “buy/sell spread” from retail and institutional investor trading. They charge a spread of approximately 0.5% for all transactions, in addition to fees of $0.99.

Building the crypto economy

As Coinbases revenue is primarily derived from the trading of cryptocurrency, mostly by the retail investors, this leads to very volatile income. Thus, to diversify the company’s product offerings and grow further, Coinbase is investing heavily, spending approximately 7% of revenues in fiscal 2022 to build the crypto economy.”

For example, the firm has recently announced the launch of Coinbase NFT, a peer-to-peer marketplace that will make minting, purchasing, showcasing and discovering NFTs easier than ever. As Coinbase has 68 million verified users, this offers a powerful opportunity for the brand. In the meantime, the company has a waiting list up where users can sign up.

Personally, I think this is a great idea, but I believe Coinbase is slow off the mark. An analysis of Google Trends shows searches for NFT peaked in January 2022. As a speculative asset similar to crypto, the importance of being an early platform which enables adopters is vital (as Coinbase will know). However, its late entry might have been to avoid association with the early pump-and-dump money laundering schemes that plagued the NFT space last year.

As a personal example, during the first major talk of NFTs in 2021, I signed up for Opensea, since it is the world’s largest NFT marketplace, which was recently valued at a monster $13 billion. Now, although I believe the popularity of NFTs will resurface, I would have liked to see Coinbase move faster to create a platform. The only positive is the market potential is huge, as OpenSea is valued at approximately a third of Coinbases current market cap.

In the near term, Coinbase has introduced a variety of other new products which expand the crypto economy. These include the following: Bitcoin Borrow, which allows users to borrow money using Bitcoin as collateral; Coinbase Card from Visa, which allows users to spend their cryptocurrency on everyday purchases; and Coinbase Cloud, a cloud product which allows decentralized applications to be built on top, offering a similar vision to a mini Amazon (NASDAQ:AMZN) Web Services.

Financial analysis

Coinbase achieved an incredible $7.8 billion in revenue for fiscal year 2021, up a meteoric 530% year over year. This also included a strong operating profit of $3 billion. These were incredible numbers and left the company with a strong balance sheet of $7.1 billion in cash and cash equivalents compared to just $3 billion in long-term debt.

Now if the company can keep these numbers up, the valuation could someday be approximately five times what it is today by my estimates. However, there is an issue: Coinbase makes the majority of its revenue from the retail trading of Bitcoin and Ethereum. Both of these assets had tremendous bull runs in 2020 and 2021. For example, the Bitcoin price skyrocketed by 900% at its peak in November 2021 from lows in March 2020. However, the Bitcoin price is now down 24% from its peak in November 2021.

I consider myself to be very in touch with the retail investing community, since I am a member of it. From what I’ve seen, many retail investors tend to look for the newer coins to trade (Cardano, Shiba, etc.), which isnt great news for Coinbase’s main revenue generator. Although Coinbase has introduced the ability to buy these newer coins, this wasnt until late 2022, which was behind the curve compared with other platforms. A lot of crypto traders are short-term traders looking to profit off of the next big thing.

Thus, Coinbases guidance is muted for the first quarter of 2022, with the company predicting lower subscriptions and services revenues than in the fourth quarter of 2021. They expect the annual average retail MTUs to be between 5 million and 15 million, which is a large and inaccurate range. In addition, they expect the average transaction revenue per user to decline to pre-2021 levels. Perhaps the company is sandbagging for some surprise results, but given the revenues are tied heavily to the trading of Bitcoin and Ethereum, I think these revenues would make sense.

Cathie Wood is buying

Despite the muted expectations for 2022, Coinbase is a holding in the portfolio of Catherine Wood (Trades, Portfolio) of Ark Invest, a firm which invests into disruptive technology. Wood’s firm purchased 2,000 shares worth of call options for the stock in the fourth quarter of 2021, in addition to the 5.3 million common stock shares that it holds. However, it should be noted Wood did reduce her position in the common stock by 22% in the fourth quarter, though this may have been due to investor redemptions as the growth-focused funds face a period of underperformance.

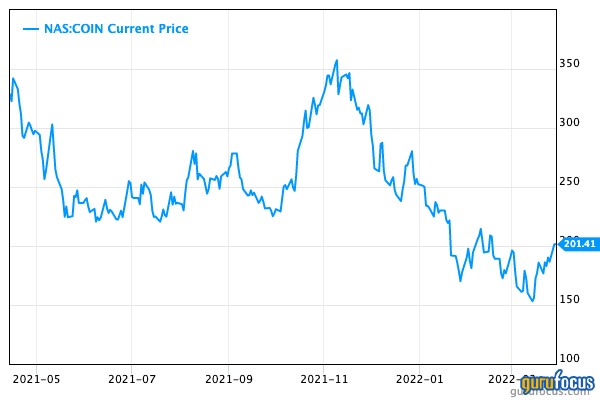

Coinbase’s price-sales ratio is just 6 at the moment, down from over 20 in 2021. In addition to the slowdown in crypto trading, high inflation and rising interest rates have also contributed to the compression of this multiple.

Final thoughts

Coinbase is a fantastic crypto exchange and they are making many investments to build the crypto economy, which offers additional optionality value to the stock. However, as the company’s revenue is tied heavily to the popularity and volatility of crypto trading, this can be seen as a major risk. The stock is cheap on a price-sales basis and the financials could rebound strongly if the crypto economy shows long-term growth.

This article first appeared on GuruFocus.