Over the last 7 days, the United States market has remained flat, yet it is up an impressive 38% over the past year with earnings expected to grow by 15% per annum in the coming years. In this environment, a good high-growth tech stock typically demonstrates strong revenue potential and innovation capabilities that align well with these positive market conditions.

Top 10 High Growth Tech Companies In The United States

|

Name |

Revenue Growth |

Earnings Growth |

Growth Rating |

|---|---|---|---|

|

Super Micro Computer |

20.86% |

27.98% |

★★★★★★ |

|

Sarepta Therapeutics |

23.67% |

43.83% |

★★★★★★ |

|

TG Therapeutics |

28.39% |

43.54% |

★★★★★★ |

|

Invivyd |

42.91% |

70.39% |

★★★★★★ |

|

Ardelyx |

27.19% |

66.44% |

★★★★★★ |

|

Amicus Therapeutics |

20.33% |

62.45% |

★★★★★★ |

|

Travere Therapeutics |

27.74% |

70.00% |

★★★★★★ |

|

Seagen |

22.57% |

71.80% |

★★★★★★ |

|

MediaAlpha |

22.72% |

61.31% |

★★★★★★ |

|

ImmunoGen |

26.00% |

45.85% |

★★★★★★ |

Click here to see the full list of 250 stocks from our US High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Simply Wall St Growth Rating: ★★★★☆☆

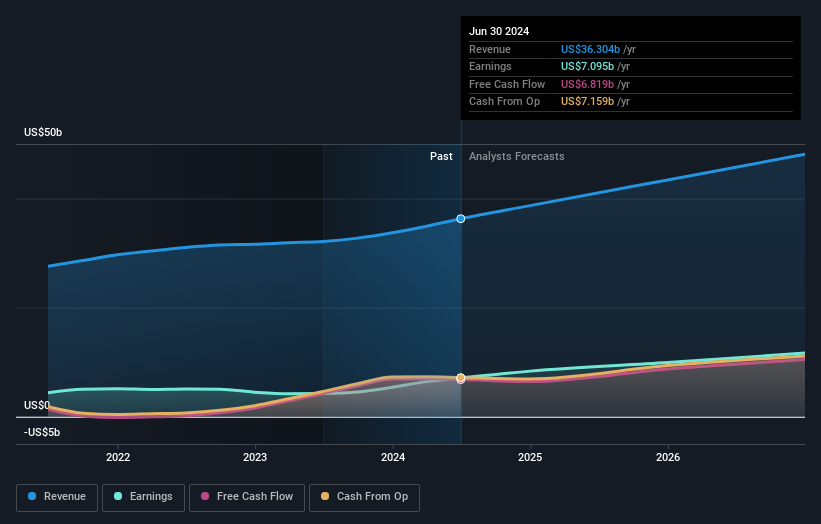

Overview: Netflix, Inc. is a company that offers entertainment services and has a market capitalization of $326.53 billion.

Operations: The company generates revenue primarily from its streaming entertainment service, amounting to $37.59 billion.

Netflix’s strategic maneuvers are evident in its robust R&D investment, which is crucial for staying ahead in the competitive streaming landscape. In 2024, the company allocated a significant portion of its revenue to R&D, emphasizing innovation in content and technology. This focus on development is reflected in its recent earnings growth of 71.9% year-over-year, surpassing industry averages significantly. Additionally, Netflix’s revised upward revenue guidance to $38.9 billion for 2024 underscores its effective adaptation and anticipation of market demands. The company also continues to enhance shareholder value through strategic share repurchases, with a notable $1.7 billion spent on buying back shares within the last quarter alone, demonstrating confidence in its future growth trajectory.

Simply Wall St Growth Rating: ★★★★☆☆

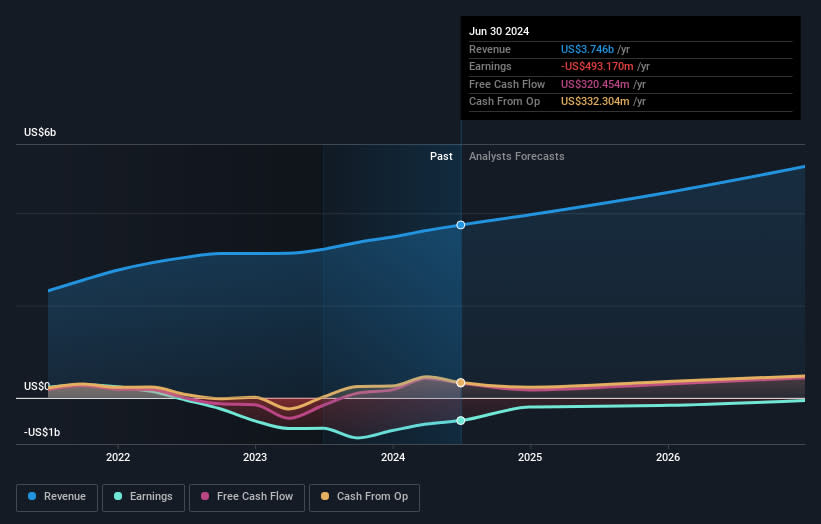

Overview: Roku, Inc., along with its subsidiaries, operates a TV streaming platform both in the United States and internationally, with a market cap of approximately $11.59 billion.

Operations: Roku generates revenue primarily through its Platform segment, which accounts for $3.19 billion, significantly outpacing the Devices segment at $551.17 million. The company’s business model focuses on monetizing its streaming platform through advertising and content distribution partnerships.

Roku’s strategic focus on integrating streaming with e-commerce, as seen in its expanded partnership with Instacart, underscores its innovative approach to capturing high-intent customers through shoppable TV ads. This move not only enhances user engagement by simplifying the purchasing process directly from advertisements but also leverages first-party data for targeted advertising, amplifying ad effectiveness. Financially, Roku has demonstrated resilience and adaptability; despite a net loss reduction to $33.95 million from $107.6 million year-over-year in Q2 2024, it projects a revenue increase of 11% to $1.01 billion in Q3 2024. The company’s commitment to innovation is further evidenced by a robust R&D expenditure which supports its strategic initiatives and future growth prospects in the evolving digital landscape.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Spotify Technology S.A., along with its subsidiaries, offers global audio streaming subscription services and has a market capitalization of approximately $76.08 billion.

Operations: The company generates revenue primarily through its Premium subscription services, accounting for €12.68 billion, and its Ad-Supported segment, contributing €1.79 billion.

Spotify Technology’s recent pivot into video content, as highlighted by its distribution deal with Cineverse Corp, marks a strategic expansion beyond audio. This move taps into the growing demand for diverse media consumption on single platforms and could reshape user engagement dynamics significantly. Financially, Spotify has turned around from a net loss to report a net income of €274 million in Q2 2024, with sales jumping to €3.8 billion from €3.2 billion year-over-year. The firm’s commitment to innovation is underscored by its R&D expenses which are pivotal in supporting these new ventures and future growth trajectories in the multimedia landscape.

Summing It All Up

-

Gain an insight into the universe of 250 US High Growth Tech and AI Stocks by clicking here.

-

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

-

Join a community of smart investors by using Simply Wall St. It’s free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqGS:NFLX NasdaqGS:ROKU and NYSE:SPOT.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]