Shares of Whiting Petroleum Corp. plunged in volatile trading to a record low, after a Debtwire report that the oil-and-gas company had engaged with advisers in an effort to find ways to refinance the large amount of debt coming due over the next year.

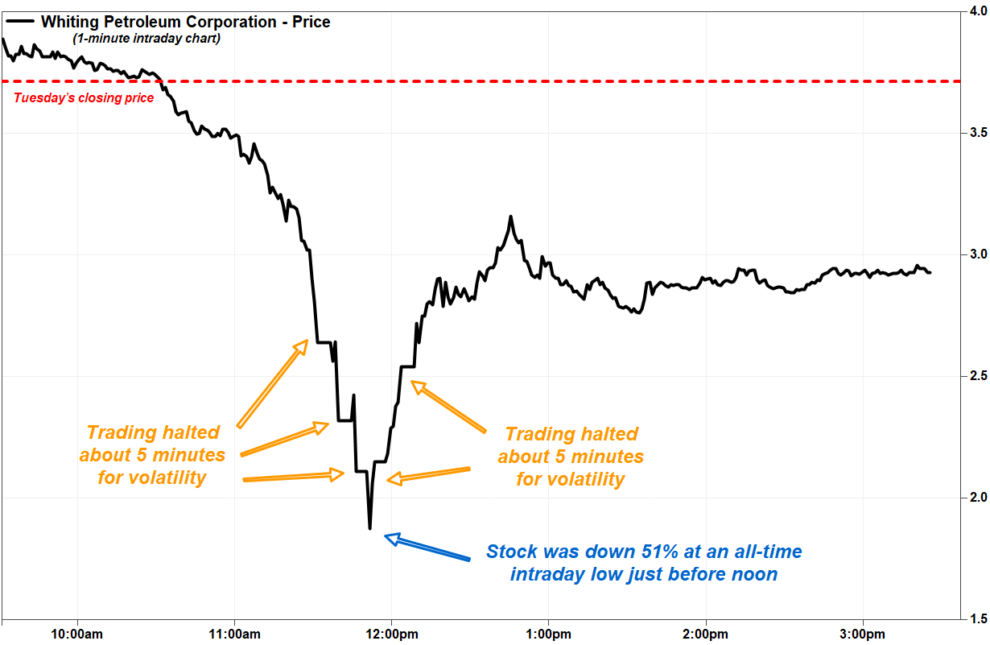

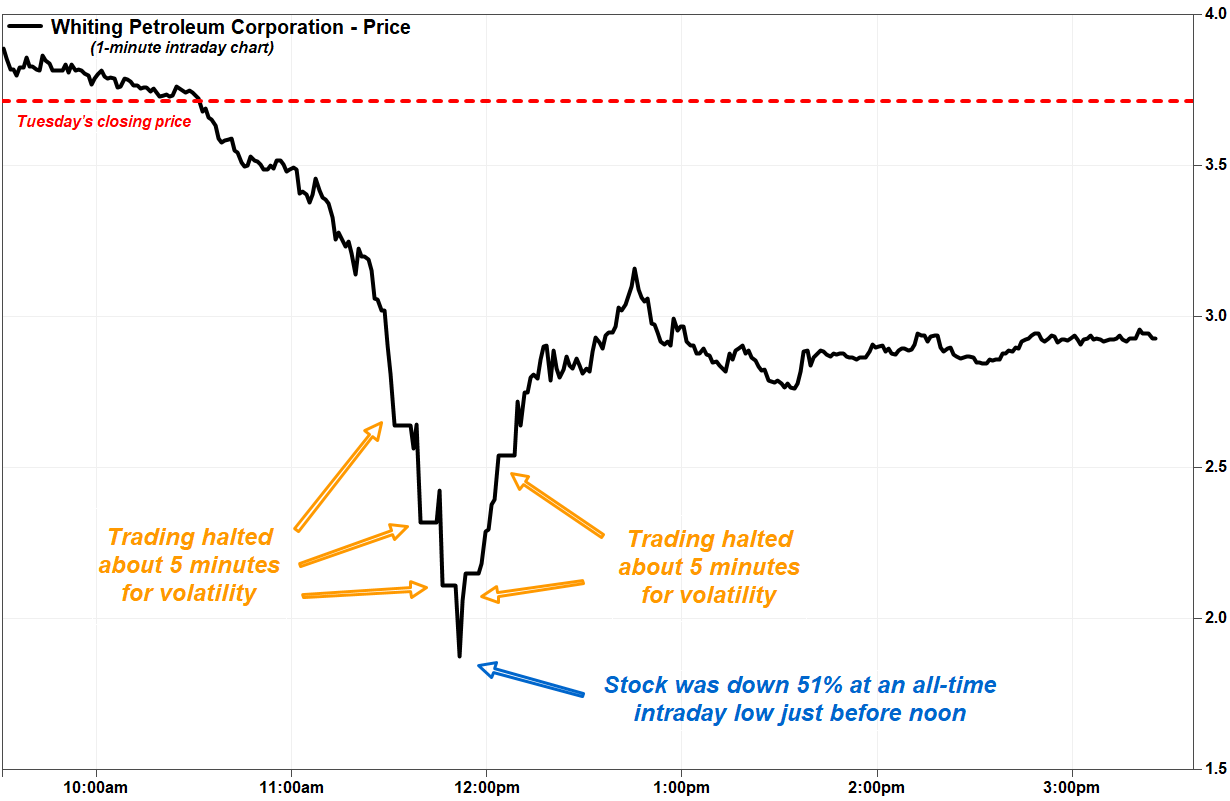

The stock WLL, -22.37% lost over half its value (down 51.2%) to an all-time intraday low of $1.81, before paring gains to close down 22.45 at $2.88, the lowest closing price since the company went public in November 2003. Trading volume spiked to 50.7 million shares, compared with the full-day average of about 10.2 million shares.

In a sign of how rapid the decline and bounce was, the stock was halted for volatility three times on the way down, and twice on the way up.

Despite the intraday bounce, the stock still suffered the biggest one-day percentage loss since it plummeted a record 38.7% on Aug. 1, 2019, when the company reported a third-straight surprise quarterly loss and slashed one-third of its workforce.

The stock has shed 89.6% over the past 12 months, while the SPDR Energy Select Sector exchange-traded fund XLE, +1.34% has lost 15.1% and the S&P 500 index SPX, +0.65% has gained 22.8%.

FactSet, MarketWatch

FactSet, MarketWatch Whiting has held talks with advisory companies to review remedies to its capital structure, according to a Debtwire report. Citing people familiar with the matter, the report said the remedies could potentially include an “up-tiering exchange.”

An up-tiering could refer to an offer that moves debt up in the capital structure, such as exchanging unsecured debt for a lower amount of secured debt, as secured debt would be better protected if there is a bankruptcy filing.

But the Debtwire report quoted a source as saying Whiting can’t do a secured deal at the moment given where gas prices are trading. Continuous natural-gas futures rose 3.3% on Wednesday, but closed at a four-year low as recently as Monday. See Futures Movers.

