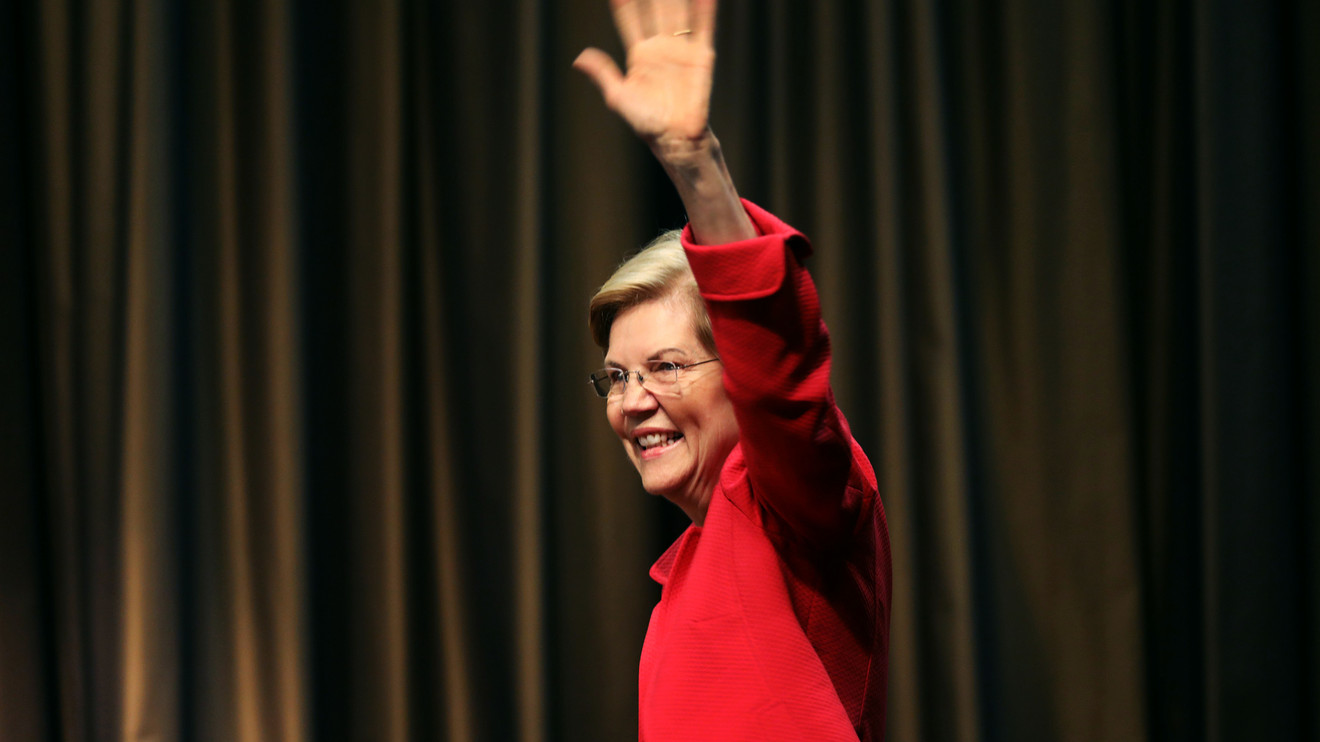

Since Sen. Elizabeth Warren, a Massachusetts Democrat, announced her plan last month to wipe away the student loans of millions of Americans as part of her presidential campaign, there’s been debate in the policy community about whether it’s a good idea.

But some polling data published this week indicates voters are less conflicted.

Nearly two-thirds of registered voters polled by news site, The Hill, and market research company, Harris-X, said they would support a plan to make public colleges tuition-free and cancel most existing student loans. The tenets of the plan were presented to voters without Warren’s name attached.

Separately, a poll conducted by Business Insider and SurveyMonkey, found that 57% of Americans at least somewhat support Warren’s plan.

Warren’s critics say wiping away some borrowers’ student debt may not be the best way to address our nation’s $1.5 trillion student-loan problem.

The polls add to a growing body of evidence that the American public is concerned about the impact of student debt and is thirsty for proposals to address it — even if the issue doesn’t rise to the priority level of more high-profile concerns, like health care, in voters’ minds.

The results come amid debate over Warren’s plan. That discussion has included both criticism from experts concerned that wiping away some borrowers’ student debt may not be the best way to address our nation’s $1.5 trillion student-loan problem and complaints online and in the media that the plan would be unfair to borrowers who already paid off their loans.

“It’s not surprising to see what we see here where there’s a bit of a lag between what the public viscerally understands is the right direction to take and what the wonks are ready to go for,” said Julie Margetta Morgan, a fellow at the Roosevelt Institute, a progressive think tank.

Indeed, many higher-education policy experts have taken issue with Warren’s plan, which would cancel $50,000 worth of student debt for those earning less than $100,000 and wipe away up to $50,000 in student loans for those making between $100,000 and $250,000.

Their main concern is that the plan would provide a bigger benefit — as measured in dollars — to borrowers earning roughly between $68,000 and $111,000. That’s because these borrowers are more likely to have higher student-debt loads than borrowers who are earning less.

(Low-income borrowers, who tend to have lower debt loads, are more likely to have their entire loan balance wiped out under the plan).

Supporters of Warren’s plan say this debt-financed system is changing the way graduates live their lives, which could put the economy at risk.

But one thing supporters of debt cancellation, like Margetta Morgan, say those arguments miss one important thing: Even borrowers who aren’t facing the most severe consequences of their student loans, our debt financed higher-education system is still changing the way that they live their lives, which could put the economy at risk.

That’s showing up in the polling. More than two-thirds of borrowers surveyed in a Politico and Morning Consult Poll said they’d put off a major purchase because of a student loan. About 40% said they’d delayed a life choice like getting married or having children.

The polling data also serves as a reminder that most Americans haven’t yet had personal experience with student loans, said Robert Kelchen, a professor of higher education at Seton Hall University. Nearly 60% of the respondents to the Politico poll said they never had a student loan and another 23% said they had one, but paid it off already.

Nonetheless, the data suggests that even those who aren’t personally burdened by student loans are concerned about it. More than half of the respondents to the Politico poll (including those without loans) said student debt is a “major problem” for the country and about 30% of respondents said the issue is a “critical threat” to the economy. The Business Insider poll found that 57% of Americans who already paid off their loans support Warren’s plan.

Regardless of whether voters and policy experts agree with Warren’s plan, Kelchen said it’s helped keep student debt towards the front of the policy conversation. And that conversation hasn’t even extended to include serious discussion of major proposals other than debt forgiveness that are part of the plan, he said.

Those include a proposal to make public college tuition-free, drastically expand the Pell grant program, ban for-profit colleges from receiving federal financial aid.

“The student-debt forgiveness piece is getting almost all the attention, but that’s just one component of the proposal,” Kelchen said.

Get a daily roundup of the top reads in personal finance delivered to your inbox. Subscribe to MarketWatch’s free Personal Finance Daily newsletter. Sign up here.