While there are many great stocks available, there can only be one “best stock to buy.” Narrowing it down was difficult, but I think Alphabet (GOOG -1.58%) (GOOGL -1.71%) tops the list.

Although Alphabet is the world’s fourth-largest company by market cap, it still has plenty of room to grow. Buying the stock now sets investors up nicely for 2025, because I think the company can excel next year.

Alphabet has a balanced growth strategy

Alphabet is better known as Google’s parent company, although it also owns the Android operating system and YouTube, among other things. While it has interests in many places, the majority of its business can be attributed to advertising. In the third quarter, advertising made up 75% of its total revenue, so it’s clearly a big part of the company.

Its advertising business is fairly mature and only grew 10% in the third quarter. That growth isn’t rapid by any measure, but it’s steady growth that allows Alphabet to invest in other areas that can deliver higher growth.

One of those areas is cloud computing, which also nicely relates to its artificial intelligence (AI) aspirations. Its cloud computing wing, Google Cloud, has been a tremendous performer lately, with revenue rising 35% year over year. This growth is occurring for multiple reasons, one of which is that Google Cloud provides access to one of the top generative AI models, Gemini.

Use of the Gemini model in APIs (application program interfaces) — plug-and-play apps that allow programmers to use another pre-built application easily — grew 14 times year over year. Building generative AI into various workflows and interfaces is becoming more popular, and its use will only increase over the next few years, boosting Google Cloud’s revenue.

There are multiple other reasons to invest in Alphabet as a business, but it all boils down to its steady advertising business keeping the lights on and then using those cash flows to build out other high-growth business sectors.

Strong financial results are another key reason to invest in the stock.

Alphabet’s stock is cheap for the performance it delivers

In the third quarter, Alphabet grew revenue 15% companywide. Thanks to improved operating efficiencies, earnings per share (EPS) increased from $1.55 last year to $2.12, a 37% rise.

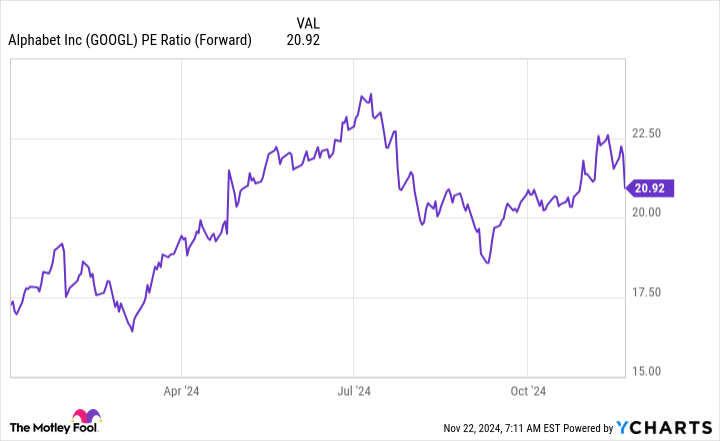

That’s an incredibly strong performance from a fairly mature business, yet the stock gets no respect. It trades at just 20.9 times forward earnings, which is less than the broader market, as measured by the S&P 500, which trades at 24.6 times forward earnings.

GOOGL PE ratio (forward); data by YCharts. PE = price to earnings.

That indicates strong value, but the undervaluation becomes clearer if you compare the stock to some of its big tech peers. Of the ones that have similar financials to Alphabet — Microsoft (MSFT 1.00%), Apple (AAPL 0.59%), and Meta Platforms (META -0.70%) — it trades at the lowest multiple.

| Company | Q3 Revenue Growth | Q3 EPS Growth | Forward P/E |

|---|---|---|---|

| Alphabet | 15.1% | 37.2% | 20.9 |

| Apple | 6.1% | (34%) | 30.9 |

| Microsoft | 16% | 10.7% | 31.9 |

| Meta Platforms |

18.6% | 37.8% | 24.8 |

Data source: YCharts. Note: Q3 encompasses the calendar quarter for Q3; Apple and Microsoft results are in the same time frame but are on a different fiscal-year calendar.

Alphabet is doing far better than Apple and Microsoft, yet it’s trading at a much lower multiple. As a result, I think investors should reconsider their positions in those two and look into Alphabet and Meta (which also stands near the top of my list of best stocks to buy now).

However, part of this valuation discount comes from the concern that the Department of Justice is seeking to break up Alphabet by forcing the sale of Google Chrome. This is obviously a concern, but we are likely some time away from having a resolution. This decision will end up in court and will take a while to get sorted out. The last high-profile DOJ breakup was when it went after Microsoft in the early 2000s. The lawsuit was originally filed in mid-1998 and concluded in late 1999. It wasn’t until mid-2001 that the appeal was heard, and the final remedial trial concluded in late 2002.

As a result, we are years away from knowing what the final outcome will be and whether Google Chrome will actually get spun off at all. Because of that, I think using the short-term weakness of this news to your advantage is a smart move.

Alphabet is a fantastic business, but it doesn’t trade near the multiple its peers do. Although there are some unknowns with how the DOJ settlement ends up, I think those fears have already been priced into the stock. As a result, investors should use this opportunity to purchase more of its stock before that trend comes to an end.

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Keithen Drury has positions in Alphabet and Meta Platforms. The Motley Fool has positions in and recommends Alphabet, Apple, Meta Platforms, and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.