Short squeezes aren’t just for videogame retailers.

The big surprise in financial markets over the last two weeks has been the strength in government bonds, even after stronger-than-forecast U.S. consumer price and retail sales data were released.

After reaching a high of 1.75% on March 31, the yield on the 10-year Treasury BX:TMUBMUSD10Y has steadily declined, down to 1.56% on Monday. Yields move in the opposite direction to prices.

The decline in bonds yields has in turn helped stocks, with the S&P 500 SPX, -0.61% ending Friday at a fresh record high.

Masanari Takada, a quantitative analyst at Nomura, said what is going on is a systematic covering of short positions in safe assets.

“Since February, bond market investors had gone too far into optimistic mode (shifting out of low-risk bonds into high-risk bonds), and from that angle the current step back from optimism looks like a spontaneous correction in sentiment,” he said in a note to clients.

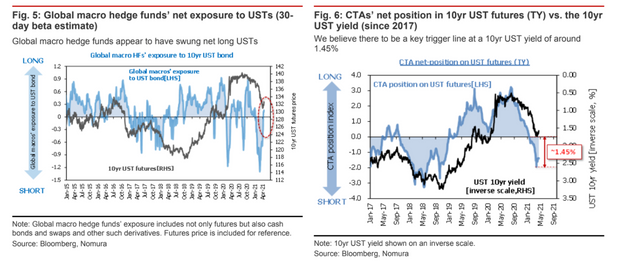

Global macro hedge funds, he wrote, got the ball rolling by covering short U.S. Treasury positions. Then came trend-following investors, who unwound short positions. Longer-term investors have also become buyers — Japan’s Ministry of Finance said Japanese investors were net buyers of foreign bonds by 1.7 trillion yen ($15.7 billion) in the week ending April 10.

Takada said trend-following investors probably break even at a yield of 1.45%, making that a crucial trigger line to see if the bond rally accelerates.

If yields fall below that level, these traders might have to unwind the remainder of their short positions — sending the yield down to 1.20%.

He said many market observers are still expecting Treasury yields to rise from here, given the strong expectations of normalization for the U.S. economy. He said the underlying stance of momentum investors is probably still bearish.