Discussion of whether markets were at a top lasted all of one day, after Tuesday’s rally put the bears back in their dens. Positive vaccine news could carry Wednesday’s session.

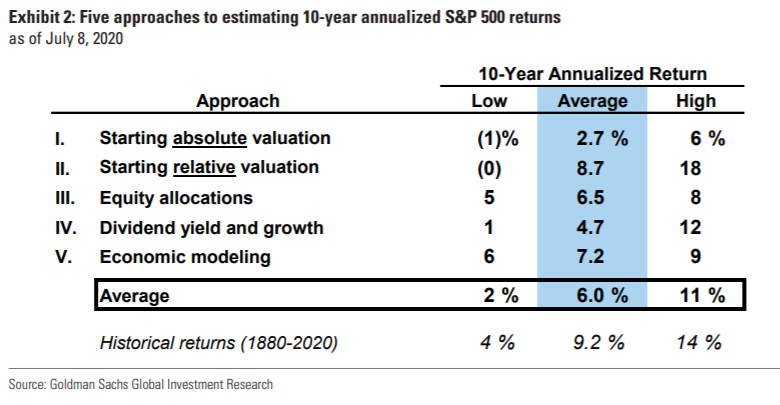

Looking a bit farther afield are strategists at Goldman Sachs, led by David Kostin. They estimate that the S&P 500 SPX, +0.90% will generate average annual returns of 6%, including dividends, over the next 10 years.

Not bad, right? Of course, any long-term forecast is subject to considerable uncertainty, and returns between 2% and 11% capture one standard deviation around its mean estimate, the Goldman strategists say. Goldman did a similar exercise in July 2012 and forecast a return of 8%, compared with the actual 13.6% gain, which was more than one standard deviation away.

How did the Goldman team arrive at 6%? They looked at five factors — today’s absolute and relative valuations, equity allocations, dividend yield estimates and economic modeling. To make a long story very short, the cyclically adjusted price-to-earnings ratio is a high 26.5, but interest rates are incredibly low.

Maybe the more notable insight is that stocks have a 90% chance of beating bonds, since the 10-year Treasury TMUBMUSD10Y, 0.618% yields a puny 0.63%.

Goldman did highlight five risks to the outlook. One is deglobalization, which puts both sales and earnings at risk. Another is taxes, with the plan from current presidential front-runner Joe Biden implying a 12% drop to S&P 500 earnings, if implemented. Labor costs, demographics and index composition — the S&P 500 has averaged 35% turnover per decade since 1980 — also are risks.