Investors are often guided by the idea of discovering ‘the next big thing’, even if that means buying ‘story stocks’ without any revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital – so investors should be cautious that they’re not throwing good money after bad.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like NVIDIA (NASDAQ:NVDA). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for NVIDIA

How Fast Is NVIDIA Growing Its Earnings Per Share?

In business, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS) performance. So a growing EPS generally brings attention to a company in the eyes of prospective investors. Commendations have to be given in seeing that NVIDIA grew its EPS from US$0.19 to US$1.73, in one short year. When you see earnings grow that quickly, it often means good things ahead for the company. Could this be a sign that the business has reached an inflection point?

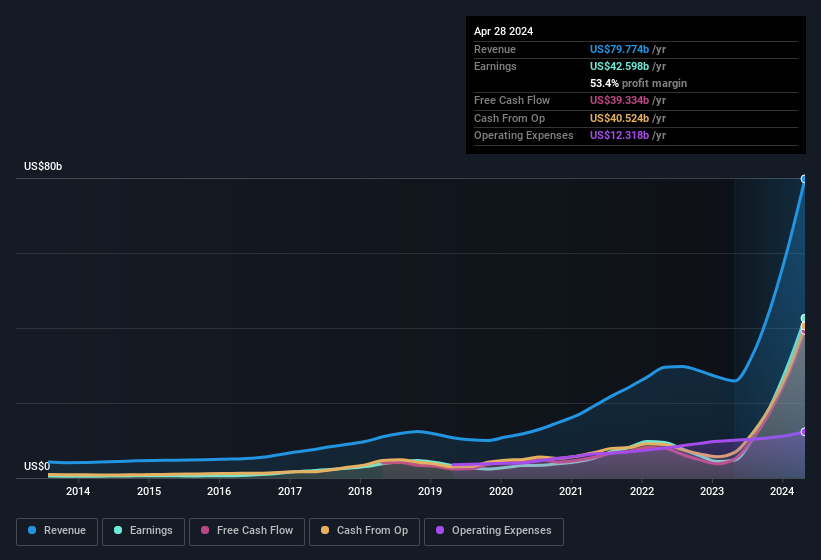

One way to double-check a company’s growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The good news is that NVIDIA is growing revenues, and EBIT margins improved by 42.5 percentage points to 60%, over the last year. That’s great to see, on both counts.

You can take a look at the company’s revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don’t exist, you can check our visualization of consensus analyst forecasts for NVIDIA’s future EPS 100% free.

Are NVIDIA Insiders Aligned With All Shareholders?

Since NVIDIA has a market capitalisation of US$2.9t, we wouldn’t expect insiders to hold a large percentage of shares. But we are reassured by the fact they have invested in the company. Indeed, they have a considerable amount of wealth invested in it, currently valued at US$114b. Holders should find this level of insider commitment quite encouraging, since it would ensure that the leaders of the company would also experience their success, or failure, with the stock.

Does NVIDIA Deserve A Spot On Your Watchlist?

NVIDIA’s earnings per share have been soaring, with growth rates sky high. That EPS growth certainly is attention grabbing, and the large insider ownership only serves to further stoke our interest. The hope is, of course, that the strong growth marks a fundamental improvement in the business economics. Based on the sum of its parts, we definitely think its worth watching NVIDIA very closely. Even so, be aware that NVIDIA is showing 1 warning sign in our investment analysis , you should know about…

Although NVIDIA certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of companies that not only boast of strong growth but have strong insider backing.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]