Health stocks had another bad day, with investor jitters spreading to the biotech and pharmaceutical sectors, as well.

Investors’ anxiety seemed to have expanded from health retailers, managed care companies and health insurers to include biopharma companies on Thursday. The three biggest losers in the Health Care Select Sector SPDR Fund ETF XLV, +0.16% were Regeneron Pharmaceuticals Inc. REGN, -2.81% , Incyte Corp. INCY, -0.48% and Amgen Inc. AMGN, -2.74%

The health-care ETF edged up 0.2% on Thursday, to erase an intraday loss of as much as 1.5%, after falling 2.9% on Wednesday. It is now down 0.7% for the year, while the S&P 500 SPX, +0.16% has notched gains of 16%.

Pfizer Inc. PFE, -1.25% , Johnson & Johnson JNJ, -0.72% , Merck & Co. Inc. MRK, -0.99% and Walgreens Boots Alliance Inc. WBA, -0.92% were among the Dow Jones Industrial Average’s DJIA, +0.42% top five losers.

The recent decline in health-care stocks comes during an uncertain time for the future of U.S. health-care policy, with lawmakers demanding tighter regulations and transparency on drug prices and questions swirling around the probability of the country implementing a single-payer system, also known as “Medicare for All.”

Investors initially seemed more concerned about the impact such a system could have on managed care companies and insurers. But “sub-sectors are all naturally intertwined,” said Michael Yee of Jefferies in a note to clients on Thursday, calling the hit to biopharma “collateral damage.”

Biopharma companies enjoyed a relatively strong start to the year, but shares have slumped since. The iShares Nasdaq Biotechnology ETF IBB, -0.57% fell 0.6% on Thursday, and was down as much as 1.6% intraday. Although the ETF is up 8.4% this year, it is still trailing the S&P 500 by over 7 percentage points. The SPDR S&P Pharmaceuticals ETF XPH, +0.03% , up 6.2% for the year, is lagging the S&P 500 by almost 10 percentage points.

The health sector has seen other anxiety-inducing routs in the past, most notably in 2010, when the Affordable Care Act was signed into law that March. The sector lagged the S&P 500 by 5.1 percentage points during April of that year, as investors grappled with the possibility that mandatory coverage would cut into the profits of health insurers and medical-services companies.

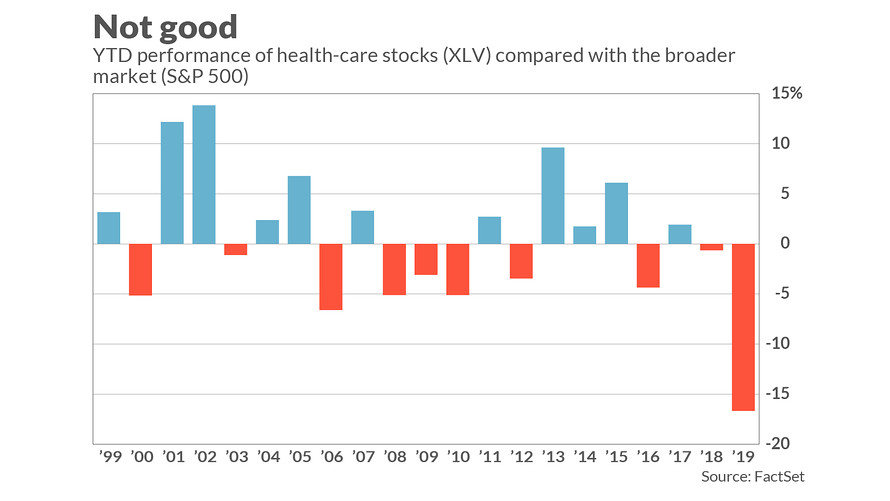

But health stocks are doing much worse this year, lagging the S&P 500 by nearly 17 percentage points, the largest gap in performance since 2006.

“We are now in the midst of one of the worst pull-backs in the past 20 years,” Evercore ISI analyst Ross Muken wrote in a Thursday note to clients. “I think we can officially confirm health care has entered a panic of sorts,” he wrote.

That panic was front and center on Tuesday, after shares of UnitedHealth Group Inc. UNH, +2.26% tumbled despite the company reporting earnings that beat expectations, while also boosting its full-year outlook. That did not prevent the stock, already in decline, from falling another 4% to close at $221.

Analysts blamed the disparity between UnitedHealth’s positive earnings and stock reaction to worries around Sanders’ Medicare-for-all proposal. “We believe the market is ascribing an inordinately high probability that some form of Medicare-for-all proposal could become reality,” Cowen analyst Charles Rhyee said at the time.

Read: What ‘Medicare for All’ would do to the health-care sector

Don’t miss: Sanders’ ‘Medicare for All’ gets cheers at Fox News town hall