Despite scaling back its initial public offering, Uber Technologies Inc. still completed one of the biggest deals in U.S. history.

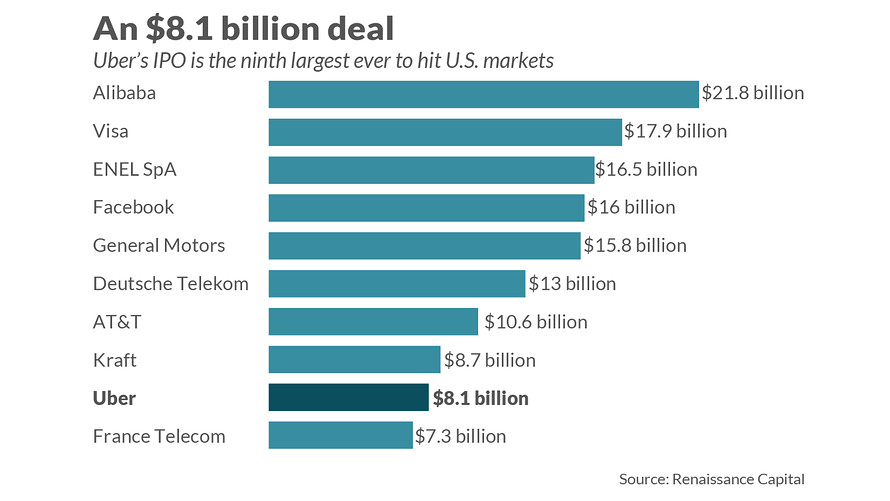

Uber UBER, +0.00% raked in $8.1 billion through its initial public offering Thursday, which would put the company’s initial valuation at just over $75 billion. The deal amount signifies the biggest IPO for a U.S.-based company in seven years and the ninth-largest ever to hit the U.S. markets.

The ride-hailing giant’s offering is the most sizable for a U.S.-based company since Facebook Inc. FB, -1.71% brought in $16 billion back in 2012 and the biggest for any U.S. offering since Alibaba Group Holding Ltd.’s BABA, -1.97% mammoth debut in 2014. The Chinese e-commerce giant raised about $22 billion on the day of its offering, and the deal size went up to $25 billion after underwriters exercised options to sell additional shares.

See more: Uber prices shares at $45 for biggest U.S. IPO since Facebook

Uber joins a top-10 crowd that includes companies across a variety of industries: Visa Inc. V, -1.34% places second with its 2008 offering that brought in nearly $18 billion, while General Motors Co. GM, -0.98% ranks fifth at nearly $16 billion and Kraft Foods ranks eighth at almost $9 billion. Three telecommunications companies, Deutsche Telekom, AT&T Wireless Group, and France Telecom, are also among the largest.

Read more: 5 things you need to know about the biggest IPO in years

When Uber detailed its expected pricing range of $44 to $50 a share in late April, that range implied that the company could have raised up to $9 billion at the high end. The company’s decision Thursday to price its offering at $45 a share struck Wedbush analysts as “conservative” but “prudent strategy,” given a disappointing debut for rival Lyft, which has seen its stock sink more than 20% below its IPO price of $72 from late March.

Uber announced in its prospectus that it had also entered into an agreement with PayPal Holdings Inc. PYPL, -1.73% which will buy $500 million worth of Uber’s stock at the IPO price. The company struck another agreement with affiliates of the Softbank Vision Fund, Toyota Motor Corp. and Denso Corp., which will together invest $1 billion in a newly created entity for Uber’s autonomous-driving efforts.