These companies are trading at better values than their closest AI rivals.

A surge in artificial intelligence (AI) last year led to a rally in the tech market. The Nasdaq-100 Technology Sector index has climbed 81% since the start of 2023, driven primarily by excitement over AI. While the bull run has benefited current investors, it has also raised the price of entry for new ones, as the stocks of many of the world’s leading tech giants are trading at a premium.

It can be difficult to figure out when a stock is a good buy, but investors can start by looking at its price-to-earnings ratio (P/E) and comparing it to the P/E of competitors. The ratio is calculated by dividing a company’s stock price by its earnings per share, and lower is considered better.

AI superstar Nvidia‘s (NVDA -0.57%) P/E sits at 56. With Advanced Micro Devices‘ P/E at 181 and Intel‘s at 96, Nvidia looks like a bargain. Meanwhile, Nvidia keeps succeeding with its majority market share in AI chips, and its stock looks like a no-brainer way to invest in AI right now.

And Nvidia isn’t the only compelling option. So, have $20,000 that you don’t need for anything in the short or medium term? Here are two AI stocks that look like bargain buys in 2024 and beyond.

1. Nvidia ($108 per share)

According to research group BIS research, the AI graphics processing unit (GPU) market saw spending of about $15 billion last year and will expand at a compound annual growth rate of 32% until at least 2028 — hitting $62 billion. GPUs are a crucial growth area in AI, with the chips necessary for training and running AI models. Meanwhile, fierce competition between various AI software giants means companies will require the latest and most powerful chips to keep up with their rivals, creating instant demand for newly released GPUs.

Nvidia has enjoyed this demand firsthand, with an estimated 90% market share in AI GPUs.

The company posted its second-quarter fiscal 2025 results on Aug. 28. Revenue increased 122% year over year, beating Wall Street expectations by just over $1 billion. Meanwhile, earnings per share came in $0.04 higher than analysts had forecast. The quarter benefited from consistent growth in AI GPU sales, with revenue in its data center segment popping 154%.

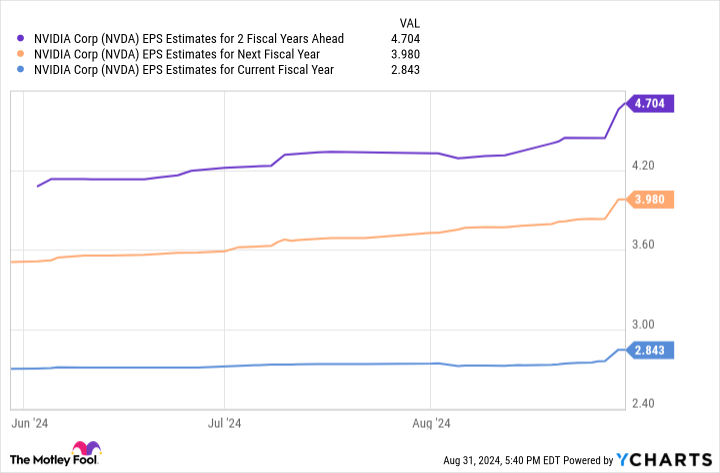

Furthermore, the chart below shows that Nvidia’s earnings could reach nearly $5.00 per share in two fiscal years. If the stock’s P/E stays near where it is, that would mean a much higher stock price in two years.

Data by YCharts

2. Alphabet ($158 per share)

Alphabet (GOOGL 0.23%) (GOOG 0.33%) has delivered impressive gains over the years, with its stock up 178% since 2019. Alphabet’s operating income and free cash flow have climbed 135% and 96% over the last five years.

Popular services like YouTube, Google, Android, and Chrome have made Alphabet an invaluable resource to consumers and businesses worldwide. These platforms attract billions of users daily, providing the company with a lucrative tool for building a highly profitable digital advertising business. And now, the company has a similar opportunity in AI.

Advertising has spurred the company’s growth in recent years; in the most recent quarter, advertising accounted for nearly 80% of Alphabet’s revenue. The tech giant’s investment in AI is also promising as it employs an expansion strategy similar to what it used to succeed in advertising. Over the last year, the company has integrated AI into many of its services, using the technology, for example, to better track viewing trends on YouTube and recommend videos, create a more responsive Google Search, and add a range of generative AI features to Android.

Meanwhile, Alphabet has even ventured into AI hardware with its recently revealed Google Pixel 9 smartphone, likely to give Apple‘s coming iPhone 16 a run for its money with its advanced generative features.

As you can see in the chart below, Alphabet stock is a bargain compared to its rivals when viewed on a P/E basis. The company’s P/E of 23 is a low on this list. An investment in Alphabet could offer big gains over the long term.

Data by YCharts

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Dani Cook has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Apple, Microsoft, and Nvidia. The Motley Fool recommends Intel and recommends the following options: long January 2026 $395 calls on Microsoft, short January 2026 $405 calls on Microsoft, and short November 2024 $24 calls on Intel. The Motley Fool has a disclosure policy.