First published on Simply Wall St News

Since PayPal Holdings, Inc. (NASDAQ:PYPL) lost all gains made after the March 2020 drop, we decided to revisit the future profit capacity of the company as well as make a relative value analysis.

We can summarize the finding of our analysis as:

-

Enthusiasm has waned as the company is not expected to keep growing earnings on the short-term

-

Future Free Cash Flows indicate that the stock is fairly valued on a relative basis

-

A change in management may be necessary before significant improvements are made

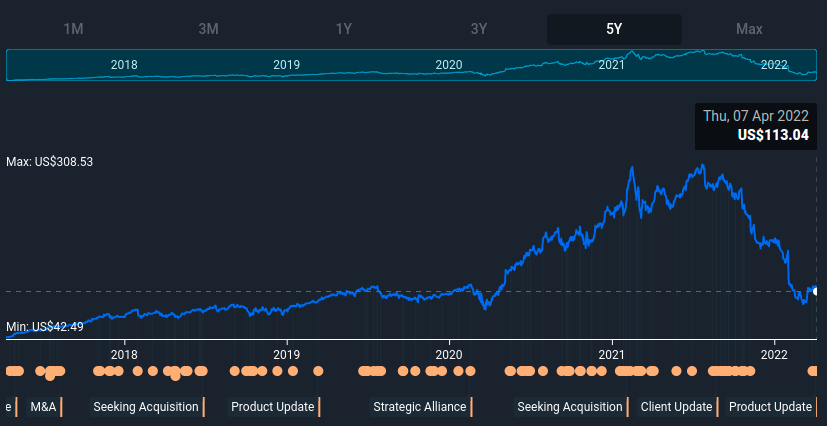

Starting off with the price history of PayPal, we can see that the stock is back at 2020 levels. While the company did well during 2020 and most of 2021, it seems that investors and analysts have lowered their expectations for the future of the company.

In hindsight, it is easy to attribute the 2020 rise to an overoptimistic market, however, it was quite hard to evaluate to what extent our lives would shift online back in 2020. This was also coupled with a low interest rate environment, which allowed for larger capital deployment in tech growth companies.

This is partly why we got the situation above, a top in 2021 and a sharp decline after a degree of consumer spending normalization mixed with fears of an economic downturn.

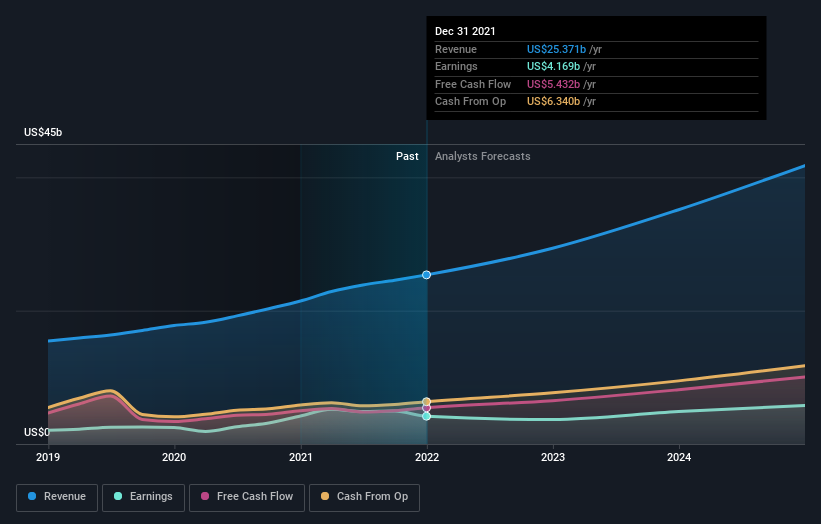

While PayPal did make more profits in the last two years – US$4.169b in the last 12 months, it still falls short from what investors expected in 2020.

Analysts have also revised their earnings forecasts after the last quarter, and while profits are still expected to be higher than 2020, we now have a much better picture of how much long-term growth we can expect from the 2020 boost.

View our latest analysis for PayPal Holdings

PayPal Holdings’ 48 analysts are now forecasting revenues of US$29.4b by the end of 2022, a 16% improvement. However, the picture is different for profits. EPS is forecast to drop 13% to US$3.11, reflecting a net income of US$3.67b.

While the current P/E ratio for PayPal is 31.6x, future earnings indicate a forward P/E of 35.9x, which means that PayPal is underperforming on the growth expectations, and investors who have an obligation to deliver yearly returns will be harder to convince to keep the stock in their portfolios.

The story is slightly different for investors that are keeping an eye on the cash flows, since the company is actually expected to grow free cash flows, which are higher than profits. For the end of 2022, analysts expect free cash flows of US$6.5b, resulting in a more reasonable forward EV to FCF of 20.8x. This is quite closer to fair value on a relative basis, and should put some concerns of investors to ease.

Note: free cash flows are before debt, so we need to use the enterprise value when converting to a multiple.

If we want, we can even take it a step further: by assuming maturity, a low future growth, we can compute a value for the company as Next year’s free cash flows / (Mature Cost of Capital – Riskfree Rate)

Calculation: US$6.5 / (0.0745 – 0.027) = US$136.84b

Keep in mind that this is the value of the stock Today, and may shift as forecasts and riskfree rates change.

Conclusion

While analysts have revised their forecasts for PayPal, the company seems to be fairly valued on a relative free cash flow basis.

It is now up to management to improve the service and attract new or lost customers in order to secure future growth.

While PayPal was the hallmark of payment processing, competitors are actively developing technologies that take current and future market share from the company, this tilts the balance of risk for the company’s future. Improving the quality of something existing is harder than increasing the number of services/features, partly because it implies admitting to mistakes made from management.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.