Whiting’s bonds also sold off sharply after the Debtwire report, along with its stock, according to MarketAxess, with the 6.625% notes maturing in January 2026 yielding 20.65% in afternoon trading Wednesday.

S&P Global Ratings rates Whiting’s credit at BB-, which is three notches deep into speculative, or “junk” territory. The outlook is negative.

In a Nov. 6 conference call following the company’s third-quarter earnings report, analyst Timothy Rezvan said, according to a FactSet transcript, that from talking with equity investors, “the elephant in the room is that $1.3 billion of debt maturing by the spring of 2021.”

Whiting Chief Financial Officer Correne Loeffler said at the time that following an amendment to Whiting’s credit facility, the company is allowed to use over $1.4 billion of the facility to repurchase senior notes. “[W]e are positioning ourselves for a successful refinancing,” Loeffler had said.

SunTrust Robinson Humphrey analyst Neal Dingmann said in a note Wednesday that he was “not aware of any imminent credit discussions,” and noted that Whiting has more than $2 billion in liquidity to address debt concerns.

Dingmann reiterated his buy rating and stock price target of $10, which implied a more than three-fold gain from current levels. He did acknowledge, however, that it could be difficult for the company to address next year’s debt maturities under the current environment for exploration and production debt.

See related: Why weak energy companies won’t likely get a lifeline from higher oil prices.

“While Whiting could utilize its borrowing base to pay the 2020s, the company would likely also need to address its 2021 maturities against a challenged market for new-issue, noninvestment grade E&P debt,” Dingmann wrote in a note to clients. “We believe the most likely course of action for the company would be to propose a secured debt exchange to address upcoming maturities, which could provide incrementally more comfort vs. utilizing spare revolver capacity, in our view.”